Fluence Staking Calculator

Staking Returns Calculator

Calculate estimated returns from staking Fluence (FLT) tokens based on current APY rates

Estimated Returns

Important: These are estimated returns based on current Fluence staking rates. Actual returns may vary due to network conditions, token price fluctuations, and protocol changes. Staking carries risk and is not guaranteed.

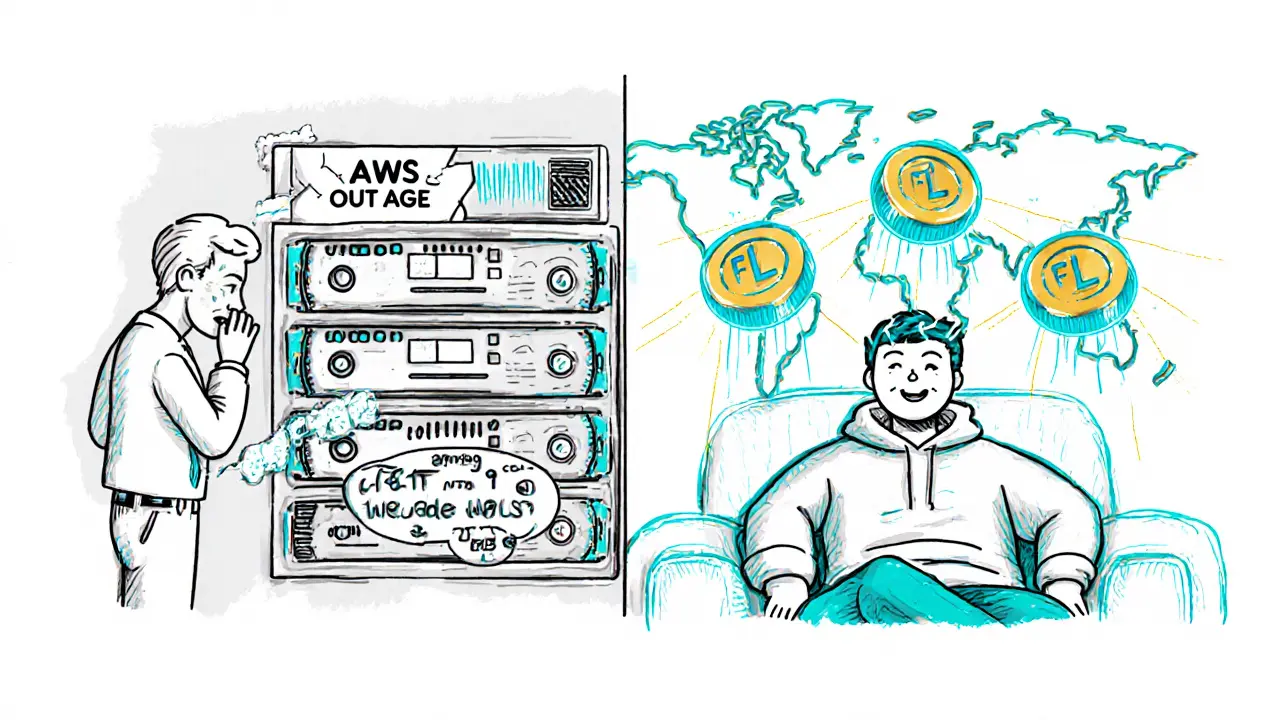

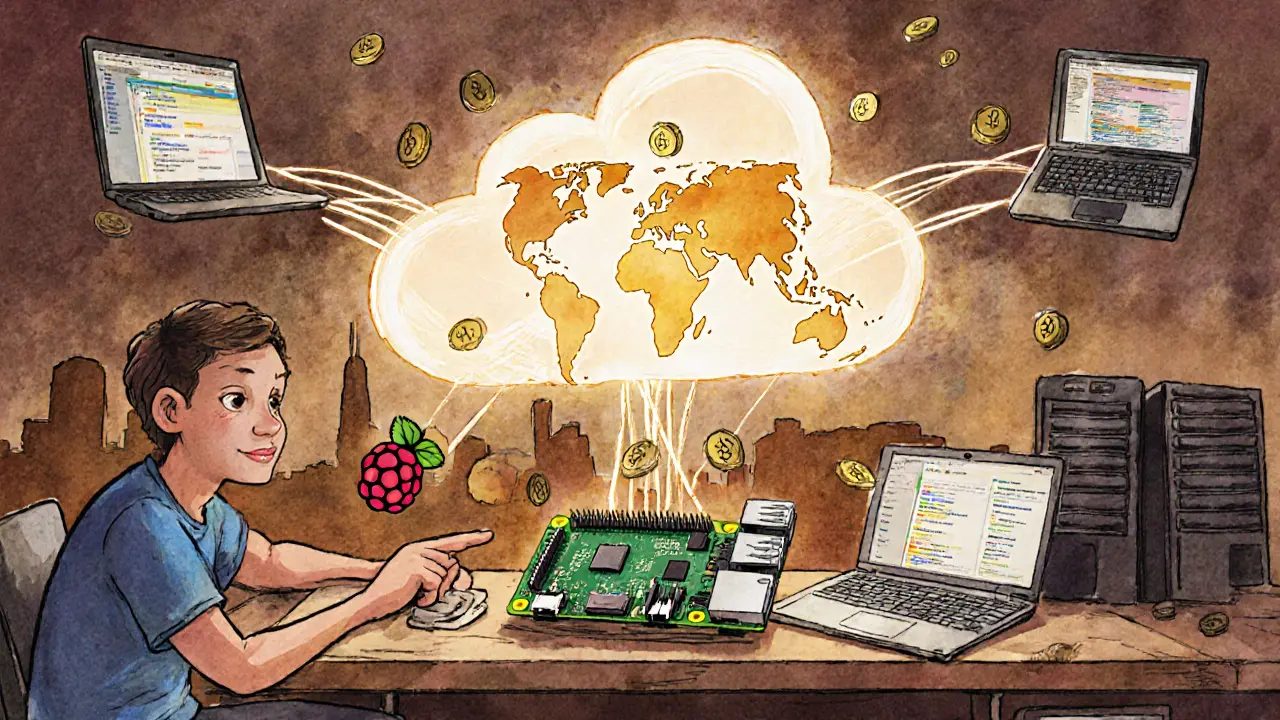

Fluence (FLT) isn’t just another cryptocurrency. It’s a bet on a future where your laptop, server, or even a Raspberry Pi in someone’s garage becomes part of a global, decentralized cloud. Unlike Bitcoin or Ethereum, which focus on money or smart contracts, Fluence is built to power actual computing-like running AI models, hosting apps, or processing data-without relying on Amazon, Microsoft, or Google. The idea? Cut out the middlemen, lower costs, and make the internet more resistant to outages and censorship.

What exactly is Fluence?

Fluence is a decentralized physical infrastructure network (DePIN) that turns idle computing power into a tradable resource. Think of it like Uber for servers. Instead of renting cloud space from a single company, you tap into a global network of computers owned by individuals and small businesses. These machines, called nodes, contribute their unused CPU, memory, and storage to run applications. In return, they earn FLT tokens-the native currency of the Fluence network.

The platform launched in February 2024 and runs as an ERC-20 token on Ethereum, with the smart contract address 0x236501327e701692a281934230af0b6be8df3353. It has a fixed supply of 1 billion FLT tokens, and as of October 2025, all of them are in circulation. That means no more tokens will be created. The token isn’t mined-it’s distributed through sales, staking rewards, and incentives.

