USDT.a: What It Is, How It Works, and Why It Matters in Crypto

When you see USDT.a, the version of Tether native to the Avalanche blockchain. Also known as USDT on Avalanche, it’s not just another stablecoin—it’s a bridge that lets you move value quickly and cheaply between DeFi apps on Avalanche and other chains. Unlike regular USDT, which runs on Ethereum, TRON, or Solana, USDT.a was built specifically to work with Avalanche’s fast, low-cost network. This means if you’re trading, lending, or staking on Avalanche-based platforms like Trader Joe or Pangolin, USDT.a is often the go-to stablecoin because it settles in under a second and costs pennies in fees.

USDT.a isn’t a separate currency—it’s the same USDT, just wrapped for Avalanche. It’s backed 1:1 by Tether’s reserves, so its value stays locked to the U.S. dollar. But here’s the key: Avalanche, a high-performance blockchain known for speed and scalability. Also known as Ava Labs network, it enables apps to handle thousands of transactions per second makes USDT.a far more efficient than USDT on older chains. That’s why traders and DeFi users in places like Pakistan and Canada—where fast, low-cost crypto transfers are a necessity—favor USDT.a for cross-chain swaps, liquidity pools, and margin trading. You won’t find it on centralized exchanges like VirgoCX or COEXSTAR, but you’ll see it everywhere on decentralized platforms that support Avalanche.

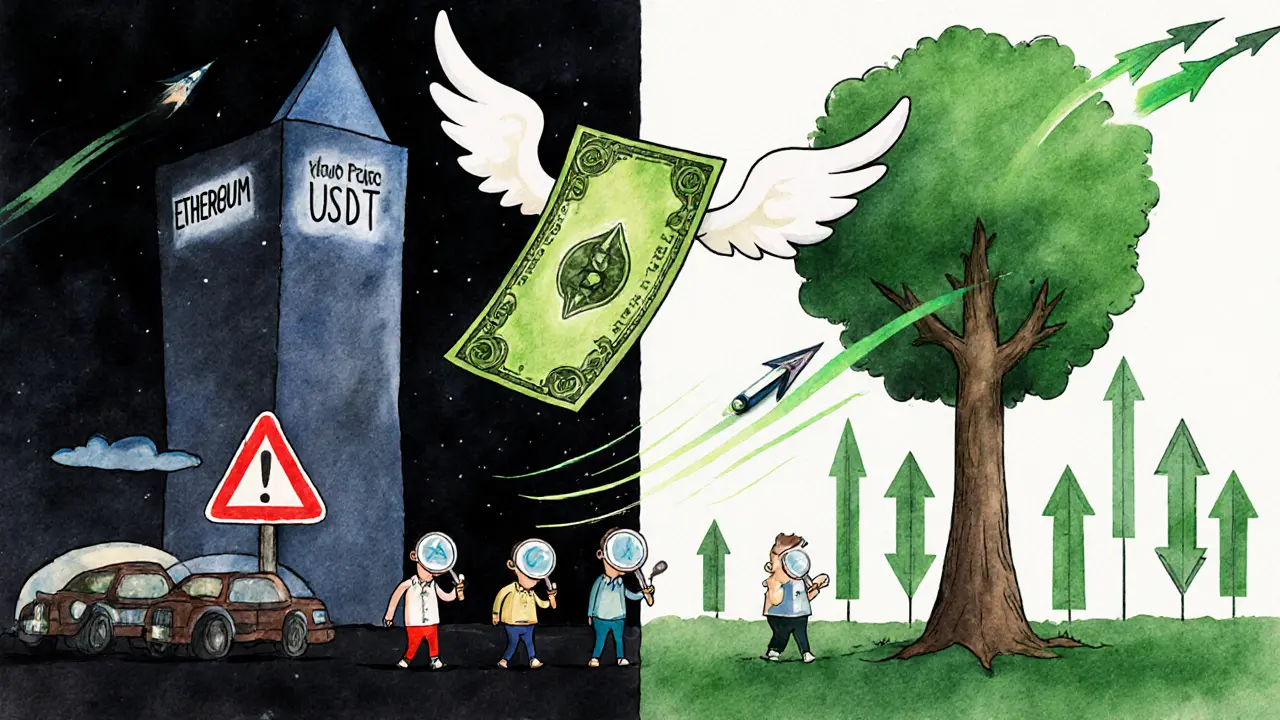

What’s interesting is how USDT.a fits into bigger trends. In 2025, as countries like Cambodia and Kazakhstan tighten crypto rules, users are turning to chains like Avalanche not because they’re unregulated, but because they’re faster and cheaper. USDT.a becomes a quiet tool for bypassing slow bank rails without breaking rules. It’s not a scam, not a meme coin—it’s infrastructure. And just like how Merkle Trees, a cryptographic structure that lets blockchains verify transactions efficiently. Also known as hash trees, they enable lightweight wallets to confirm data without downloading entire ledgers keep blockchains light and secure, USDT.a keeps value moving without the drag of legacy networks.

You’ll find posts here that dig into real-world cases: how Pakistan’s $300 billion crypto economy leans on stablecoins like USDT.a to bypass banking bans, how airdrops like GMPD and MOONED use it for cross-chain rewards, and why exchanges like Ethfinex and Poloniex don’t list it directly but still rely on it behind the scenes. This isn’t about hype. It’s about what works when speed, cost, and reliability matter—and USDT.a is one of the quietest, most reliable tools in crypto right now.