Central Bank Digital Currency: What It Is and Why It Matters

When you hear central bank digital currency, a digital form of a country’s official money issued and controlled by its central bank. Also known as CBDC, it’s not Bitcoin. It’s not Ethereum. It’s the same dollar, euro, or yen you already use—but in digital form, tracked by the government. Unlike decentralized crypto, CBDCs have no anonymity. Every transaction can be monitored, frozen, or restricted. That’s the whole point.

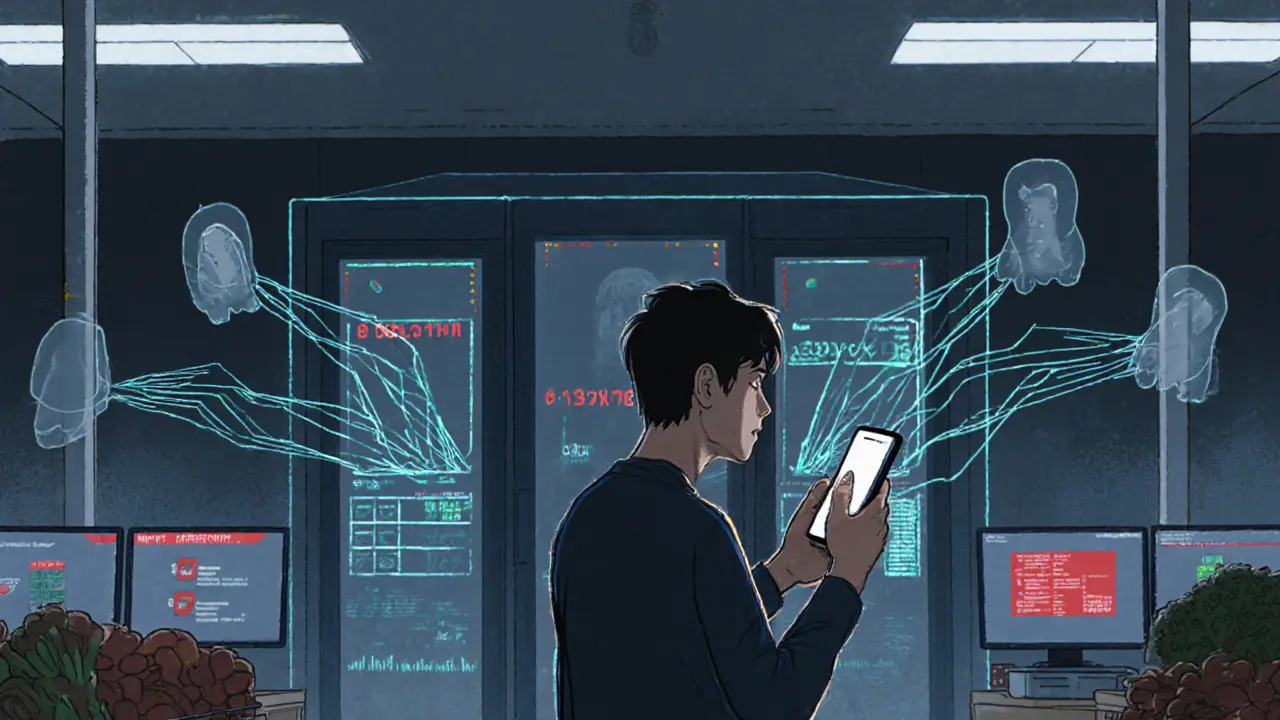

Think of it like this: your bank account is already digital, but your cash isn’t. A CBDC turns physical cash into something you can hold in your phone wallet—except the government holds the keys. Countries like China, Sweden, and Nigeria are already testing them. China’s digital yuan has over 260 million users. Sweden’s e-krona is being piloted for elderly citizens who rarely use banks. In Nigeria, the central bank pushed out the naira’s digital version after crypto adoption exploded. These aren’t experiments anymore—they’re replacements in the making.

What makes CBDCs different from stablecoins like USDT? Stablecoins are issued by private companies and backed by reserves. CBDCs are backed by the full power of the state. That means they’re safer from collapse—but also more vulnerable to control. Want to buy something the government doesn’t like? Your CBDC might just get blocked. Want to pay someone in a sanctioned country? Good luck. This isn’t just about efficiency—it’s about power.

And it’s not just about payments. CBDCs enable new forms of monetary policy. Imagine the central bank sending stimulus directly to your digital wallet, with rules: "Spend this on groceries by Friday, or it expires." Or taxing spending instantly—higher rates on luxury goods, zero on essentials. No more waiting for tax refunds or stimulus checks. Money moves in real time, with conditions baked in. That’s the future. And it’s already here in places most people don’t talk about.

Behind the scenes, CBDCs rely on blockchain-like tech, but not always. Some use centralized databases. Others use hybrid systems. The tech doesn’t matter as much as the control. And that’s why crypto enthusiasts and privacy advocates are worried. If you’re using crypto to avoid surveillance, a CBDC is the opposite of freedom. But for people in countries with unstable banks or hyperinflation, a government-backed digital currency might be the only reliable option left.

What you’ll find in the posts below isn’t hype. It’s real examples of how digital money is changing lives—from Nigeria’s underground crypto traders to Japan’s regulated exchanges, from tax rules in Mexico to how North Korea exploits anonymity. This isn’t science fiction. It’s happening now. And you need to understand it before it decides what you can buy, who you can pay, and how much of your money the state lets you keep.