Why does Fluence exist?

Centralized cloud providers dominate the market, but they come with big problems. In July 2024, a Microsoft outage took down thousands of websites and apps worldwide. That wasn’t an isolated event-it’s the norm. When you rely on one company’s data centers, you’re vulnerable to their mistakes, policy changes, or geopolitical pressure.

Fluence was built to fix that. By spreading workloads across hundreds of independent nodes spread across the globe, the network avoids single points of failure. If one node goes down, another picks up the task. That’s especially useful for applications that need to stay online even when governments try to shut them down.

Fluence also promises cost savings. According to the team, using their network can be up to 75% cheaper than AWS or Azure. That’s because node operators aren’t paying for massive data centers, power bills, or corporate overhead. They’re just using hardware they already own. The savings get passed on to users.

How does FLT work?

FLT is the fuel that keeps the Fluence network running. Here’s how it’s used:

- Payment: Developers pay in FLT to run apps on the network.

- Staking: Node operators lock up FLT to prove they’re reliable. The more they stake, the more work they can get.

- Governance: FLT holders can vote on upgrades, fee structures, and new features.

- Rewards: Node operators earn FLT for providing compute power.

In September 2024, Fluence launched its official staking program. You can earn between 8.5% and 14.2% annual returns depending on how long you lock up your tokens. That’s attractive compared to many other crypto projects, but it comes with risk-more on that later.

