Liquidity Providers: What They Do and Why They Matter in Crypto

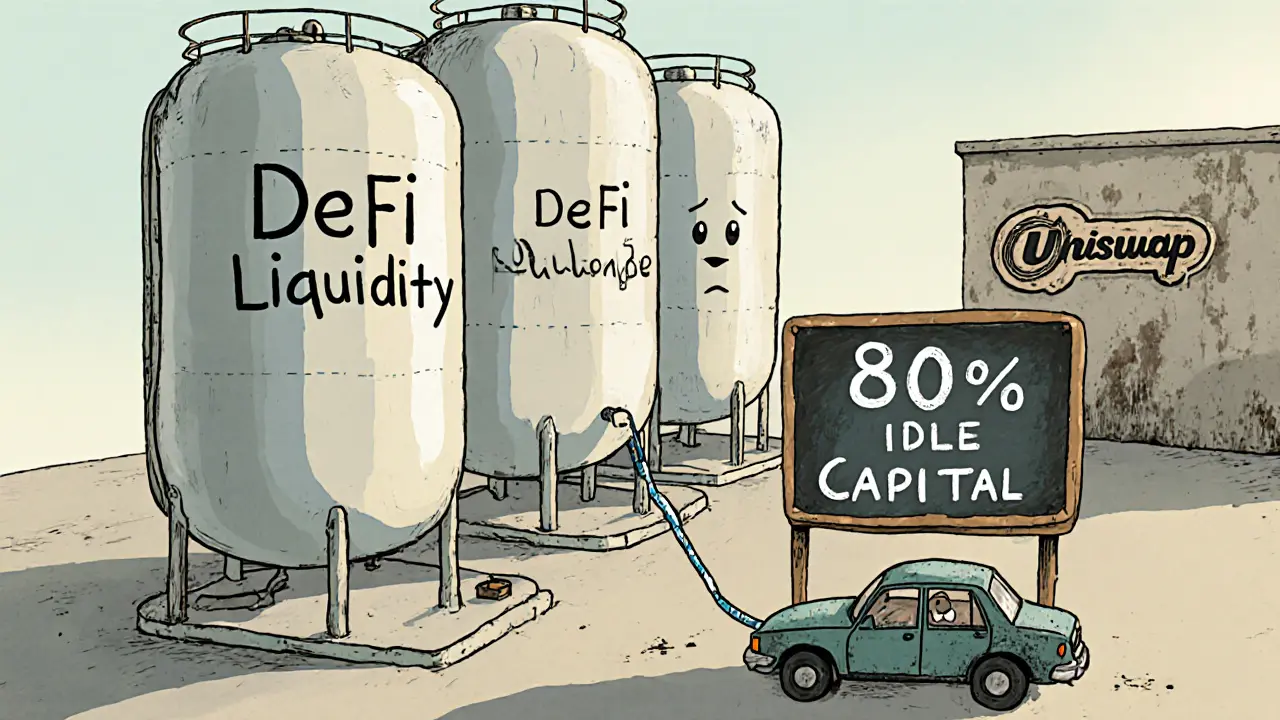

When you trade crypto on a decentralized exchange like liquidity providers, individuals or entities who supply trading pairs to decentralized exchanges to enable smooth trading. Also known as LPs, they’re the backbone of every DEX — without them, there’s no trade, no price, no market. They’re not banks. They don’t hold your money. They lock their own crypto into smart contracts so others can swap tokens instantly. Think of them as the gas that keeps the engine running.

Every time you trade ETH for USDT on a DEX, you’re using liquidity provided by someone else. That person earns a cut — usually a small percentage of every trade — called a trading fee. But it’s not free money. If the price of one token in the pair swings wildly, they can lose value. That’s called impermanent loss, a temporary reduction in value experienced by liquidity providers when the price of their paired tokens diverges significantly. It’s not a loss until they pull out, but it’s real. That’s why smart LPs stick to stablecoin pairs like USDT/USDC, or pick DEXs with tools that reduce this risk — like Lifinity on Solana or Camelot V3 on Arbitrum.

Liquidity providers aren’t just random traders. Some are professional teams running automated bots. Others are everyday users staking their tokens for rewards. In fact, many airdrops — like the one from Camelot V3, a zero-fee decentralized exchange built for the Arbitrum ecosystem that rewards liquidity providers with $GRAIL tokens. — are designed to attract them. Why? Because more liquidity means better prices, lower slippage, and more users. It’s a cycle: more LPs → better trading → more traders → more fees → more LPs.

But not all DEXs are created equal. Some, like SheepDex or EvmoSwap, pretend to be real exchanges but have zero liquidity. That’s not a platform — it’s a ghost town. Real liquidity providers won’t touch those. They look for audits, real volume, and clear reward structures. If a DEX can’t show you who’s providing liquidity, don’t trust it.

Whether you’re thinking of becoming a liquidity provider or just trying to understand why your trades work at all, knowing how this system works changes everything. You’ll see why some tokens are easy to swap and others vanish. You’ll know why some airdrops require you to stake, not just follow a Twitter account. And you’ll spot the fake exchanges before you lose money.

Below, you’ll find real reviews of DEXs where liquidity providers actually earn — and others where they get burned. No fluff. Just what works, what doesn’t, and why.