National Bank of Cambodia and Its Role in Crypto Regulation

When it comes to National Bank of Cambodia, the central monetary authority responsible for managing Cambodia’s currency, financial stability, and payment systems. Also known as NBC, it’s one of the few central banks in Asia that has openly embraced digital currency while cracking down on unregulated crypto trading. Unlike many countries that ban or ignore cryptocurrency, the National Bank of Cambodia has taken a hands-on approach — not by banning Bitcoin, but by pushing its own digital currency, the e-Khmer, a central bank digital currency (CBDC) launched in 2020 to replace cash and streamline payments across the country. This move wasn’t just about modernizing finance; it was a direct response to the flood of unregulated crypto activity that had already taken root in Cambodia’s informal economy.

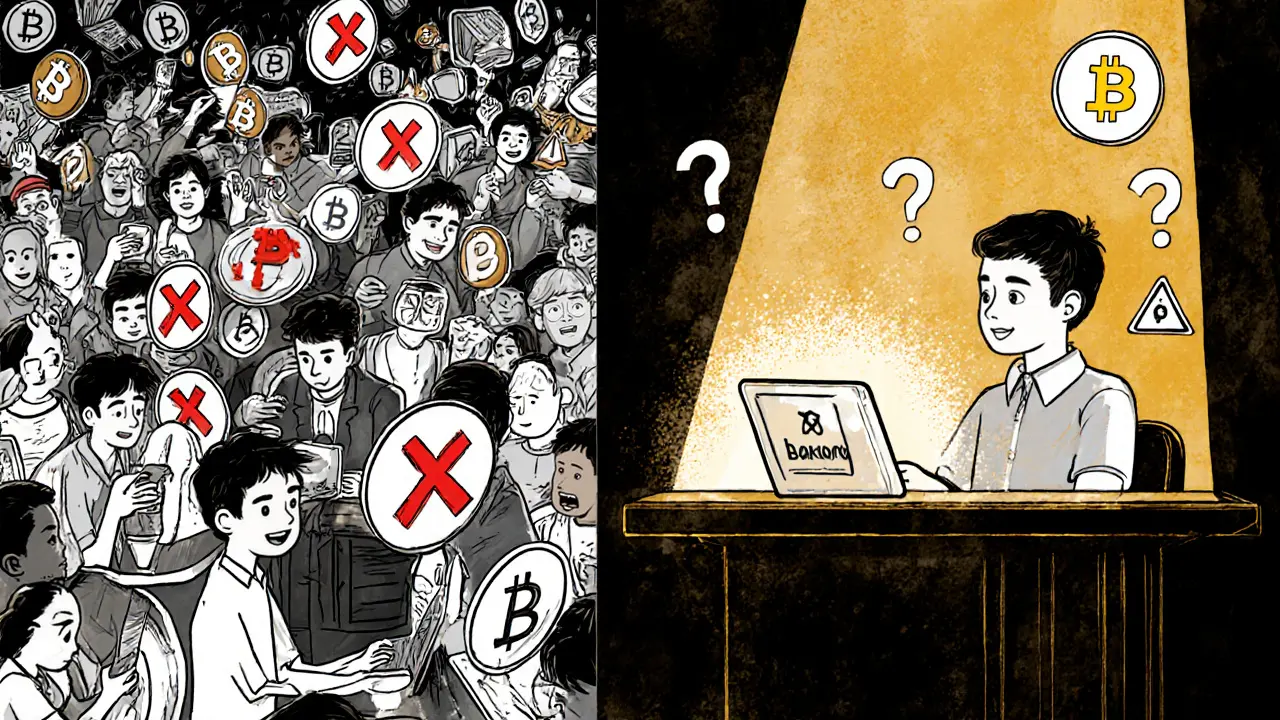

While the National Bank of Cambodia doesn’t allow crypto exchanges to operate legally, it also doesn’t arrest people for holding Bitcoin. Instead, it focuses on controlling the flow of money. That’s why you see so many Cambodians using USDT to send remittances or buy goods — they’re bypassing traditional banks that still refuse to touch crypto. The bank’s stance is clear: if you want to use digital money, use ours. But if you’re using foreign tokens, don’t expect help from regulators. This creates a strange reality: crypto thrives underground, while the official digital currency grows in government-backed apps. The e-Khmer is now used by millions for daily payments, from street vendors to ride-hailing drivers. Meanwhile, crypto traders operate on Telegram groups and peer-to-peer apps, often using the same phones that run the official digital wallet.

What does this mean for you? If you’re trading crypto in Cambodia, you’re operating in a gray zone — not illegal, but unsupported. The National Bank of Cambodia doesn’t protect your assets, doesn’t verify exchanges, and doesn’t offer recourse if you get scammed. But it also doesn’t stop you. This tension between control and chaos is why Cambodia is one of the most interesting case studies in global crypto policy. You’ll find posts here that dig into how Cambodians moved $300 billion in crypto despite banking bans, how local users navigate the gap between e-Khmer and USDT, and why exchanges that claim to be "Cambodia-friendly" are often just fronts for offshore operations. The National Bank of Cambodia didn’t create the crypto boom — but its rules shaped how it survived.