Fluence vs. other decentralized computing platforms

Fluence isn’t alone in the DePIN space. Here’s how it stacks up against competitors:

| Platform | Primary Use Case | Token | Network Uptime | Market Share (DePIN Computing) |

|---|---|---|---|---|

| Fluence (FLT) | General-purpose computing, AI, censorship-resistant apps | FLT | 92.7% | 4.7% |

| Render Network (RNDR) | GPU rendering for 3D, AI, video | RNDR | 98.1% | 28.3% |

| Akash Network (AKT) | Cloud hosting for apps and websites | AKT | 96.5% | 19.1% |

| io.net | AI training and GPU clusters | IO | 97.8% | 15.6% |

| Bittensor (TAO) | Decentralized AI models and machine learning | TAO | 95.2% | 8.2% |

Fluence stands out because it’s not focused on one narrow task like rendering or AI training. It’s designed to handle any kind of workload-web apps, databases, real-time analytics, even blockchain nodes. But that also means it’s trying to do everything, which makes it harder to beat specialists like Render or io.net in their own lanes.

Current price and market performance

As of October 2025, FLT trades around $0.021. That’s down over 85% from its all-time high of $1.54 in March 2024. The drop wasn’t caused by one event-it’s the result of broader crypto market conditions, slow adoption, and skepticism about whether decentralized compute can truly compete with big cloud providers.

Trading volume is low-around $130,000 per day on MEXC, the main exchange. That’s a red flag for many investors. Low volume means prices can swing wildly with just a few big trades. If you’re thinking of buying FLT, be prepared for volatility.

Despite the price drop, the project hasn’t stopped building. In October 2024, Fluence announced its Vision 2026 roadmap, which includes:

- Integration with major AI frameworks like PyTorch and TensorFlow

- Expanding node coverage to 100+ countries by mid-2025

- Adding zero-knowledge proofs to verify computations without exposing data

These updates could help if they deliver. But so far, progress has been slow. Only 3-5 enterprise customers have publicly adopted the platform, and developer tools remain clunky.

Who is using Fluence?

Right now, Fluence is mostly used by:

- Blockchain developers who need decentralized backends for dApps

- AI researchers running small-scale training jobs on a budget

- Privacy-focused projects that need to avoid U.S.-based cloud providers

- Node operators in Europe and North America who rent out spare hardware

It’s not yet used by big companies. Why? Because reliability is still an issue. Fluence reports 92.7% uptime. That sounds good-until you compare it to AWS’s 99.99%. For businesses, even 1% downtime means lost revenue. Fluence hasn’t proven it can handle mission-critical workloads yet.

Developer feedback is mixed. On GitHub, the open-source code gets high marks-4.1 out of 5 stars. But many say documentation is incomplete. One developer wrote: “The examples work, but modifying them for production requires reverse engineering.” That’s a big barrier to adoption.

Pros and cons of Fluence (FLT)

Pros:

- Truly decentralized-no single company controls it

- Lower costs than AWS/Azure for basic workloads

- Staking rewards offer decent APY (8.5-14.2%)

- Open-source and transparent

- Strong vision for censorship-resistant infrastructure

Cons:

- Price has crashed over 85% since peak

- Low trading volume = high volatility

- Only 92.7% uptime-not enterprise-ready

- Limited global node coverage (78% in North America and Europe)

- Customer support takes 72+ hours on average

- Hard to use without technical skills

Is Fluence worth investing in?

If you’re looking for a quick flip, FLT is a risky bet. The token’s price action shows it’s been driven more by hype than real demand.

But if you believe in the long-term idea of decentralized infrastructure-where the internet isn’t controlled by a few tech giants-then Fluence could be worth watching. The DePIN sector is projected to grow from $1.2 billion in 2024 to $8.7 billion by 2027. Fluence is one of the few projects trying to solve general-purpose computing, not just niche tasks.

Here’s the catch: Fluence needs to win over enterprises. Right now, it’s a tool for hobbyists and early adopters. If it can fix its reliability issues, improve documentation, and attract even a handful of real businesses, it could become a major player. If not, it might fade into obscurity like dozens of other crypto infrastructure projects.

Staking FLT might be the safest way to participate. You’re not betting on price-just on the network staying alive. If nodes keep running and developers keep building, the token’s utility grows-even if the price stays low.

How to get started with Fluence

If you want to try Fluence, here’s what you need to do:

- Get a crypto wallet (MetaMask or Phantom work best).

- Buy FLT on MEXC or another exchange that lists it.

- Join the Fluence Discord or Telegram for support.

- Follow the official docs to deploy a test app.

Expect a 3-4 week learning curve. This isn’t like buying Bitcoin. You’re interacting with a complex distributed system. If you’re not comfortable with command-line tools or debugging network issues, wait until the platform gets easier to use.

