Stablecoin Crypto: What They Are, How They Work, and Why They Matter

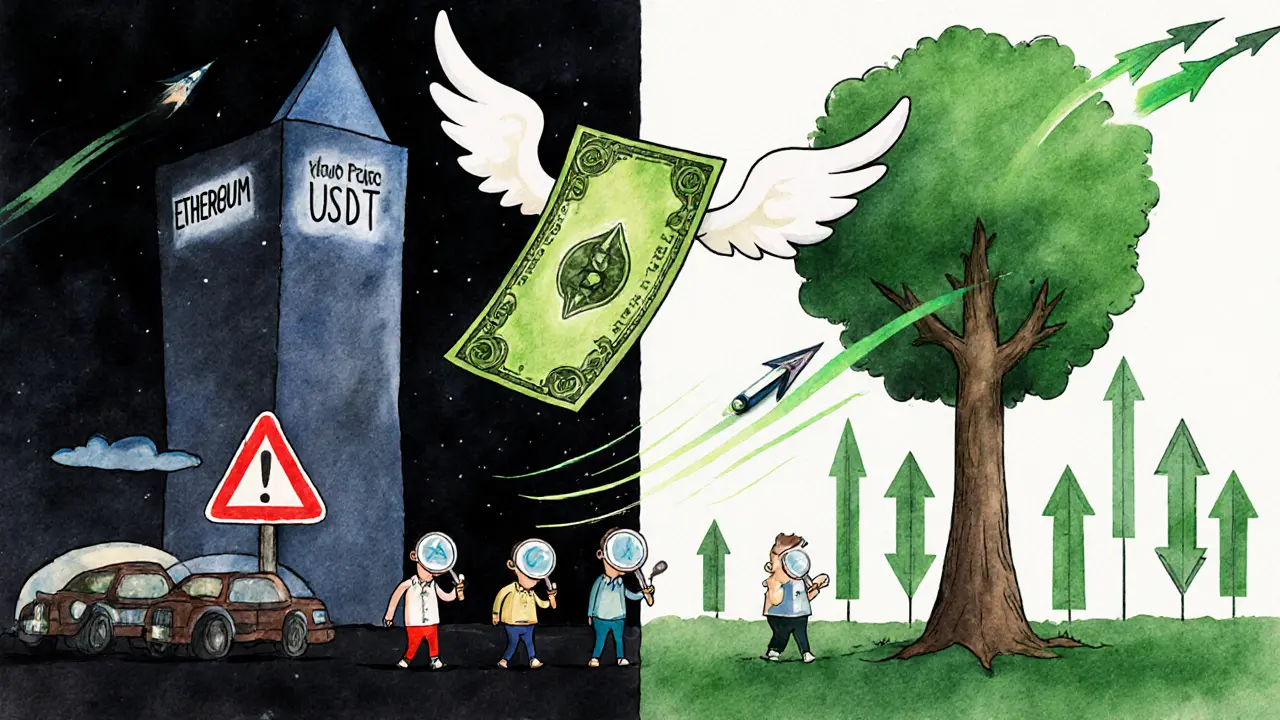

When you hear stablecoin crypto, a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset like the US dollar. Also known as pegged tokens, they’re the quiet backbone of crypto markets—letting traders move in and out of riskier coins without cashing out to fiat. Unlike Bitcoin or Ethereum, which swing wildly in price, stablecoins hold steady. That’s why you see them everywhere: on exchanges, in DeFi apps, and in airdrop requirements. They’re not meant to make you rich overnight—they’re meant to keep your money safe while you wait for the next big move.

Two names dominate the space: USDT, Tether, the oldest and most traded stablecoin, backed by a mix of cash, bonds, and other assets, and USDC, USD Coin, issued by Circle and Coinbase, with full transparency and regular audits. Both aim for a 1:1 ratio with the US dollar. But not all stablecoins are created equal. Some, like algorithmic ones, try to stay stable without real-world backing—and those have crashed hard in the past. If you’re using stablecoins to trade, hold, or earn yield, you need to know what backs them. No mystery. No guesswork.

Stablecoins are also the bridge between crypto and real life. They let you send money across borders in minutes for pennies. They’re used in DeFi lending platforms to earn interest. They show up in airdrops because they’re reliable—unlike volatile tokens, you know exactly what you’re getting. That’s why so many of the posts here focus on them: whether it’s a new exchange that accepts USDC, a DeFi protocol that pays in stablecoins, or a scam that pretends to be a stablecoin, you need to spot the difference fast.

There’s no hype here. No promises of 100x returns. Just the facts: stablecoin crypto is the foundation. It’s what lets the rest of the crypto world keep spinning. And if you’re trading, investing, or chasing airdrops, you’re already using them—whether you realize it or not. Below, you’ll find real reviews, deep dives, and scam alerts that cut through the noise and show you exactly how stablecoins are being used—and abused—in today’s market.