Bakong System: What It Is and How It’s Changing Cambodia’s Crypto and Payments

When you think of digital money in Asia, you might picture China’s digital yuan or India’s UPI—but Bakong system, a central bank digital currency (CBDC) platform launched by the National Bank of Cambodia in 2020. Also known as Cambodia’s digital payment infrastructure, it lets anyone with a phone send money instantly between banks, mobile wallets, and even small vendors—no bank account needed. This isn’t a side project. It’s the backbone of financial access for millions.

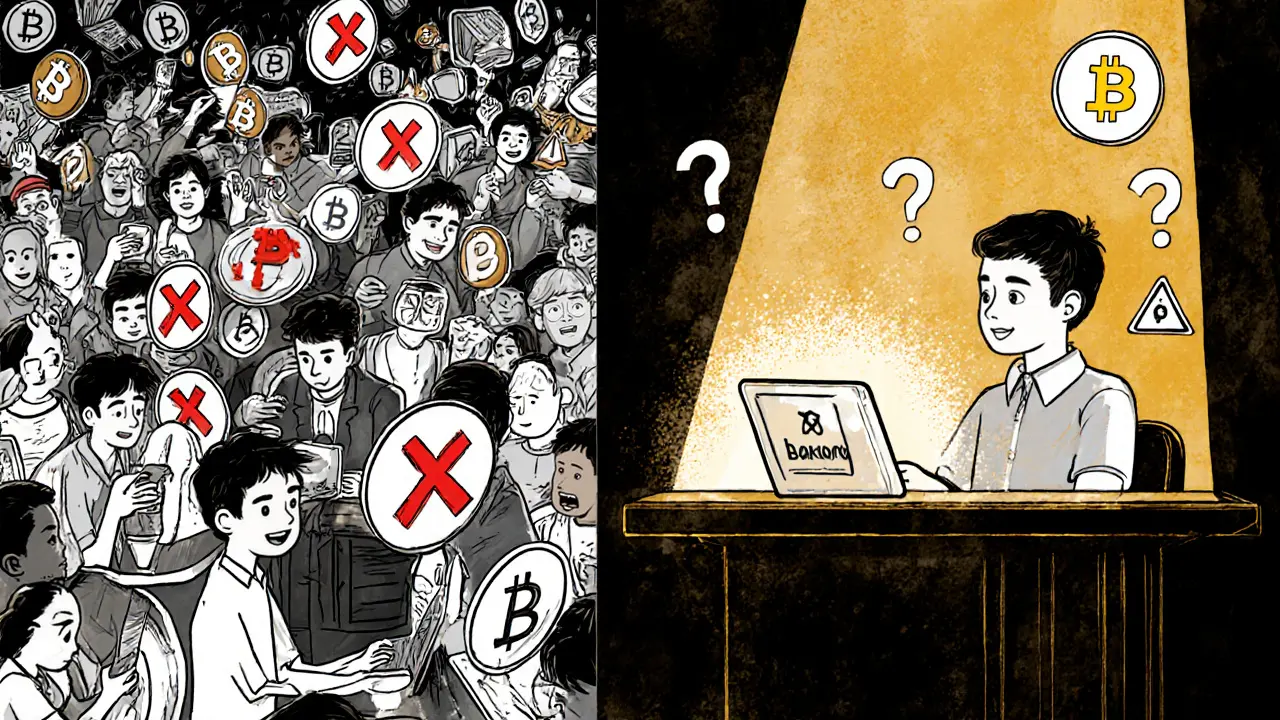

The Bakong system doesn’t just digitize cash. It connects over 30 banks and fintech apps under one network, so a farmer in Siem Reap can pay a vendor in Phnom Penh using a QR code, and the money clears in seconds. No intermediaries. No delays. No fees. That’s the power of a government-backed CBDC. Unlike crypto, Bakong isn’t volatile—it’s tied directly to the Cambodian riel. But here’s the twist: it’s also enabling crypto adoption indirectly. People who use Bakong to pay bills or send remittances are getting used to digital wallets. That makes it easier for them to later try crypto apps like USDT transfers or DeFi tools. It’s not crypto—but it’s training a whole country to trust digital money.

What makes Bakong different from apps like PayPal or Venmo? It’s public infrastructure, not a private company’s product. The central bank owns it. No one can shut it down. No one can freeze your account without legal cause. And because it’s built on open APIs, startups can plug into it easily. That’s why you see local apps like Pi Pay and ABA Pay thriving on Bakong’s foundation. It’s not about replacing cash—it’s about giving people who’ve never had a bank card a way to participate in the economy.

Behind the scenes, Bakong uses blockchain-like tech for transaction tracking, but it’s not a public blockchain. It’s a permissioned ledger, meaning only approved institutions can validate transactions. This keeps it fast, secure, and compliant. It’s not designed for anonymity like Monsoon Finance’s MCASH. It’s designed for inclusion.

And it’s working. Over 70% of Cambodians now use digital payments—up from less than 10% in 2019. The World Bank calls it one of the most successful CBDC rollouts in the world. You won’t find Bakong on CoinMarketCap. But if you’re looking at how real people adopt digital finance—especially in emerging markets—it’s one of the most important systems on the planet.

Below, you’ll find real-world stories and breakdowns of platforms, scams, and payment systems that intersect with digital money trends like Bakong. From airdrops that promise free tokens to exchanges that vanish overnight, these posts show what happens when new money meets old systems—and why understanding the infrastructure matters more than chasing hype.