CBDC Anonymity: Can Central Bank Digital Currencies Really Be Private?

When you think of CBDC anonymity, the level of privacy offered by government-issued digital currencies, you might picture Bitcoin-style secrecy. But central bank digital currency, a digital form of a country’s official money issued and controlled by its central bank is built on a totally different model. Unlike decentralized crypto, CBDCs are designed for control—not freedom. They’re not meant to hide transactions; they’re meant to track them. This isn’t speculation. Countries like China, Sweden, and the Bahamas have already launched pilot programs, and every one of them includes some form of transaction monitoring. Even if a CBDC claims to offer "limited anonymity," it’s usually only for small, everyday purchases—like buying coffee or paying for a bus ticket. Anything above that threshold? Fully traceable by the state.

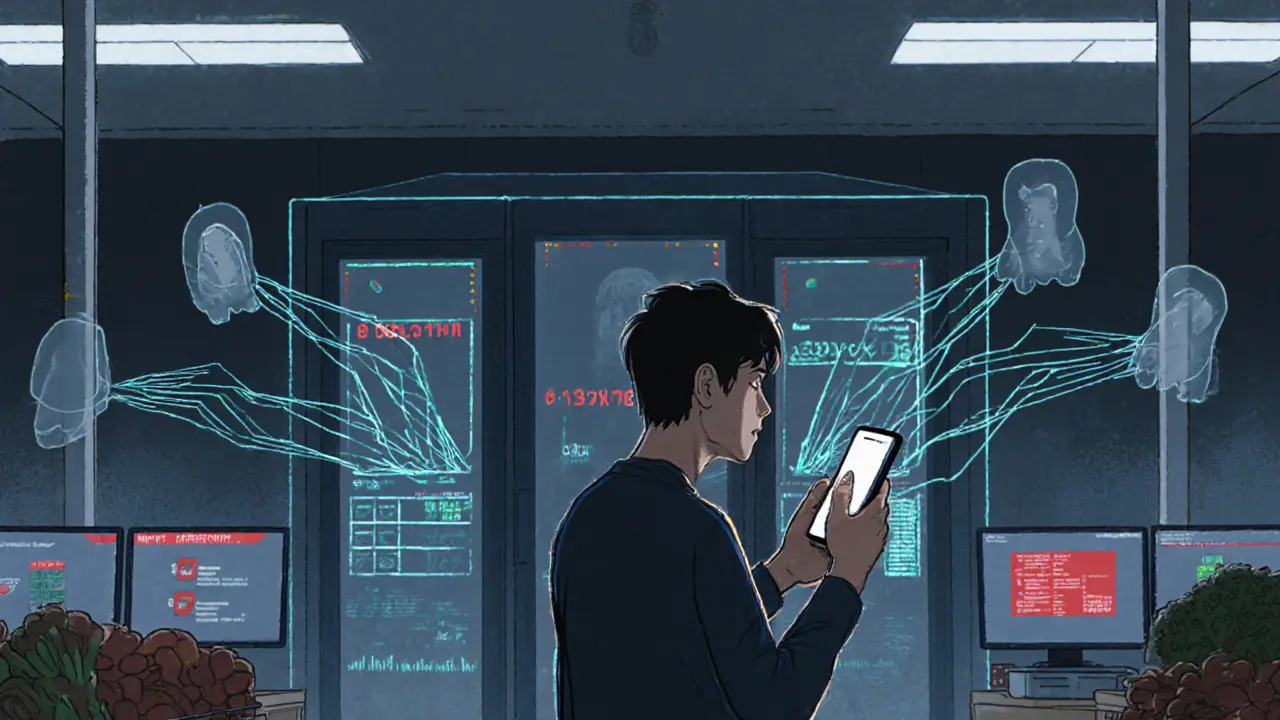

That’s where blockchain privacy, the ability to conduct transactions without revealing identity or amount clashes with digital fiat, a government-backed electronic version of traditional currency. In crypto, you control your keys and your data. In CBDCs, the central bank holds the keys—and the data. This isn’t just a technical difference; it’s a power shift. Think about it: if your government can see every dollar you spend, they can also freeze it, limit where you spend it, or even deny you access if you’re flagged as a "risk." That’s not theory. It’s already happening in places like Nigeria, where the central bank restricted access to certain crypto wallets during protests. CBDCs could make that kind of control permanent and automated. And while some argue that CBDCs could help fight money laundering (like the 央行数字货币, the Chinese term for central bank digital currency), they also open the door to surveillance that’s far more invasive than anything banks do today.

So what does this mean for you? If you value financial privacy, CBDCs aren’t your friend. They’re the opposite of decentralized identity or crypto mixing services—tools designed to protect you from oversight. Instead, they’re built for oversight. The posts below dig into real cases: how North Korea uses tumblers to hide stolen crypto, how Nigerians bypass banking controls with stablecoins, and how Mexico and the UK tax every crypto move. These aren’t fringe stories. They’re signals. The world is moving toward digital money—but the question isn’t whether CBDCs will arrive. It’s whether you’ll still own your own money when they do.