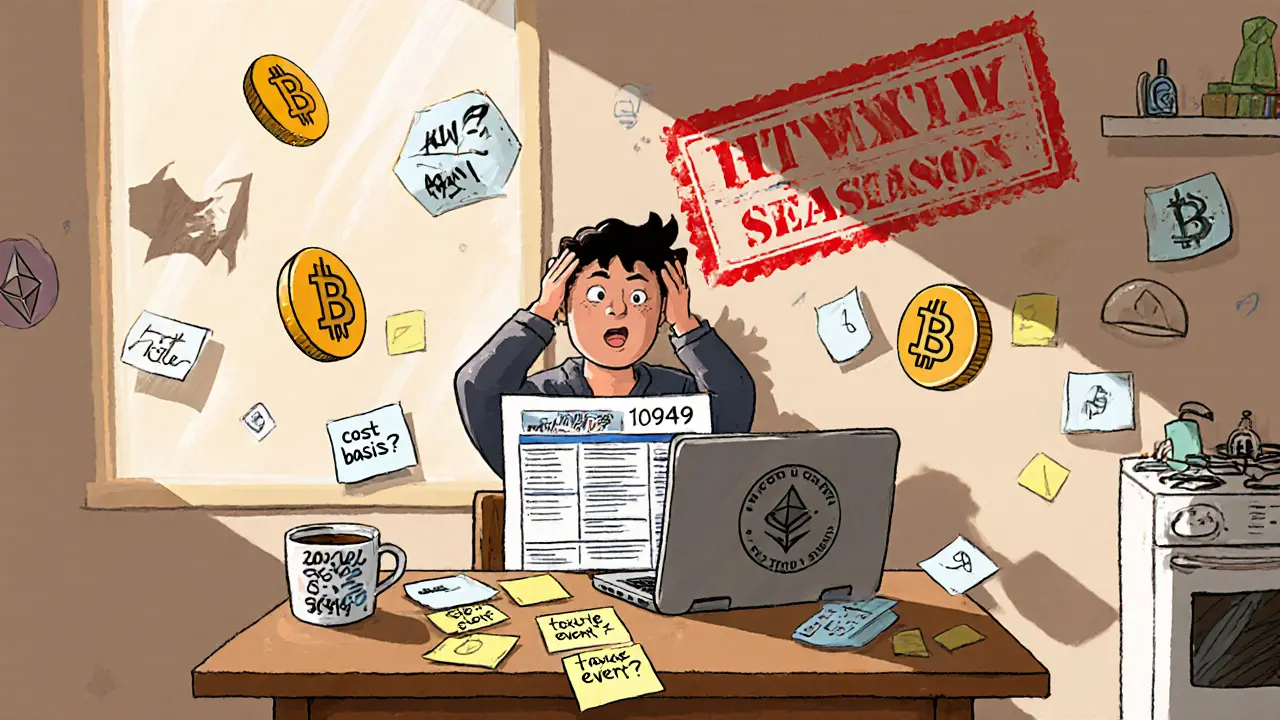

Report Crypto Taxes: What You Need to Know About Crypto Tax Rules and Reporting

When you report crypto taxes, you’re legally required to track and declare gains, losses, and income from digital assets like Bitcoin, Ethereum, or any token you trade, earn, or sell. Also known as cryptocurrency tax reporting, this isn’t optional — the IRS and other tax agencies treat crypto like property, not cash. If you bought Bitcoin in 2020 and sold it for a profit in 2024, you owe taxes. If you got paid in USDT for freelance work, that’s income. If you swapped one token for another, even if you didn’t touch fiat, that’s a taxable event. Most people think they’re safe if they never cashed out — they’re wrong.

People get tripped up because crypto moves fast and tools are messy. You can’t just look at your exchange statement and call it done. Crypto tax software, like Koinly, CoinTracker, or TokenTax, helps connect your wallets, exchanges, and DeFi activity to calculate what you owe. But even those tools can miss things if you don’t import all your addresses. Airdrops, staking rewards, and NFT sales? All taxable. If you earned $500 in BUTTER tokens from a staking campaign or got 8.50 ZOO tokens from a Christmas airdrop, that’s income at the market value the day you received it. If you later sold those tokens for $700, you have a $200 capital gain. The IRS doesn’t care if you didn’t realize it — they see the transaction.

And it’s not just the U.S. The UK, Canada, Australia, and the EU all have their own rules, but the core idea is the same: track everything. In Pakistan, where $300 billion in crypto trades happen yearly, users still need to report gains. In Kazakhstan, where mining got regulated, miners still report income. Even if you’re using a platform like VirgoCX or COEXSTAR that doesn’t send you a 1099, the responsibility is yours. Many think, "I didn’t get a form, so I don’t have to report" — that’s how audits start. The IRS has data from Coinbase, Binance, and other major platforms. They’re cross-referencing wallet addresses. If you didn’t report, you’re already behind.

What you’ll find here aren’t generic guides. These are real breakdowns of what actually happened with tokens like HPY, MK, MCASH, and SPAT — and how those events trigger tax consequences. You’ll see how airdrops like GMPD or MOONED are treated differently than trading, how staking rewards on HECO Chain count as income, and why shutting down an exchange like AlphaX doesn’t erase your tax liability. We don’t sugarcoat it. If a token is dead — like MIMO or POP — and you still hold it, you might still owe taxes on the last sale. If you lost money, you can claim losses, but only if you documented the trades. This isn’t about guessing. It’s about knowing exactly what you did, when you did it, and what it was worth.