Blockchain: What It Is, How It Works, and Why It Powers DeFi

When you hear blockchain, a distributed digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively. Also known as distributed ledger technology, it’s the reason you can send crypto without a bank. It’s not just Bitcoin’s underbelly—it’s the operating system for DeFi, NFTs, and decentralized apps. Every time you swap tokens on Uniswap or stake ETH on a lending platform, you’re interacting with a blockchain. No middleman. No paperwork. Just code and consensus.

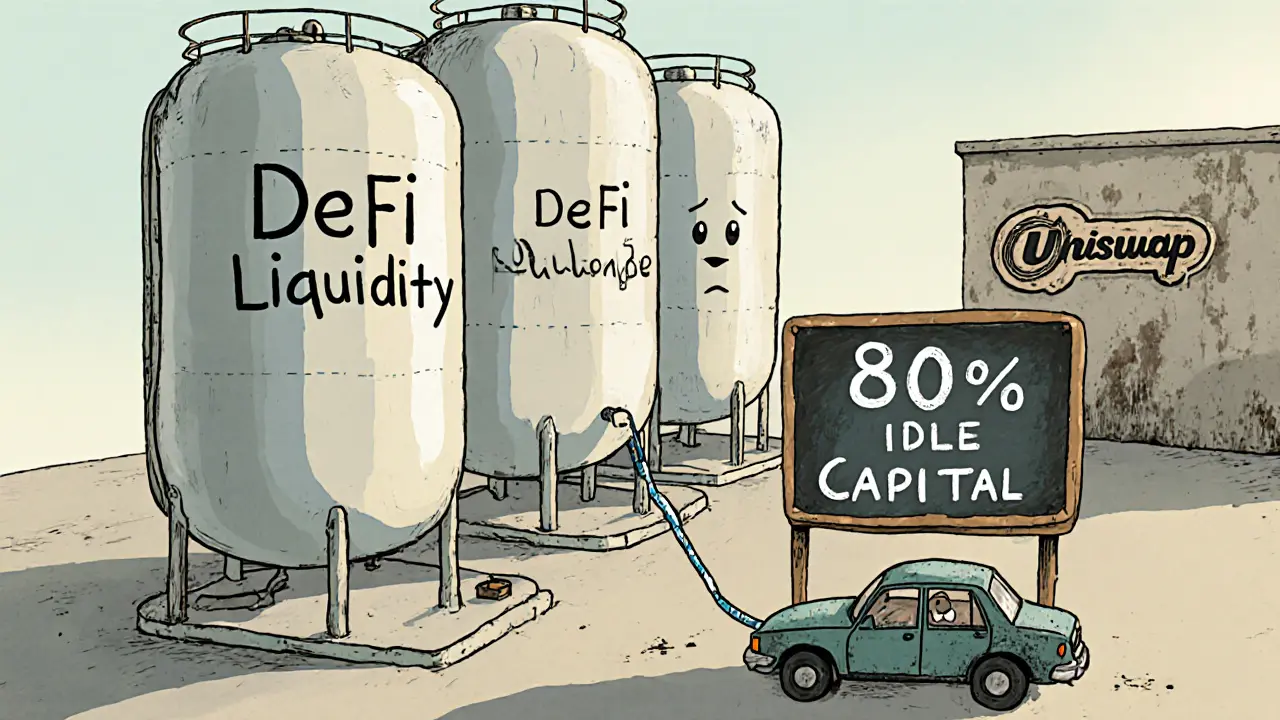

What makes blockchain special isn’t just security—it’s how it enables AMM protocols, automated market makers that use algorithms instead of order books to price assets. Unlike old-school exchanges, AMMs like Uniswap v3 and Curve don’t need buyers and sellers to match. Instead, they rely on concentrated liquidity, a technique where liquidity providers pin their funds to specific price ranges, boosting capital efficiency. This means less money locked up, more fees earned. But it’s not magic—it’s math. And it only works if you understand how the underlying blockchain, a distributed digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively handles smart contracts and gas fees.

That’s where capital efficiency, the ratio of returns generated versus capital deployed in a financial system comes in. In DeFi, it’s everything. If you’re providing liquidity, you want to earn the most possible with the least amount of tokens. Uniswap v3 lets you do that by focusing your funds where trades actually happen—instead of spreading them thin across a wide price range. Curve does something similar for stablecoins. But both depend on the blockchain to execute trades instantly, accurately, and without censorship. If the blockchain slows down or gets expensive, none of this works.

So when you look at a DeFi protocol, you’re not just looking at a website. You’re looking at layers: the blockchain underneath, the AMM on top, and the liquidity strategy in between. And if you want to make smarter moves—whether you’re a casual holder or an active provider—you need to understand how they connect. That’s what this collection is for. Below, you’ll find real breakdowns of how these systems work, who benefits, and where the risks hide. No fluff. Just clear, actionable insight.