Binance Nigeria: What You Need to Know About Trading Crypto in Nigeria

When you hear Binance Nigeria, the Nigerian branch of the world’s largest cryptocurrency exchange, known for its P2P trading dominance and high liquidity in local currency. Also known as Binance NG, it became the go-to platform for Nigerians after banks blocked crypto transactions in 2021. It’s not just an exchange—it’s a financial workaround for a country where inflation eats savings and access to dollars is tight.

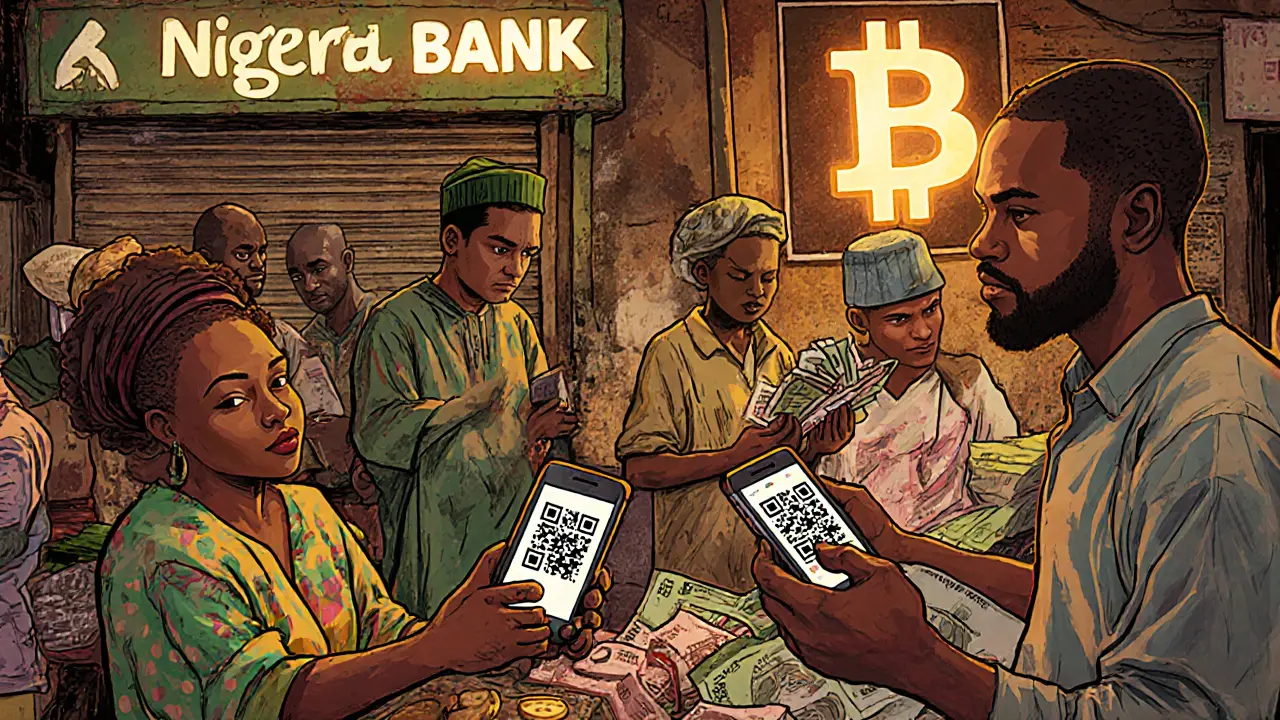

Binance Nigeria doesn’t operate as a traditional bank-connected platform anymore. After the Central Bank of Nigeria banned financial institutions from dealing with crypto in 2021, users shifted entirely to Binance P2P, a peer-to-peer trading system that lets users buy and sell crypto directly with other people using bank transfers, mobile money, or cash deposits. This turned Binance into a digital marketplace where Nigerians trade Naira for USDT, BTC, or ETH, often at premiums that reflect real market demand. The platform’s P2P system is built for speed and simplicity: you pick a seller, pay them directly, and get crypto in minutes. No middlemen. No delays. Just direct trades.

What makes Binance Nigeria different from other exchanges isn’t just volume—it’s survival. While many platforms faded after the banking ban, Binance adapted. It didn’t fight the rules; it worked around them. Today, it’s estimated that over 30 million Nigerians have used Binance for crypto trading, making it the most active crypto market in Africa. And it’s not just for speculators. Farmers sell crops and get paid in USDT. Freelancers get paid in crypto instead of waiting months for international wire transfers. Students buy course materials using USDT because local banks won’t let them access foreign currency.

But it’s not without risks. Scammers mimic Binance P2P ads. Fake sellers take your Naira and disappear. And while Binance offers dispute resolution, you’re still on your own for most transactions. That’s why knowing how to verify sellers, use escrow properly, and avoid too-good-to-be-true rates matters more than ever. The platform also doesn’t offer direct Naira withdrawals anymore—everything flows through P2P, which means you’re always trading with other people, not a bank.

Underneath it all, Binance Nigeria reflects a bigger truth: when formal systems fail, people turn to decentralized tools. Crypto isn’t a luxury here—it’s a necessity. The posts below dive into how Nigerians use Binance daily, what happened after the bank ban, how P2P trading really works, and why some traders are now shifting to other platforms like LocalBitcoins or Paxful. You’ll also find real stories about who’s winning, who’s losing, and what’s next for crypto in Nigeria.