Sei (SEI) isn’t just another cryptocurrency. It’s a blockchain built from the ground up to fix the biggest headaches in decentralized trading. If you’ve ever waited minutes for a trade to confirm, paid $5 in gas fees to buy a token, or watched your order get front-run by bots, Sei was made for you. Launched in August 2023 by Sei Labs, this Layer 1 blockchain doesn’t try to be everything to everyone. It focuses on one thing: making decentralized exchanges faster, cheaper, and fairer.

Why Sei Exists

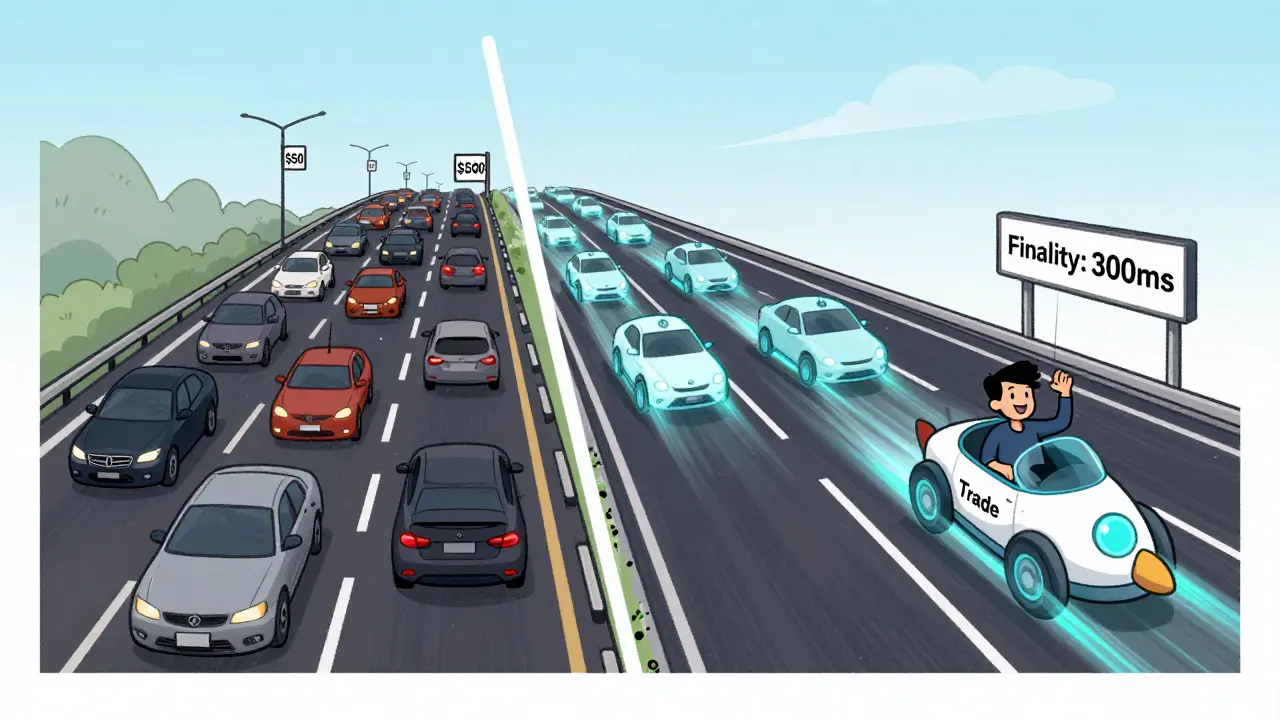

Most blockchains were designed for simple transfers or basic smart contracts. Ethereum, for example, handles only about 15 transactions per second. Even fast chains like Solana, which can do 10,000 TPS, still struggle with order matching in decentralized trading. That’s where Sei steps in. It wasn’t built to replace Ethereum or Solana. It was built to outperform them in trading.Before Sei, decentralized exchanges (DEXs) had to fake order books using smart contracts. That meant orders were processed one at a time, creating delays and letting bots sneak in front of your trade-something called sandwich attacks. Sei solved this by building a native order-matching engine directly into its blockchain. That means buy and sell orders are matched at the network level, not in a slow, congested smart contract. The result? Trades execute in under half a second.

