Liquidity Risk Calculator

Calculate Your Liquidity Risk

Enter your liquidity parameters to see potential impermanent loss. Note: Lifinity has significantly higher risk than established DEXs due to low volume and scam risks.

Risk Analysis Results

Enter your values and click "Calculate Risk" to see your potential impermanent loss.

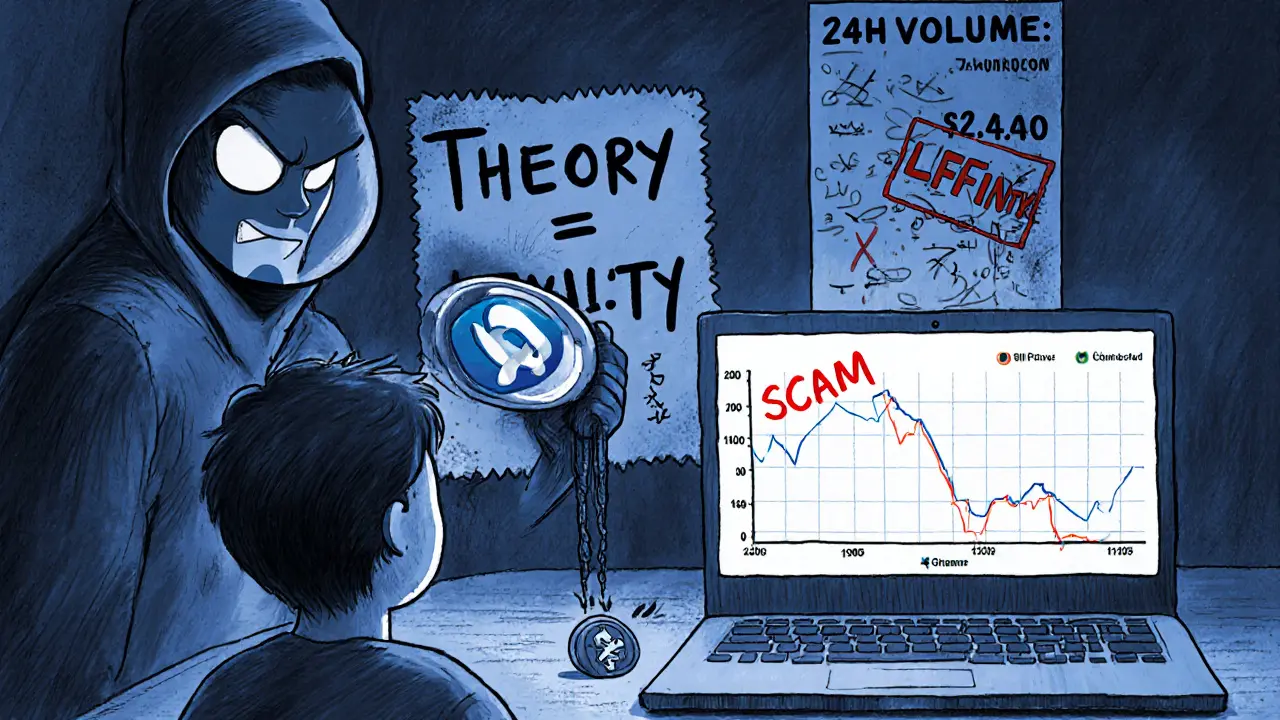

When you’re looking for a decentralized exchange on Solana, you’ve got options: Orca, Raydium, Jupiter. So why would you pick Lifinity? It promises to fix one of the biggest headaches in DeFi - impermanent loss. But does it deliver? Or is it just another obscure token with a flashy website and a bunch of scammers lurking in the shadows?

Lifinity isn’t a centralized exchange like Binance or Kraken. It’s a DEX - a decentralized exchange built directly on Solana. That means no middleman, no account sign-ups, no KYC. You connect your wallet, swap tokens, and add liquidity. Simple. Except it’s not that simple. Because while the idea sounds great, the reality is messy.

What Lifinity Actually Does

Lifinity is an automated market maker (AMM) - the same kind of system Uniswap and SushiSwap use. But it claims to be smarter. Instead of relying on outdated price feeds, it uses oracle-based pricing to get real-time, accurate rates. That’s supposed to reduce slippage and make trades smoother. More importantly, it’s designed to cut down on impermanent loss - the thing that makes liquidity providers lose money when token prices swing.

How? By acting as a proactive market maker. Most AMMs just sit there and match trades passively. Lifinity tries to adjust its liquidity pools dynamically based on market movement. Think of it like a trader who’s always watching the market and adjusting bids and asks in real time. That’s the theory, at least.

But theory doesn’t pay the bills. And right now, the numbers don’t lie. As of October 2025, Lifinity’s native token, LFNTY, trades at around $1.48. That’s below its 50-day moving average of $1.69. The 200-day average is $1.18 - meaning the token’s been trending sideways, then down. The 24-hour trading volume? Just $2,840. That’s less than what a single popular meme coin on Ethereum moves in five minutes.

