Meme Coin: What They Are, Why They Surge, and Which Ones Actually Matter

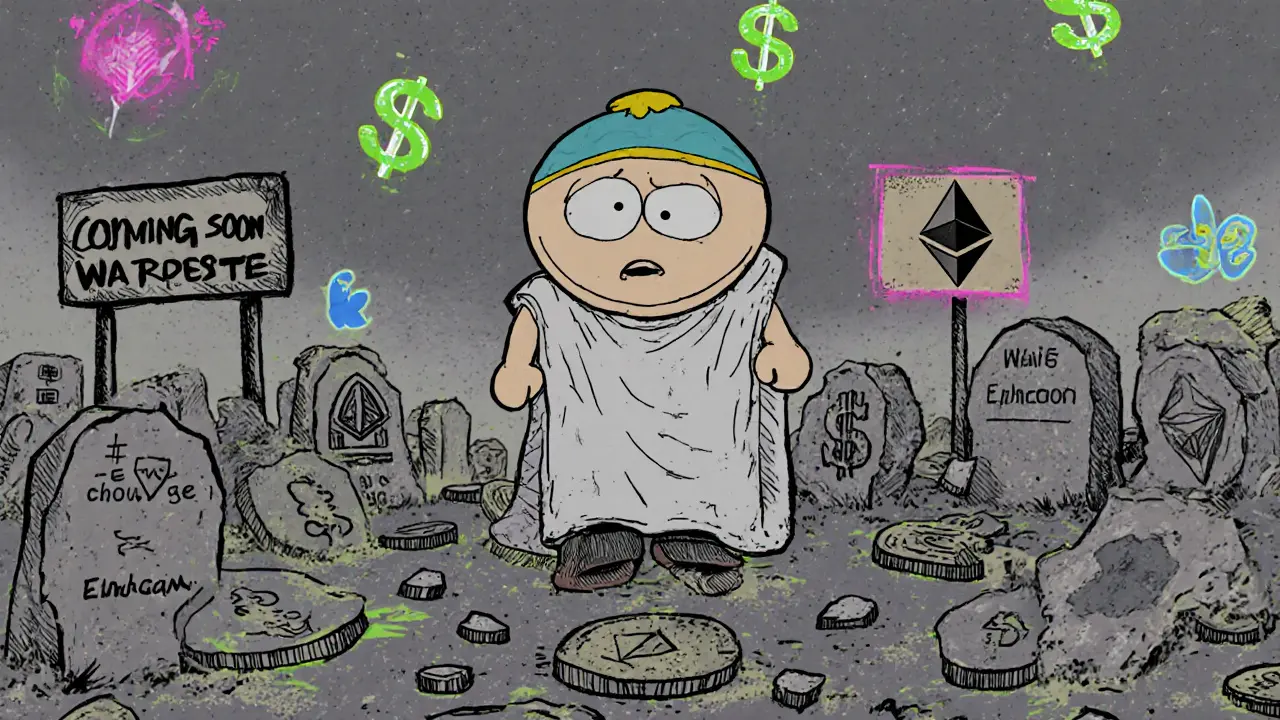

When you hear meme coin, a cryptocurrency created mostly for fun, humor, or viral appeal rather than technical innovation. Also known as dog coin, it often starts as a joke but can turn into a financial phenomenon overnight. Most meme coins have no team, no whitepaper, no real use case—just a catchy name, a meme, and a community that believes hard enough to push the price up. Dogecoin started as a parody of Bitcoin. Shiba Inu copied Dogecoin. Then came CHEEPEPE, CharCoin, AINN, and dozens more—all built on Solana or Ethereum, with zero real tech, and prices that crash as fast as they rise.

What keeps these coins alive isn’t utility—it’s hype. A tweet from a celebrity. A Reddit thread gone viral. A Discord group pushing FOMO. Meme coins thrive on attention, not architecture. That’s why they’re so risky. If the meme dies, the price collapses. Look at AINN: it hit $3 in early 2024, then dropped 90% because it had no team and no AI tech behind it. CHEEPEPE? It lost 96% of its value. CharCoin claims to donate to charity every time you trade—but there’s no proof it ever did. These aren’t investments. They’re bets on collective belief.

But here’s the twist: some meme coins survive longer than you’d expect. Why? Because they build communities, not code. They turn holders into fans. They give people something to cheer for. That’s why a meme coin on Solana can outlast a blockchain project with a $50 million budget. The real danger isn’t the joke—it’s the people pretending it’s not a joke. Scammers know this. They create fake meme coins like BTC2.0, which isn’t Bitcoin at all—it’s an Ethereum token with infinite supply and zero backing. Or EvmoSwap, which pretends to be a real exchange but has no users and no liquidity. They all sound convincing. They all look real. Until you dig.

What you’ll find below isn’t a list of top meme coins to buy. It’s a collection of real investigations. We’ve looked at the ones that exploded, the ones that vanished, and the ones that still fool people. You’ll see how RACA’s airdrop turned a meme into a game economy. How NEKO became a scam magnet. How a coin like CHEEPEPE can drop 96% and still have people holding on. This isn’t advice to buy. It’s a guide to understand why these things happen—so you don’t get burned by the next one.