Memecoin Risk Assessment Tool

Is This Memecoin Safe?

Based on the article's research of 9,000+ memecoins, this tool evaluates critical risk factors. Only use money you can afford to lose.

There is no such thing as a cryptocurrency called MEMECOIN. Not on CoinGecko. Not on CoinMarketCap. Not on any blockchain explorer. If you searched for "just memecoin" expecting to find a real token with that name, you’ve been misled - probably by a scam site, a YouTube ad, or a viral TikTok post. The term "memecoin" isn’t a coin. It’s a category. And understanding that difference could save you thousands.

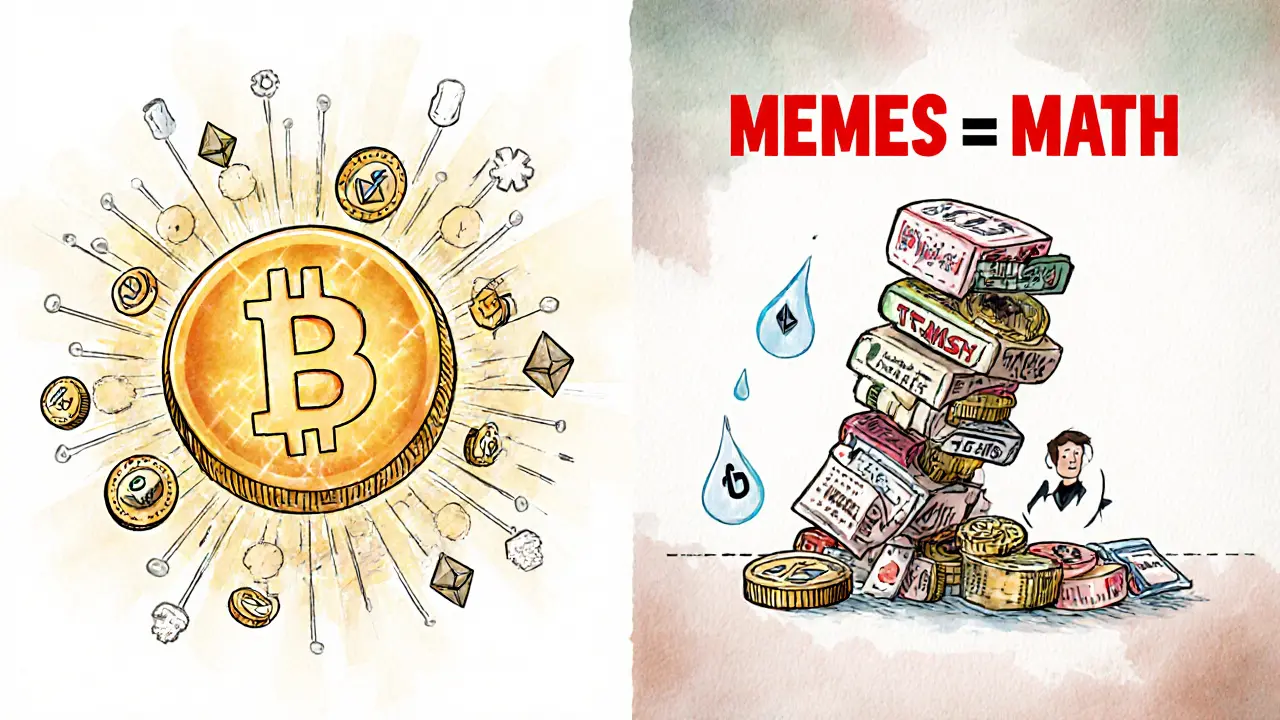

Memecoins Are Internet Jokes That Became Financial Wildfires

Memecoins started as jokes. Dogecoin, the first one, was created in 2013 by two software engineers who were poking fun at Bitcoin’s seriousness. They picked the Shiba Inu dog from the "Doge" meme - the one with the broken grammar and the confused look - and turned it into a cryptocurrency. Nobody expected it to go anywhere. But then people on Reddit started using it to tip each other for funny comments. It became a digital inside joke. And then it exploded.

