Monero Laundering: What It Really Means and How It Connects to Crypto Privacy

When people talk about Monero laundering, a term often misused to describe the use of Monero to obscure transaction history. Also known as crypto obfuscation, it’s not a technical term used by developers—it’s a label applied by regulators and media to describe how Monero’s privacy features make funds harder to track. Monero isn’t designed to hide illegal activity. It’s built to protect financial privacy, just like cash does in the real world. The difference? Cash leaves no digital trail. Monero does—but no one can read it.

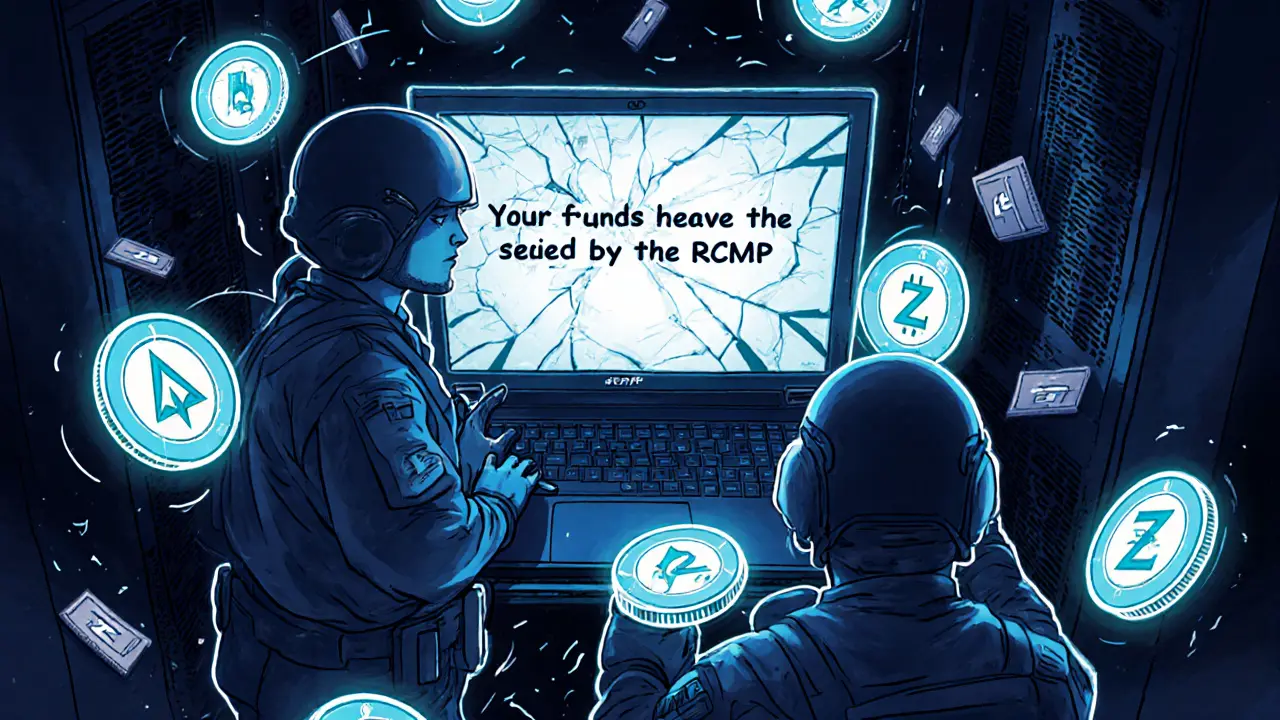

This is where blockchain tracing, the practice of following crypto transactions across public ledgers. Also known as chain analysis, it hits a wall with Monero. Unlike Bitcoin, where every transaction is visible and linkable, Monero uses ring signatures, stealth addresses, and confidential transactions to break those links. No wallet address can be tied to a sender or receiver. No amount can be seen. That’s not a flaw—it’s the whole point. And that’s why platforms like VirgoCX and COEXSTAR, which follow strict KYC rules, don’t list Monero. They can’t comply with regulations that demand full transparency.

Meanwhile, privacy coin, a category of cryptocurrencies engineered to hide transaction details. Also known as anonymous crypto, it isn’t just Monero. Zcash and Dash tried similar things, but Monero is the only one that made privacy mandatory, not optional. That’s why it’s still the go-to for users who don’t want their spending habits, income sources, or financial relationships exposed—even if they’re doing nothing illegal. People in countries like Pakistan, where banking access is restricted, or in places with heavy surveillance, use Monero not to launder money, but to move money without permission.

The truth is, most Monero transactions are completely normal. Paying a freelancer. Sending rent. Buying goods across borders. But because it’s hard to trace, it gets grouped with criminals in headlines. That’s the same logic that would call cash laundering because drug dealers use it. The tool isn’t the problem. The misuse is.

What you’ll find in the posts below aren’t guides on how to hide money. They’re real stories about how privacy tools work, who uses them, and why they’re still alive despite bans and crackdowns. From how Monsoon Finance’s MCASH token enables anonymous cross-chain swaps, to why quantum-resistant cryptography might change everything for privacy coins, these posts cut through the noise. You’ll see what’s real, what’s a scam, and what’s being misunderstood. No hype. No fearmongering. Just how crypto privacy actually works today.