NeonGrafix Crypto Hub Archives: August 2025 Crypto Trends and Airdrops

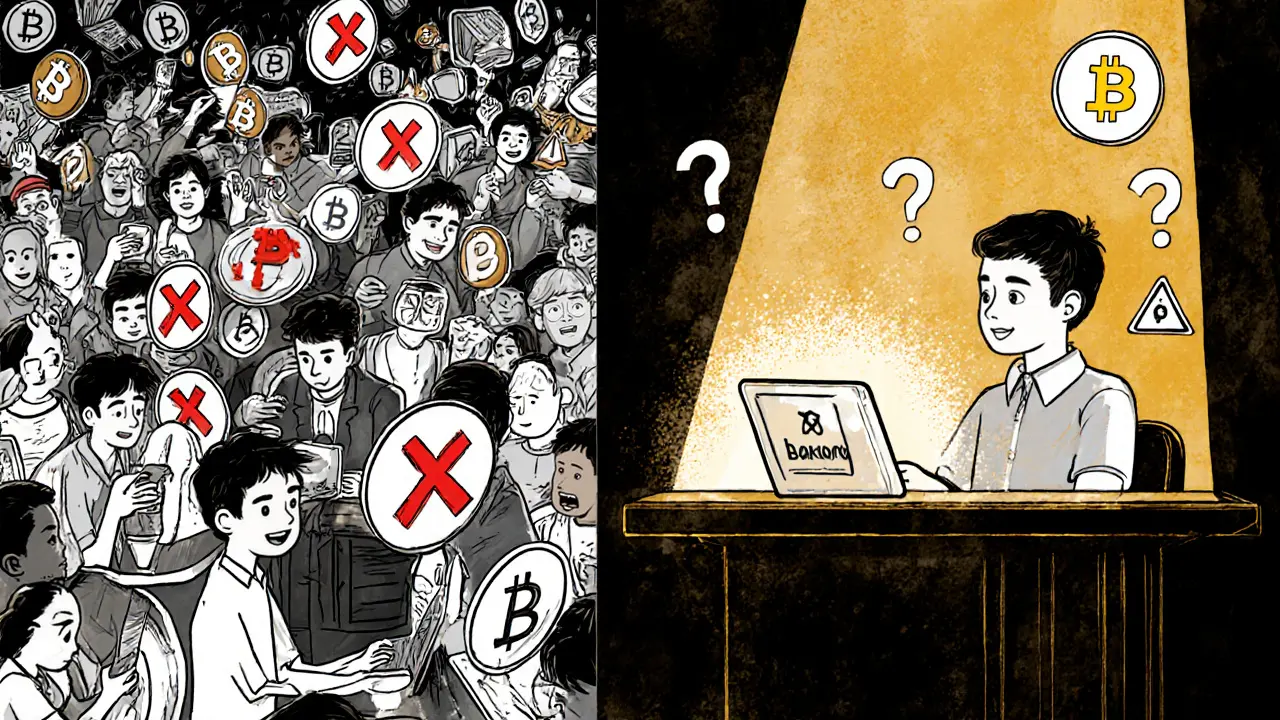

When you're trying to make sense of the crypto airdrops, free token distributions by blockchain projects to grow their user base. Also known as token giveaways, they're one of the most direct ways regular users can get exposure to new projects without spending a dime. In August 2025, these airdrops weren’t just random drops—they were strategic moves by teams building real utility, not just hype. From layer-2 networks optimizing transaction speeds to privacy-focused chains gaining traction, the airdrops that mattered had clear roadmaps, active communities, and verifiable on-chain activity.

Behind every big airdrop is a cryptocurrency exchange, a platform where users buy, sell, and trade digital assets. Also known as crypto trading platforms, they’re the backbone of how most people access new tokens. In August, major exchanges like Binance, KuCoin, and smaller niche platforms rolled out new listing rules. Some started requiring users to hold a minimum balance for 30 days to qualify for airdrops. Others integrated wallet tracking tools so users could see exactly which projects they were eligible for. These changes made it harder to game the system—but fairer for those who actually used the platforms.

And then there’s the blockchain coins, digital currencies built on decentralized ledgers with unique use cases. Also known as altcoins, they’re not just Bitcoin clones—they’re tools for everything from gaming economies to decentralized identity. August 2025 saw a spike in coins tied to AI-driven data markets and real-world asset tokenization. These weren’t speculative plays. Projects like ChainLink’s new oracle network for supply chain tracking and Fetch.ai’s decentralized agent marketplace went live with testnet results that actually worked. People weren’t just buying them—they were using them.

What You’ll Find in This Archive

This collection pulls together every guide, review, and alert published in August 2025. You’ll find step-by-step breakdowns on how to claim the top 5 airdrops that paid out real value, not just paper gains. We covered which exchanges had the most reliable tracking systems and which ones dropped the ball. You’ll see real data on which blockchain coins gained real usage, not just price pumps. No fluff. No guesses. Just what happened, what worked, and what to watch next.

If you’re wondering whether the crypto space slowed down in August, think again. The moves made that month set the tone for the rest of the year. The posts here show you exactly how to spot the difference between noise and opportunity—so you don’t miss the next big thing because you were looking in the wrong place.