What’s next for Fluence?

The next 12 months will be critical. If Fluence delivers on its Vision 2026 roadmap-especially the AI integrations and global node expansion-it could gain real traction. If it doesn’t, the community may lose momentum.

Regulation is another wildcard. The EU’s MiCA rules classify FLT as a utility token, which is good-it means they’re not treating it like a security. But the U.S. SEC is still watching. Any legal action could hurt adoption.

For now, Fluence remains a high-risk, high-reward experiment. It’s not a store of value. It’s not a payment network. It’s a bet on a more open, distributed internet. Whether that bet pays off depends on whether enough people believe in it-and are willing to build on it.

Man, I love the idea of turning old laptops into cloud nodes. I’ve got a Raspberry Pi collecting dust in my closet - might as well put it to work. No more paying $50/month for AWS when I can just let my unused CPU earn me some FLT. It’s like crypto meets dumpster diving for tech.

92.7% uptime? That’s not a network, that’s a nap. If your ‘decentralized cloud’ can’t beat AWS’s four nines, you’re not building infrastructure - you’re building a hobby project with a token. Don’t waste your time.

There’s something poetic about this - a world where computation isn’t owned, but shared. Like neighbors lending tools instead of buying their own. But we’re still in the age of the industrial cloud - centralized, efficient, and cold. Fluence is the first whisper of something warmer. Whether it becomes a shout or fades into static… that’s the question.

It’s not about beating Amazon. It’s about asking: why should one company control the lungs of the internet?

Staking at 14% sounds great until you realize you’re betting on a network that still needs a lot of work. I’m not rushing in, but I’m watching. If they fix the docs and get more global nodes, this could be real. For now, I’m just holding a little and seeing what happens. No need to force it.

Fluence? More like Fail-ence. You’re telling me I should trust a network where 78% of nodes are in the US and Europe? That’s not decentralized - that’s just a fancy VPN for crypto bros. And 0.021 USD? Bro, this is a dead coin with a PowerPoint roadmap. Stop pretending it’s Web3.

The uptime stats are interesting - 92.7% is actually decent for a DePIN project, especially compared to early Filecoin. The real issue is adoption velocity. If you’re not seeing enterprise use cases beyond hobbyist dApps, then the token’s utility is theoretical. Still, the AI integration roadmap could be a game-changer if executed.

FLT is the quiet builder not the loud trader if it works we all win if not no big loss just don’t hype it

So… you’re telling me this is like Uber for computers… but Uber failed at bikes, got sued for labor, and still charges $30 for a 5-minute ride. Now we’re doing this with crypto? And expecting it to be cheaper? 😅

Also, typo in the whitepaper says ‘computing’ as ‘compuyting’. That’s not reassuring.

Wait so I can rent out my old gaming rig to run AI models?? I thought I was just gonna use it for fortnite… maybe I should try this. Docs look kinda messy tho lmao

Anyone tried deploying a test app yet? I followed the guide and got stuck on the Docker config for 3 hours. The CLI is… a lot. But when it finally worked? Felt like I was part of something weirdly cool. Like building a spaceship in your garage.

I keep coming back to this: if the goal is censorship resistance, why does the network rely on Ethereum? Isn’t that just replacing one centralized point - the miners - with another - the validators? The architecture feels like it’s still wearing a corporate suit under a hoodie.

Low volume = pump and dump waiting to happen

Okayyyy so here’s the thing 💡: If you’re thinking about staking FLT, just DO IT - but only with what you can afford to lose! 😊 The rewards are legit, and honestly? It’s like helping build the future while earning a little passive income 🌍✨. Plus, the Discord is super chill - people actually help each other! I started with 50 FLT and now I’m at 78 - not rich, but happy! 🤗

Everyone’s acting like Fluence is the next big thing. But let’s be real - the only thing decentralized here is the delusion. You think a bunch of random people with old PCs are gonna replace AWS? Please. This is just crypto’s way of pretending failure is innovation. Wake up.

Also, why is the founder from Estonia? Coincidence? I think not.

Fluence is the only project that actually matters in DePIN stop listening to these haters who dont even understand compute networks

Just staked my first 100 FLT. No drama, no hype - just happy to be part of something that doesn’t suck. I’ve seen so many crypto projects come and go, but this one? Feels like it’s quietly building something real. Not flashy. Not loud. Just… working. That’s enough for me.

Also, my grandma asked me what I was doing with ‘crypto clouds’ last night. I told her I was helping the internet be less boring. She nodded and gave me cookies. That’s a win.