Today, Dogecoin (DOGE) is worth over $12 billion. Shiba Inu (SHIB) is worth nearly $7 billion. Both have no real use case. No team building software. No business model. No roadmap to adoption. Their value comes from one thing: memes. Viral tweets. Elon Musk posts. TikTok trends. Reddit hype.

That’s why "just memecoin" isn’t a product. It’s a mindset. You’re not buying a currency. You’re buying a cultural moment. And moments fade.

How Memecoins Actually Work (And Why They’re So Dangerous)

Technically, most memecoins are built on top of existing blockchains. Dogecoin runs on its own network. Shiba Inu lives on Ethereum as an ERC-20 token. Newer ones like Bonk and Pudgy Penguins run on Solana. The code to create one is simple. You can launch a memecoin for under $50 using open-source templates. No coding skills needed.

But here’s where it gets scary:

- Uncapped supply: Dogecoin prints 5 billion new coins every year. That’s inflation on steroids.

- Quadrillions of tokens: Shiba Inu launched with 1,000,000,000,000,000 tokens. Half were burned immediately - but the rest? Still floating around.

- Zero utility: No major store accepts DOGE or SHIB. No app uses them. They don’t power anything. They’re digital collectibles with price tags.

And the volatility? Insane. In January 2025, a Solana memecoin called BONK jumped 19,000% in two days - then crashed 92% a week later. That’s not investing. That’s gambling with extra steps.

Why 99% of Memecoins Die Within 90 Days

Over 9,000 new memecoins launched on Ethereum in 2024. Only 47 lasted longer than six months. That’s a 0.5% survival rate.

Why? Because most are scams.

Here’s how it works: Someone creates a token, pumps it with fake social media buzz, gets influencers to shout about it, and then - boom - they sell everything. This is called a "rug pull." The developers drain the liquidity pool, vanish, and leave investors holding worthless tokens. In March 2024, a memecoin called EthereumMax was drained of $11 million in one day. The SEC filed charges. The devs? Gone.

Even "legit" ones like Pudgy Penguins - which had cute NFT art and a loyal fanbase - collapsed 88% after its founder settled an SEC case for $2.1 million in October 2025. The lesson? No matter how fun the meme, if the team is shady, your money is gone.

Who’s Buying These Things? And Why?

Most memecoin buyers are under 34. Median income? Under $45,000. They’re not finance professionals. They’re students, gig workers, people who saw a TikTok video saying "Turn $100 into $10,000 with SHIB!"

Charles Schwab’s 2025 investor study found that 68% of young memecoin traders treat them like lottery tickets. They buy a few thousand tokens for a few dollars, watch the charts like a sports game, and hope for a miracle. The average holding time? Less than 72 hours.

It’s not investing. It’s entertainment. And like any form of gambling, the house always wins. In 2024, over $417 million was lost to memecoin scams, according to CryptoScamDB. That’s not a typo. Four hundred seventeen million dollars.

What’s the Difference Between a Memecoin and Real Crypto?

Bitcoin and Ethereum aren’t memes. They’re networks.

- Bitcoin is digital gold - a decentralized store of value.

- Ethereum runs smart contracts - powering DeFi, NFTs, and apps.

- Dogecoin is a dog with a hat.

Bitcoin processes 7 transactions per second. Ethereum handles 30. Solana does 65,000. Dogecoin? 28. That’s barely enough for a coffee shop. But it doesn’t matter - because no one uses DOGE to buy coffee. They use it to send tips on Reddit or gamble on Twitter.

Real crypto has utility. Memecoins have vibes.

Should You Buy a Memecoin? The Hard Truth

Here’s the honest answer: Only if you’re okay with losing it all.

If you’re thinking of buying a memecoin because you heard someone made money - stop. That person likely got lucky. Or they were part of the pump. Or they sold before the crash.

SEC Chairman Gary Gensler called memecoins "gambling tokens." Nouriel Roubini compared them to Beanie Babies. Charles Schwab’s chief strategist said they’re "cultural artifacts, not currencies."

There’s no future in memecoins unless you’re betting on internet culture never changing - and that’s a risky bet.

But if you still want to try it? Here’s how to do it without getting wrecked:

- Only use money you can afford to lose. Like, $10, not $1,000.

- Never invest based on a tweet or a YouTube video.