How Sei Works

Sei’s secret sauce is its Twin Turbo consensus. This system splits the work of confirming transactions into two parts: ordering and execution. While other chains wait for every node to agree before processing, Sei lets orders be processed in parallel. Think of it like a highway with 12,500 lanes instead of 10,000. Each lane handles trades for a specific asset pair-like SEI/USDC or ETH/SEI-without blocking others.That’s why Sei can handle 12,500 transactions per second, faster than Solana, and with finality in just 300-400 milliseconds. Compare that to Ethereum, where finality can take 5-15 minutes. On Sei, you can place 50 limit orders in under two seconds. Total gas cost? Less than a penny.

It’s also fully compatible with Ethereum’s Virtual Machine (EVM). If you’re a developer who knows Solidity, you can deploy your DApp on Sei with minimal changes. No need to learn a new language. Just adjust for Sei’s parallel execution and native order book features.

Performance Compared to Other Chains

| Feature | Sei | Solana | Ethereum |

|---|---|---|---|

| Transactions per second (TPS) | 12,500 | 10,000 | 15 |

| Finality time | 300-400 ms | 400-600 ms | 5-15 minutes |

| Avg. transaction cost (10k tx) | $0.05 | $0.01-$0.10 | $15-$50 |

| Native order matching | Yes | No | No |

| Network outages (2024) | 0 | 3 | 0 |

Sei doesn’t just win on speed-it wins on reliability. While Solana suffered three major outages in 2024, Sei stayed online. That matters when you’re trading large positions. A single network crash can cost you thousands.

Who Backs Sei?

Sei didn’t launch with just a whitepaper and a Discord. It had serious money behind it. Major institutions like Coinbase, GSR, Flow Traders, and Circle invested early. Circle, the company behind USDC, integrated its stablecoin directly into Sei’s network. That means you can trade USDC on Sei-based DEXs with zero conversion delays.Sei Labs also launched a $120 million ecosystem fund to support developers building trading apps on the chain. Over 800,000 daily active addresses are already using it, and the Total Value Locked (TVL) has crossed $600 million. That’s not Bitcoin-level adoption, but for a chain focused on one niche, it’s explosive growth.

What You Can Do on Sei

Right now, the biggest use cases are:- High-frequency DEXs like Hyperliquid, which handles perpetual futures with sub-second execution.

- Order-book spot exchanges like Pheasant Network and Magma, where users place precise buy/sell orders instead of swapping through liquidity pools.

- NFT marketplaces where fast bidding and auction endings matter.

- Prediction markets where timing is everything.

You can use MetaMask or Phantom to connect to Sei. Just add the network manually using the RPC details from Sei’s official docs. No new wallet needed. You can even use the same seed phrase you use for Ethereum.

Limitations and Risks

Sei isn’t perfect. Its focus on trading means it’s not ideal for things like social apps, gaming, or DeFi protocols that don’t rely on order books. If you’re building a simple token swap app, Uniswap on Ethereum or PancakeSwap on BSC might still be easier.Developers have reported a learning curve. The native order book system requires thinking differently than standard AMM (Automated Market Maker) models. One developer on GitHub said it added 2-3 weeks to their timeline because they had to restructure how their app handled liquidity.

There’s also the risk of specialization. If no major DEXs adopt Sei, the chain could stagnate. Right now, it’s betting on the future of decentralized trading-and that future needs to grow faster than centralized exchanges like Binance or Coinbase.

The Future: Sei Giga and AI Integration

Sei’s next big upgrade, called Sei Giga, is planned for late 2025. It’s not just an improvement-it’s a leap. The new Autobahn consensus protocol will boost throughput to over 200,000 TPS and enable 5 gigagas per second, making it 50x faster than current EVM chains.Even more surprising: Sei is integrating AI. The upcoming MCP (Model Context Protocol) Server will let tools like ChatGPT and Claude interact with the blockchain using natural language. Imagine typing, “Buy 0.5 ETH for SEI when price drops below $3,200,” and the AI executes it on-chain. That’s not science fiction-it’s coming to Sei.

Other planned upgrades include zk-proofs for private trades in late 2024 and multi-chain deployment in 2025, letting users move assets between Sei and other Cosmos chains like Osmosis or Celestia with near-instant speed.

Is SEI a Good Investment?

