CBDC Privacy: What You Need to Know About Central Bank Digital Currency Surveillance

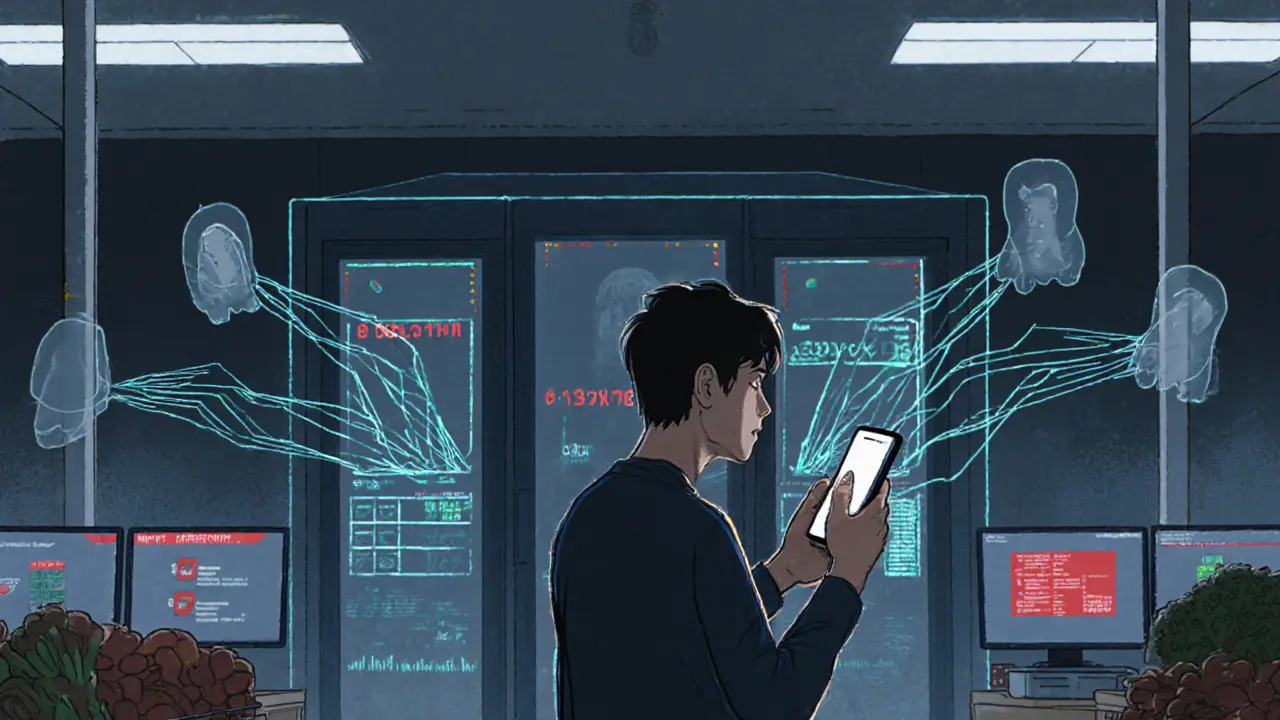

When we talk about CBDC privacy, the level of anonymity allowed in government-issued digital currency. Also known as central bank digital currency, it’s not just about faster payments—it’s about who sees your every transaction. Unlike cash, which lets you buy coffee without a paper trail, a CBDC could track every dollar you spend, who you pay, and when. That’s not speculation. It’s the design goal of most central banks testing these systems right now.

Think of government surveillance, the monitoring of financial activity by state authorities as the hidden engine behind CBDCs. Countries like China with its Digital Yuan already limit how much you can spend in a day, freeze accounts for "suspicious" behavior, and block payments to certain vendors. The digital cash, currency issued and controlled by a nation’s central bank in electronic form isn’t meant to replace physical money—it’s meant to replace anonymity. And that’s where it clashes with financial privacy, the right to control who accesses your spending and income data. In places like Nigeria or Argentina, people use crypto to escape inflation and control. In places pushing CBDCs, they’re building systems to make that impossible.

There’s no middle ground here. Either your transactions are private, or they’re not. Either you own your money, or the bank does. The debate isn’t about convenience—it’s about power. CBDCs give authorities the ability to freeze assets without a court order, restrict spending on certain goods, or even turn off your digital wallet if you protest, donate, or shop in a way they disapprove of. This isn’t sci-fi. It’s happening now. And the people designing these systems aren’t hiding it. They’re proud of it.

What you’ll find in the posts below aren’t just articles about CBDCs. They’re real-world stories about what happens when money becomes traceable. You’ll see how decentralized identity helps you stay in control, how mixing services get exploited by bad actors, and how governments are already shaping the future of your wallet. This isn’t theoretical. It’s already in your pocket—whether you know it or not.