- Use a self-custody wallet like MetaMask or Phantom - never keep coins on an exchange.

- Check the liquidity lock on Etherscan or Solscan. If the devs can pull the funds, walk away.

- Don’t fall for "staking rewards" on new memecoins. Those are almost always traps.

What’s Next for Memecoins?

The market is cooling. In late 2024, over 200 new memecoins launched every day. In Q3 2025, that number dropped to 43. People are getting burned. Regulators are stepping in. The EU now requires a 30-day cooling-off period before retail investors can buy memecoins. The SEC has filed 17 cases since 2023.

Only two memecoins have any staying power: Dogecoin and Shiba Inu. Even those are hanging on by a thread - mostly because Elon Musk still tweets about them. But even that might not last. His influence is fading. The culture is moving on.

Memecoins aren’t going to revolutionize finance. They’re not the future of money. They’re the last gasp of a generation that turned finance into a game show.

So if you’re wondering what "just memecoin" is - it’s not a coin. It’s a warning.

Is there a cryptocurrency called MEMECOIN?

No. There is no official cryptocurrency with the ticker symbol MEMECOIN. This is a common misunderstanding. "Memecoin" is a category of crypto tokens inspired by internet memes - like Dogecoin (DOGE) and Shiba Inu (SHIB). Any website or ad selling a token called "MEMECOIN" is likely a scam.

Why do people buy memecoins if they have no value?

People buy them because they’re fun, viral, and sometimes make quick money. Memecoins thrive on social media hype - a single tweet from Elon Musk can spike a token’s price overnight. But that’s speculation, not investment. Most buyers treat them like lottery tickets: low cost, high risk, big dream. The problem? The odds are stacked against you.

Can you make money from memecoins?

Some people have. A few early Dogecoin holders turned $100 into thousands in 2021. But those cases are rare. For every winner, there are thousands who lost everything. Over 99% of memecoins crash within months. The only guaranteed winners are the developers who dump their coins before the public buys in.

Are memecoins safe to invest in?

No. Memecoins are among the riskiest assets in crypto. They lack fundamentals, have no regulatory protection, and are easy targets for rug pulls. The SEC and EU regulators classify them as high-risk or even unregistered securities. If you’re looking for safety, avoid them entirely.

What’s the difference between Dogecoin and a new memecoin?

Dogecoin has a 12-year history, a real community, and cultural staying power - even if it’s just a meme. New memecoins have none of that. They’re built overnight, promoted by paid influencers, and often vanish within weeks. Dogecoin survives because people still use it to tip each other. New ones? They exist only to be sold.

How do I avoid getting scammed by a memecoin?

Check the token’s contract on Etherscan or Solscan. Look for a locked liquidity pool - if the devs can withdraw funds, it’s a rug pull waiting to happen. Avoid tokens with no GitHub, no website, and no team info. Never trust a Discord server full of bots. And if someone says "this is the next Dogecoin," run. It’s never the next Dogecoin.

memecoins are just digital confetti tbh

OMG YES 😭 I just lost $800 on "JUSTMEMECOIN" bc some TikTok influencer said it was "the next DOGE"... and now his account is gone?? 🤡 The audacity. I feel like I paid to watch a clown show. 🎪💸

The real tragedy isn’t the financial loss-it’s the epistemological collapse. Memecoins represent the commodification of absurdity as a cultural substrate. When value is derived purely from collective hallucination, we’ve entered post-economic semiotics. The blockchain didn’t disrupt finance-it became the stage for a Kafkaesque theater of belief.

Y’all need to chill. I know it feels personal when you lose money, but this isn’t failure-it’s participation. You didn’t get scammed, you got culture. 💪 If you’re not laughing while you cry, you’re doing it wrong. Also-here’s a tip: next time, buy a meme NFT instead. At least you get the art. 🐶✨

lol u guys are so naive. Dogecoin was a joke that worked. Now EVERYONE is trying to copy it. But u dont get it-memecoins arent about tech. They’re about vibes. And vibes arent measurable. Also, i bought SHIB at 0.000001 and now its 0.000012 so im basically rich 😎

It’s okay to feel embarrassed, but don’t beat yourself up. You’re not alone-this happens to so many people. The internet is loud, and the hype is engineered. If you’re learning from this, you’re already ahead of 90% of the crowd. Keep your head up, and maybe next time, just scroll past the TikTok ads. 🤗💙

Bro, in India we call this "bhaiya ka lottery"-the guy who sells you a fake gold coin and says "this will make you rich". Same energy. We’ve been doing this since the 90s with fake diamonds and miracle tonics. Now it’s crypto. Same scam, new packaging. 🤷♂️ But hey-at least now you can blame Elon instead of your uncle.