LFNTY sits at #5345 in market cap. That’s not just small - it’s barely on the map. When you’re comparing it to Raydium or Jupiter, which move millions in volume daily, Lifinity looks like a ghost town.

The Scam Problem Is Real

Here’s the scary part: if you search for Lifinity, you’re not just competing with other DEXs. You’re competing with fraudsters.

There’s a fake site called lfinity.io - one letter missing from the real one. It looks identical. Same logo, same layout, same UI. It even has a “Connect Wallet” button that works. But once you connect your Phantom or Solflare wallet, it drains your funds instantly. No warning. No chance to cancel. The money’s gone before you even blink.

These scams are everywhere. Fake Twitter accounts. Telegram groups. Google ads that redirect you to the fake site. Even YouTube videos pretending to be tutorials. PCRisk has flagged this as a classic social engineering scam. And because Solana transactions are irreversible, there’s no way to get your crypto back.

If you’re new to DeFi, this is a trap waiting to happen. You think you’re on the real Lifinity. You click “Connect Wallet.” Boom. You’re out $500, $2,000, $10,000. And there’s no customer service to call. No refund policy. Just silence.

Is It Safe to Use?

Let’s be clear: the Lifinity protocol itself hasn’t been hacked. The code hasn’t been exploited. The issue isn’t technical - it’s reputational. The brand is being abused. And that makes using it risky.

Even if you type lifinity.io perfectly, you’re still relying on your own vigilance. No browser warns you if you mistype it. No app checks the URL. You’re on your own.

There’s also zero public documentation on how to integrate with Lifinity. No developer guides. No API specs. No GitHub activity worth mentioning. That’s not how a serious project behaves. If you’re a developer looking to build on it, you’re out of luck. If you’re a regular user, you’re trusting a team that doesn’t seem to care about transparency.

Who Is This For?

Lifinity isn’t for beginners. It’s not for casual traders. It’s not even for most DeFi users.

It might be for one kind of person: someone who believes in the long-term theory behind proactive market making and is willing to risk their capital on an unproven idea. Someone who’s already familiar with Solana, knows how to check URLs, understands impermanent loss, and has extra funds they’re okay losing.

But even then - why Lifinity? Why not Raydium, which has 100x the volume, better liquidity, and a working community? Why not Jupiter, which aggregates the best rates across dozens of DEXs? Why risk your money on a project with no track record, no user reviews, and a fake website that looks better than the real one?

The Token: LFNTY - Speculation Over Substance

LFNTY is the token behind Lifinity. It’s used for governance, staking, and fee discounts. But here’s the thing: no one’s using it. The trading volume is tiny. The holders are few. The social media chatter? Almost nonexistent.

Some analysts say LFNTY could hit $3.12 by the end of 2026. Others predict $27 by 2034. Those numbers aren’t based on usage. They’re based on hope. On speculation. On the idea that maybe, someday, someone will notice Lifinity.

But crypto doesn’t work like that. Projects don’t grow because someone wrote a bullish tweet. They grow because people use them. Because liquidity flows in. Because developers build on them. Because users come back.

Lifinity has none of that. Not yet.

Bottom Line: Avoid Unless You’re an Experienced Speculator

Lifinity has a clever idea. Reducing impermanent loss on Solana? That’s worth exploring. But execution matters more than theory. And right now, Lifinity is failing at execution.

Low volume. No community. No transparency. A fake website that’s easier to find than the real one. And a token that’s barely trading.

If you’re looking for a Solana DEX, go with Orca or Raydium. They’re proven. They’re active. They have real users. If you’re looking to trade LFNTY, treat it like a lottery ticket - not an investment. And if you’re thinking about adding liquidity to Lifinity pools? Don’t. The risk of losing your funds to a scam or impermanent loss far outweighs any theoretical upside.

For now, Lifinity isn’t a crypto exchange you should trust. It’s a cautionary tale.

Is Lifinity a legitimate crypto exchange?

Yes, the official Lifinity platform (lifinity.io) is a real Solana-based DEX. But it’s not trustworthy for most users. While the protocol itself hasn’t been hacked, it’s plagued by scam websites that mimic its design to steal funds. The low trading volume and lack of community activity also suggest it’s not widely adopted or actively maintained.

How do I avoid the Lifinity scam sites?

Always type the URL manually: lifinity.io. Never click links from Twitter, Telegram, or Google ads. Bookmark the real site. Check the URL before connecting your wallet - even one missing letter (like lfinity.io) means it’s fake. Use a wallet that shows the domain before signing transactions, like Phantom. If it looks too good to be true, it is.

Can I make money trading LFNTY?

You might, but it’s extremely risky. LFNTY trades at around $1.48 with very low volume ($2.8K daily). That means prices can swing wildly on small trades. Most people buying it are speculating on future price boosts, not using the platform. Don’t invest more than you can afford to lose. It’s not a stable asset - it’s a high-risk gamble.

