Binance ban Cambodia: What Happened and How It Changed Crypto in Southeast Asia

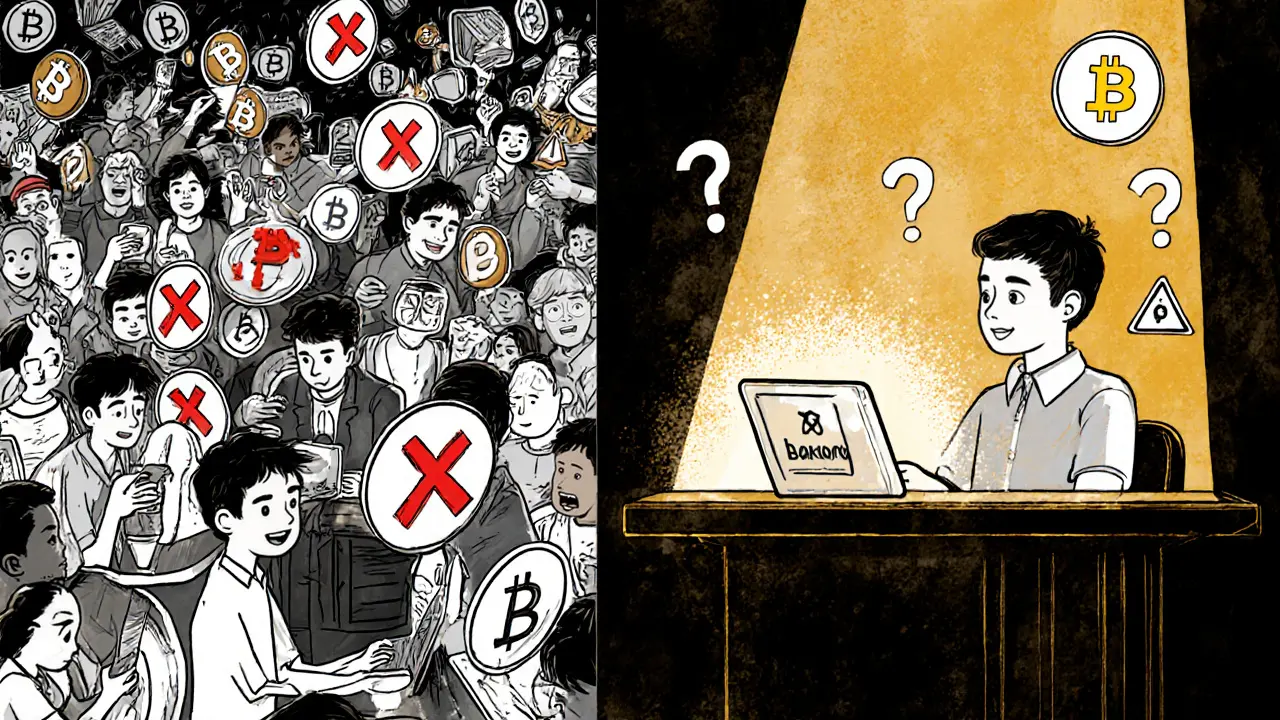

When Binance, the world’s largest cryptocurrency exchange by volume, was banned in Cambodia in 2023, it wasn’t just a local regulatory move—it was a wake-up call for the entire Southeast Asian crypto scene. The ban came after Cambodia’s Securities and Exchange Regulator accused Binance of operating without a license, offering derivatives and staking services to local users without proper oversight. This wasn’t a random decision. It followed years of unchecked growth, where millions of Cambodians turned to Binance for trading, earning interest, and even paying for goods—all without any legal guardrails. The government didn’t shut down crypto. It shut down the unregulated part of it.

What followed was a domino effect. Other exchanges like OKX and Bybit quickly pulled back or started working with local regulators to get licensed. Meanwhile, users scrambled to move funds to wallets or switch to peer-to-peer platforms. The crypto regulation Cambodia, the legal framework governing digital asset trading in the country had been vague for years, but after the Binance ban, it became clear: no more gray zones. The government started pushing for licensed local exchanges and required all crypto businesses to register. This wasn’t about killing crypto—it was about controlling it. And it worked. Trading volumes dropped short-term, but trust started to rebuild as regulated platforms emerged.

The real story here isn’t just about one exchange being banned. It’s about how a small country became a test case for how emerging markets handle crypto growth. Cambodia had no banking infrastructure for many, so crypto filled the gap. People used USDT to send money home, pay for imports, or save against inflation. When Binance vanished overnight, they didn’t stop using crypto—they just found new ways. P2P platforms like Paxful and LocalBitcoins saw traffic spike. Wallets like Trust Wallet and MetaMask became essential tools. And suddenly, the Southeast Asia crypto, the collective market of nations like Cambodia, Vietnam, and Indonesia where crypto adoption is driven by necessity wasn’t just about speculation anymore—it was about survival.

What you’ll find in the posts below are real stories from this shift: how exchanges responded, how users adapted, and what lessons other countries can learn. Some posts dig into the technical side—how Binance’s infrastructure handled the exit. Others show how local traders built new systems without relying on big platforms. There’s also analysis on how this ban compares to similar crackdowns in Kazakhstan and Pakistan. This isn’t just history. It’s a blueprint for what happens when crypto outgrows regulation—and how markets force change when governments move too late.