It is imperative to elucidate that the phenomenon under consideration constitutes a quintessential manifestation of speculative mania, wherein the conflation of semiotic signification with economic utility results in a pathological distortion of market valuation. The absence of intrinsic value, coupled with algorithmic amplification via social media, renders such instruments not merely non-viable, but ethically indefensible as investment vehicles.

99% of memecoins die? Yeah, and 99% of people who buy them deserve to lose it. I’ve seen people spend their rent money on BONK because a Discord bot said "1000x incoming". You think this is finance? Nah. This is a circus. And you’re the clown with the credit card.

You think this is new? In 2011, people paid real money for virtual swords in World of Warcraft. In 2015, it was rare Pokémon cards. Now it’s Doge. Tomorrow it’ll be AI-generated cats with NFT hats. The pattern is clear: humans will always pay for illusions. The only difference? Now the illusion is coded in Solidity.

Hey, I get it. You wanted to believe. That’s human. But here’s the good part-you’re awake now. That’s more than most people can say. Start small. Learn the basics. Follow real devs, not influencers. And if you ever feel the urge to buy a memecoin again? Pause. Breathe. Ask: "Would I do this with my grocery money?" If the answer’s no… walk away. You got this. 🙌

memecoins are the last gasp of capitalism before it becomes a cartoon. we’re not investing, we’re acting in a satirical play written by bots and funded by dopamine. i bought a coin called "pepe2.0" and it crashed in 4 hours. i laughed. then i cried. then i bought another. 🤭

It’s wild how something so silly can bring so many people together. I’ve met my best friends through Dogecoin Discord servers. We don’t care if it’s worth anything-we just like the vibe. But yeah, if you’re risking your rent? That’s not fun anymore. Keep it light. Keep it safe. And keep the memes coming. 🐶❤️

My cousin in Nairobi bought $20 of SHIB last year. Now he’s paying for his sister’s college tuition. Not because he’s smart-because he got lucky. But here’s the thing: he didn’t quit his job. Didn’t borrow money. Just played with spare change. That’s the only way to do it. Treat it like a lottery ticket you buy at the gas station. Not a retirement plan.

I read this whole thing. Took me 12 minutes. I still don’t know if I should laugh or cry. But I do know one thing: I’m deleting every crypto app from my phone. Goodbye, dopamine. Hello, savings account. 🤷♀️

why do people even care about this? its just digital trash. if you think a dog with a hat is worth billions you deserve to lose everything. also why is everyone on reddit acting like theyre economists now? stop pretending you understand blockchain

memecoins are proof that the internet has broken. i am from india and we have seen this before-fake gold, miracle weight loss powders, pirated software. now its crypto. the youth are being manipulated. the system is rigged. and no one in america wants to admit it because they think theyre too smart to be fooled. theyre not.

everyone’s acting like memecoins are new but they’re just the latest version of tulip mania. the only difference? now you can buy them with your phone and blame Elon instead of your parents. also why is this article 5000 words long? i just wanted to know if memecoin exists. it doesn’t. done.

Let’s not forget the real agenda: this entire meme ecosystem was engineered by the Federal Reserve to distract the masses from the collapse of fiat currency. The SEC’s crackdown? A smokescreen. The real targets are the decentralized wallets that enable financial sovereignty. They’re not here to protect you. They’re here to control you. 🕵️♀️

As a teacher, I showed my students this post. We talked about psychology, economics, and internet culture. They’re 15. Half of them already bought a memecoin. We didn’t stop them-we just asked: "What’s your exit strategy?" They had no answer. That’s the real problem.

That’s exactly why we need more educators in crypto spaces. Not to shut it down, but to help kids understand risk before they risk everything. You’re doing important work. Keep going. 🙏