Why is Lifinity’s trading volume so low?

Because no one’s using it. Compared to Solana’s top DEXs like Jupiter and Raydium, Lifinity offers no clear advantage in liquidity, speed, or fees. Its unique features - like reducing impermanent loss - haven’t been proven at scale. Without users or liquidity providers, the platform can’t grow. It’s stuck in a cycle: low volume scares away users, and no users mean no volume.

Should I add liquidity to Lifinity pools?

No. Not unless you’re an experienced DeFi user with deep knowledge of AMMs and are willing to risk your capital on an unproven protocol. The risk of impermanent loss is still real, and the lack of liquidity means your funds could get stuck. Plus, the scam risk makes any interaction with the platform dangerous. Stick with well-established pools on Raydium or Orca instead.

What are the alternatives to Lifinity on Solana?

Use Jupiter, Raydium, or Orca. Jupiter aggregates liquidity across dozens of DEXs for the best prices. Raydium has high volume, strong liquidity, and active development. Orca is beginner-friendly with clean UI and solid security. All three have been around longer, have real user bases, and aren’t being impersonated by scam sites. They’re safer, more reliable, and actually used by people.

Lifinity is dead. Don't waste your time.

The real issue isn't just the scam sites-it's that the project doesn't seem to have a roadmap or any active development. If the team isn't even responding to GitHub issues or updating docs, how can anyone trust their claims about reducing impermanent loss? It feels like a vaporware project dressed up in shiny UI.

⚠️ PRO TIP: Always double-check the URL before connecting your wallet! 🛡️ Lifinity.io is the ONLY real one. Bookmark it. Type it manually. No links. No ads. No Telegram bots. If it looks too clean or too fast, it’s probably fake. I lost $800 last month to a lfinity.io scam-don’t be me. 🙏

You’re all missing the point. This isn’t about liquidity or volume. It’s about control. The entire DeFi ecosystem is rigged. Jupiter and Raydium are just gatekeepers with better PR. Lifinity’s quiet because they’re not playing the game. The system doesn’t want you to have a truly dynamic AMM. They want you dependent on their centralized aggregators. Wake up.

Low volume means low risk for whales to manipulate it. That’s why people are still buying LFNTY. You think this is a bad investment? No. It’s a sleeper. When the next Solana meme wave hits, this token will pump 10x. Everyone’s sleeping on it because they’re too lazy to look past the surface

I’ve used Lifinity a few times. Yeah the site looks slick but I always check the URL and use Phantom’s domain warning. The swaps are fast and the slippage is way better than Orca for small trades. I’m not putting my life savings in it but for $50 swaps? I’m cool with it. Just be smart.

Stay safe out there 🙌 But don’t let fear stop you from exploring new stuff. Lifinity might be small now but innovation doesn’t always come from the biggest names. Keep an eye on it!

The absence of public documentation, developer engagement, and transparent governance structures is not merely a technical shortcoming-it is a profound failure of fiduciary responsibility in the decentralized finance ecosystem. One cannot ethically recommend a platform that operates without accountability mechanisms, regardless of its theoretical elegance.

The post says it all. No need to read further.

This is all a distraction. The real scam is Solana itself. They’re pushing these DEXs to drain wallets while the Fed prints money. Lifinity is just a pawn. They want you to think it’s about liquidity when it’s really about control. The whole chain is a surveillance tool disguised as finance.

I tried lifinity.io and it worked fine! I swapped 200 SOL and got my tokens no prob. Maybe the scam sites are just jealous because lifinity is actually good? People just dont know how to use the internet anymore lol

The claim that Lifinity reduces impermanent loss through dynamic liquidity adjustment requires empirical validation. Are there peer-reviewed studies or on-chain analytics demonstrating statistically significant improvement over traditional AMMs? Without such data, the assertion remains speculative.

lifinity is sus but the logo is kinda cute 🤡

If you’re trading this you deserve to lose everything.

I think it's good to have options even if they're small. Maybe Lifinity will grow if more people give it a fair chance. I've been using it for small swaps and haven't had any issues. Just be careful with the URL like everyone says!

You think the fake sites are the problem? Nah. The real problem is the government is tracking every wallet. Lifinity is quiet because they don’t want to be noticed. The scam sites? They’re planted by the CIA to scare people away from real decentralization.

Why even care about this? India has better crypto projects. This is just another American waste of time.

I mean, if you’re not already staking in a Solana yield farm with 100% APY, you’re clearly not serious about DeFi. Lifinity? Cute. But it’s not even in the same galaxy as the real players. You’re playing with toy money.

I checked the contract address on Solana FM. The dev wallet still holds 42% of LFNTY. That’s a red flag. Also the last transaction on the liquidity pool was 3 months ago. This isn’t dead-it’s abandoned. Don’t touch it.