The SEI token has a fixed supply of 10 billion. Around 15% is held by the foundation for ecosystem growth. Another 20% went to early investors and team members, with a 4-year vesting schedule. The rest is in circulation, mostly distributed through trading incentives and staking rewards.Price-wise, SEI has seen volatility, as all crypto does. But its value isn’t just in speculation-it’s in utility. The more trading volume flows through Sei, the more demand there is for SEI to pay for gas and secure the network through staking. Currently, over 40% of SEI tokens are staked, which means users are betting on its long-term growth.

Analysts at Bloomberg Intelligence project Sei could capture 5-7% of the DEX market by 2026-if the Sei Giga upgrade delivers. That’s a big “if,” but the technical foundation is solid. Unlike many chains that promise the moon, Sei has real numbers: speed, cost, uptime, and adoption.

Getting Started with Sei

If you want to try Sei:- Get an Ethereum-compatible wallet like MetaMask.

- Add the Sei network manually:

Network Name: Sei Mainnet

RPC URL: https://rpc.sei-apis.com

Chain ID: 1329

Symbol: SEI

Block Explorer: https://seiscan.io - Buy SEI on exchanges like Binance, KuCoin, or OKX.

- Transfer SEI to your wallet and connect to a Sei DEX like Hyperliquid or Magma.

- Start trading. You’ll notice the difference immediately.

For developers, Sei’s docs at docs.sei.io are clear, well-organized, and include sample code. The $10 million developer incentive program is still active, offering grants for building trading apps.

Final Thoughts

Sei isn’t trying to be the next Ethereum. It’s trying to be the best place to trade crypto on-chain. And for that specific job, it’s already winning. If you care about speed, cost, and fairness in decentralized trading, Sei is the most promising chain you’re not yet using. The technology is real. The adoption is growing. And the upgrades are coming fast.Whether you’re a trader, a developer, or just curious, Sei offers something rare in crypto: a solution that actually works better than the old way.

What is SEI crypto used for?

SEI is the native token of the Sei blockchain, used to pay for transaction fees, stake to secure the network, and participate in governance. It’s primarily used by traders and developers on decentralized exchanges built on Sei, where fast order execution and low fees are critical.

Is Sei better than Solana or Ethereum for trading?

Yes, for trading specifically. Sei offers faster order matching (300-400ms finality), higher throughput (12,500 TPS), and a native order book system that prevents front-running. Solana is fast but lacks native order matching and has had outages. Ethereum is too slow and expensive for high-frequency trading.

Can I use MetaMask with Sei?

Yes. MetaMask works with Sei by adding the Sei network manually. Use the RPC URL https://rpc.sei-apis.com, Chain ID 1329, and SEI as the symbol. You can use the same wallet you use for Ethereum.

How many SEI tokens are there?

There is a fixed total supply of 10 billion SEI tokens. At launch, 15% was allocated to the foundation, 20% to team and investors (with 4-year vesting), and the rest distributed to the public via staking, trading incentives, and ecosystem grants.

Is Sei a good long-term investment?

It depends on adoption. Sei has strong technical advantages and institutional backing, but its value is tied to whether major DEXs and traders keep building on it. If the Sei Giga upgrade succeeds and trading volume grows, SEI could become a key asset in DeFi infrastructure. But if general-purpose chains improve faster, Sei’s niche could shrink.

What makes Sei different from other blockchains?

Sei is the only blockchain with a native order-matching engine at Layer 1. While others force trading into smart contracts, Sei built the matching logic directly into its consensus layer. This eliminates latency, reduces front-running, and allows parallel processing of trades-something no other chain does at scale.

I tried Sei last week after reading this and holy crap it's insane. Placed 12 orders in 1.8 seconds. Gas was $0.03 total. I thought I was dreaming. No more front-running, no more waiting. This is what crypto was supposed to be.

This is the real deal. No capes, no hype. Just speed and cheap fees. I used to hate trading on DEXs. Now I do it daily. Sei just works.

Okay but the native order book? Game changer. You guys are sleeping on this. The parallel execution layer is pure genius. And the EVM compatibility? Chef's kiss. I migrated my whole trading bot stack last month. 40% faster fills, 90% lower slippage. The $120M fund is gonna blow up the dev scene. Get in early.

I've seen this before... EVERYBODY says 'this is the future'... then the chain crashes... Solana did it... Terra did it... and now Sei? Come on... they had THREE outages in 2024? Wait no... ZERO? That's impossible... I'm not buying it... someone's lying... this feels like a pump... I'm calling it now... it's gonna crash by Q3...

