Tether USD: The Truth About the World's Largest Stablecoin

When you trade crypto, you’re probably using Tether USD, a digital token pegged 1:1 to the U.S. dollar and used as a bridge between volatile coins and cash-like stability. Also known as USDT, it’s the most traded crypto asset on earth—used in over 70% of all cryptocurrency trades. But here’s the thing: it’s not backed by cash alone. It’s backed by a mix of commercial paper, loans, and other assets, and no one outside its parent company fully knows the details. That’s why so many people are confused—or worried—about whether Tether USD is truly stable, or just pretending to be.

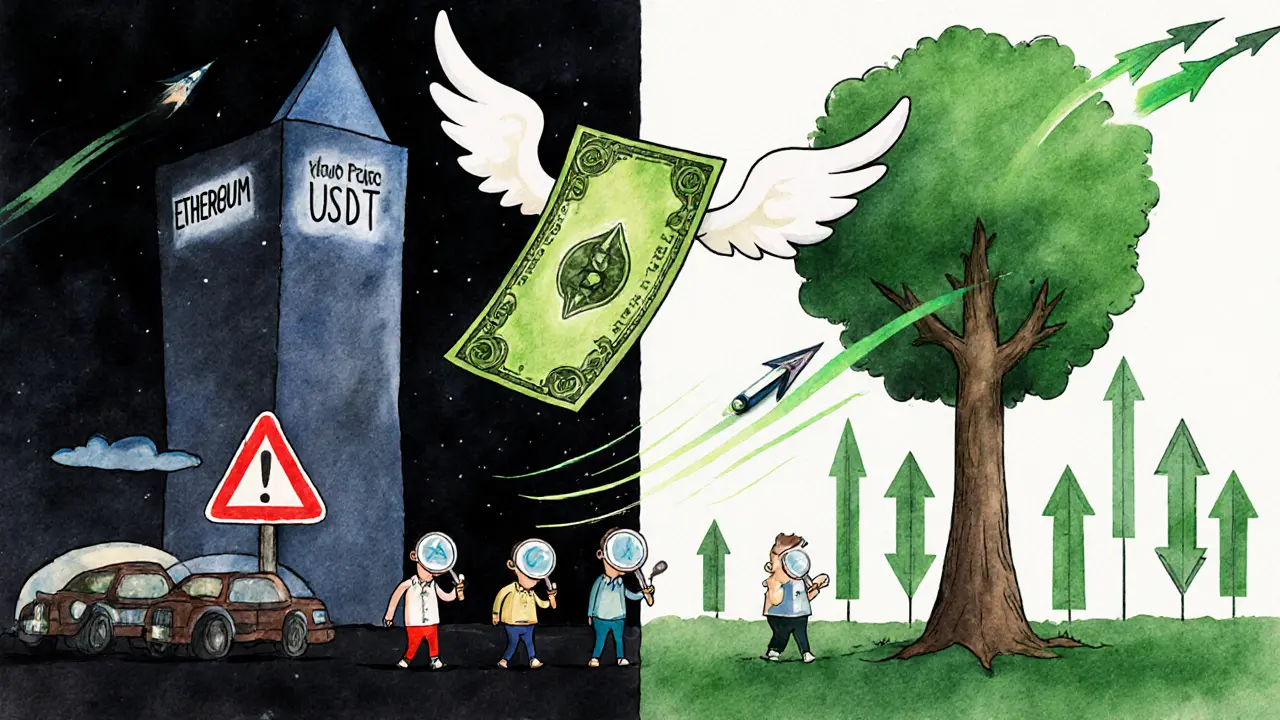

Tether USD doesn’t just sit quietly in the background. It’s the glue holding together crypto markets. When Bitcoin crashes, traders dump BTC and rush into USDT to avoid losses. When new tokens launch, they’re often paired with USDT, not Bitcoin or Ethereum. It’s the default safe harbor. But this reliance creates a massive hidden risk. If Tether ever lost its peg—if one dollar worth of USDT suddenly became worth 95 cents—trillions in crypto value could evaporate overnight. That’s not speculation. It’s what happened in 2022 when TerraUSD collapsed, and everyone scrambled to see if Tether would follow.

Related to Tether USD are other stablecoins like USDC and DAI, but none have its scale or controversy. USDC is fully backed by regulated U.S. banks. DAI is decentralized and algorithmic, but struggles to stay pegged during market stress. Tether? It’s the wild card. It claims to be fully backed, but its audits are limited, its transparency is minimal, and regulators from New York to the EU keep asking questions. And yet, you can’t ignore it. Even Binance, Kraken, and OKX rely on it daily.

What you’ll find in these posts aren’t marketing fluff or vague opinions. You’ll see real breakdowns of how Tether USD works behind the scenes, how it’s used in scams, how exchanges depend on it, and why some traders avoid it entirely. You’ll learn how fake USDT tokens circulate on rogue chains, how airdrops use USDT as a bait, and why even legitimate projects sometimes get tangled in its web. This isn’t about whether Tether is good or bad. It’s about understanding what it actually is—so you don’t get caught off guard when things go sideways.