Blockchain Trust: How Decentralized Systems Build Confidence Without Middlemen

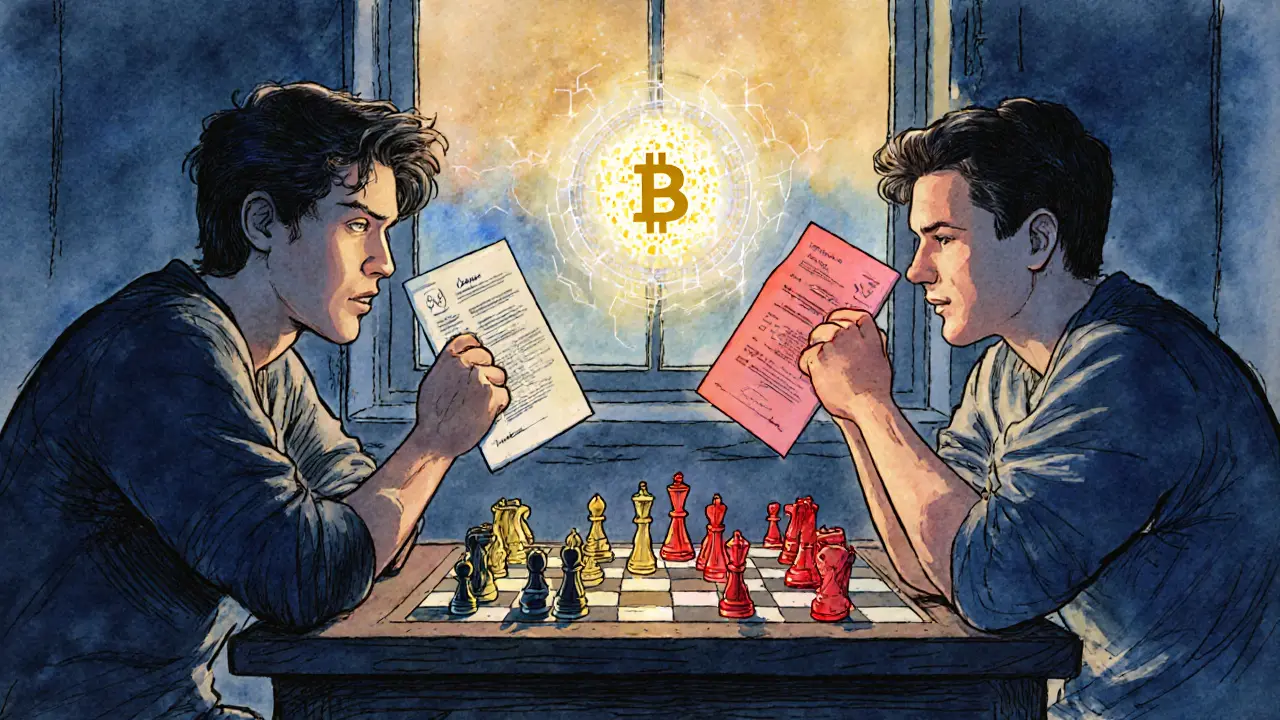

When you hear blockchain trust, a system where participants verify transactions without needing a central authority like a bank or government. Also known as trustless technology, it doesn’t mean you can’t trust it—it means you don’t need to trust anyone else to make it work. Every Bitcoin transaction, every token swap on a DEX, every NFT transfer relies on this idea: if the math checks out, the deal stands. No CEO, no regulator, no middleman can reverse it. That’s the promise. But not every blockchain delivers it.

That’s where decentralized identity, a way to prove who you are online without handing your data to a company. Also known as self-sovereign identity, it lets you control your credentials—like your age, license, or passport—without exposing your whole life story. Think of it like showing a driver’s license instead of your entire birth certificate. Projects like those using verifiable credentials are trying to make this real, but they’re useless if the underlying blockchain can’t be trusted. And that’s where things get messy. cryptocurrency mixing, services that obscure transaction trails to protect privacy. Also known as crypto tumblers, they’re used by everyday users to avoid surveillance—but also by North Korean hackers to launder stolen crypto. The same tool that shields your savings can enable crime. That’s the double-edged sword of blockchain trust: it empowers freedom, but also anonymity without accountability.

Then there’s the flip side: CBDC privacy, when governments issue digital money that can track every dollar you spend. Also known as central bank digital currency, it’s the opposite of decentralized trust—it’s centralized control wrapped in blockchain tech. Countries like China and the EU are testing it, but if your digital yuan can be frozen because you bought the "wrong" goods, is that trust—or surveillance? The posts below show how real people are navigating this. Some use crypto to survive hyperinflation in Argentina. Others trade on shady DEXes like CRODEX or DerpDEX, betting on low-volume tokens because they trust the code more than the banks. Meanwhile, scams like Step Exchange and dead airdrops like StarSharks remind us that not every "decentralized" project is honest. You’ll find reviews of real exchanges, deep dives into how wrapping tokens works, and warnings about tax traps in Mexico and the UK. This isn’t theory. It’s about what happens when trust is built on code, not contracts—and when that code fails.