YOOOOOO SEI IS LITERALLY THE FUTURE BROOOOOO I JUST MADE 50 TRADES IN 1.2 SECONDS AND MY WALLET DIDNT EVEN BREATHE I MEAN COME ON THIS ISNT JUST A BLOCKCHAIN ITS A REVOLUTION LIKE THE INTERNET BUT FOR TRADING AND YOU KNOW WHAT I DID TODAY I BOUGHT A NFT AND SOLD IT FOR PROFIT AND IT WAS SO FAST I DIDNT EVEN HAVE TIME TO THINK ABOUT IT I LOVE THIS CHAIN I LOVE THIS CHAIN I LOVE THIS CHAIN

Sei’s twin turbo consensus with asset-pair sharding is a structural leap. The 12,500 TPS isn’t just a metric-it’s a paradigm shift in L1 design. The native order book eliminates the AMM arbitrage inefficiencies that plague every other chain. And the Circle integration? That’s institutional-grade liquidity infrastructure. This isn’t speculative-it’s foundational. The real test is whether DeFi giants like Uniswap V4 adopt it, but the tech is already superior.

Look, I’ve been in crypto since 2017 and I’ve seen a thousand ‘revolutionary’ chains. Ethereum? Overrated. Solana? A dumpster fire with a hype machine. Sei? Fine. But let’s be real-this is just another chain trying to steal attention from the real players. You think a chain built for trading is gonna outlast Bitcoin? Nah. You’re all just chasing speed while ignoring the fact that security and decentralization matter. This feels like a Wall Street play. I’m not buying into another ‘crypto unicorn’ that’ll vanish in 18 months.

I’m not saying this is bad. I’m just saying... why does it feel like you’re trying to sell me a sports car when I need a tractor? I don’t care how fast your chain is if I can’t use it to run a DAO or a social app. You’re building a Ferrari for a world that still needs bicycles. And the AI integration? Please. ChatGPT on-chain? That’s not innovation-that’s a marketing gimmick. I’ve seen this movie before. The end is always the same: abandoned GitHub repos, empty Discord servers, and a token that’s worth less than the paper it was printed on.

Sei is so good i just bought 10k sei and im gonna hold for 5 years no cap. the devs are so smart and the chain is so fast i can even buy my coffee with it now. the future is here and its called sei. dont sleep on this. also the name sei sounds like 'say' so you say sei and you get rich. its magic.

I traded on Sei for the first time yesterday. No delays. No drama. Just clean execution. I didn’t even need to think about it. That’s rare.

While the technical specifications are indeed impressive, one must consider the broader sociopolitical implications of centralizing trading infrastructure around a single, high-throughput blockchain. The concentration of liquidity, coupled with institutional backing, risks creating a new oligarchic structure within decentralized finance. One must question whether the pursuit of speed and efficiency inadvertently undermines the foundational ethos of decentralization itself.

There’s something poetic about a blockchain that doesn’t try to be everything. It’s like a violin in a world full of symphonies-focused, precise, beautiful in its singularity. We’ve spent so long chasing scalability that we forgot what it means to build something that actually serves a purpose. Sei doesn’t shout. It just... works. And sometimes, that’s louder than any whitepaper.

I’ve been lurking for months. Took the plunge last week. The UI on Pheasant Network is buttery smooth. I made my first limit order and it executed before I even blinked. I’m not a trader. But now? I kinda am. And I’m not going back.

Oh wow. A blockchain built for traders. How original. Next they’ll make one for farmers. Or librarians. I’m sure the AI will write my buy orders for me while I nap. 'Hey ChatGPT, buy me some SEI when it hits $3.20.' Yeah right. This isn’t innovation. It’s just capitalism with a blockchain sticker on it.

The native order book + parallel execution + EVM compatibility = trifecta. The only thing missing is a killer DEX that actually makes it easy for retail. Hyperliquid is great but it’s still too institutional. If someone builds a Sei version of Robinhood with 1-click trading and zero gas fees, this thing goes mainstream. I’m building a prototype. DM me if you want in.

I just saw someone in the Discord say they lost $12k because they didn’t understand Sei’s order book model. You can’t just trade it like Uniswap. The learning curve is real. But once you get it? It’s like switching from dial-up to fiber.