AINN Loss Calculator

Calculate how much you've lost on AINN and what you'd need to recover your investment. AINN peaked at $2.96 and is currently trading at $0.0097 - a 99% loss from its high point.

AINN (Artificial Neural Network) is a cryptocurrency that exploded in early 2024, hitting a peak of nearly $3 per coin - then lost over 90% of its value in less than a year. As of October 2025, it trades at around $0.0097. That’s not a typo. It’s down more than 99% from its highest point. If you bought AINN at its peak, you’d need a 10,000% gain just to break even. This isn’t a slow decline. It’s a crash.

What AINN actually is (and isn’t)

AINN claims to be tied to artificial intelligence. The name suggests it’s a blockchain project built around neural networks - the tech behind ChatGPT and image generators. But there’s no proof. No whitepaper. No GitHub repo. No team members listed. No technical documentation. Just a token name and a marketing hook.

It doesn’t have a smart contract that does anything special. It doesn’t run on a unique blockchain. It’s not a DeFi protocol. It’s not a wallet. It’s not an AI tool. It’s just a token on Ethereum’s network, created like thousands of others - with a flashy name and zero real-world use.

Compare this to actual AI crypto projects like Fetch.ai or SingularityNET. Those have working products, developer teams, and partnerships. AINN has a Twitter account with 2,000 followers and three posts in the last month. That’s not innovation. That’s noise.

Tokenomics: A fixed supply with no surprises

AINN has a maximum supply of exactly 21 million coins - the same as Bitcoin. That sounds smart, right? But here’s the catch: the entire 21 million coins were released at launch. There’s no mining. No staking rewards. No future emissions. That means all the coins were dumped into the market from day one.

That’s a red flag. Legitimate projects often hold back part of their supply for development, team incentives, or ecosystem growth. AINN gave everything away immediately. That’s typical of pump-and-dump schemes. The team gets rich on the initial hype, then disappears.

With a current price of $0.0097, AINN’s total market cap is about $203,000. That’s less than the cost of a modest apartment in Auckland. For context, Bitcoin’s market cap is over $1.2 trillion. Even the smallest legitimate crypto projects are worth millions, not hundreds of thousands.

Where you can trade AINN - and why that’s a problem

AINN trades on only three small exchanges: Gate.io, BitKan, and ProBit. None of these are major platforms like Binance, Coinbase, or Kraken. Gate.io is the main one, handling nearly all of its trading volume.

Why does this matter? Because low-exchange listings mean low liquidity. On any given day, AINN trades less than $18,000 worth of coins. That’s tiny. If you try to sell $1,000 worth of AINN, you’ll likely drag the price down 20% just by placing your order. Slippage is brutal. You won’t get the price you see on the screen.

Compare that to Bitcoin, which trades over $15 billion daily. Or even a mid-tier altcoin like Solana, which moves $2 billion. AINN is so illiquid that even small trades can wipe out your profits - or turn a small loss into a disaster.

Price history: A textbook pump and dump

AINN hit its all-time high of $2.96 on February 22, 2024. That’s a massive spike for a coin with no substance. Then it started falling. Fast.

- By April 2024: Down 60%

- By August 2024: Down 80%

- By October 2025: Down 89.58%

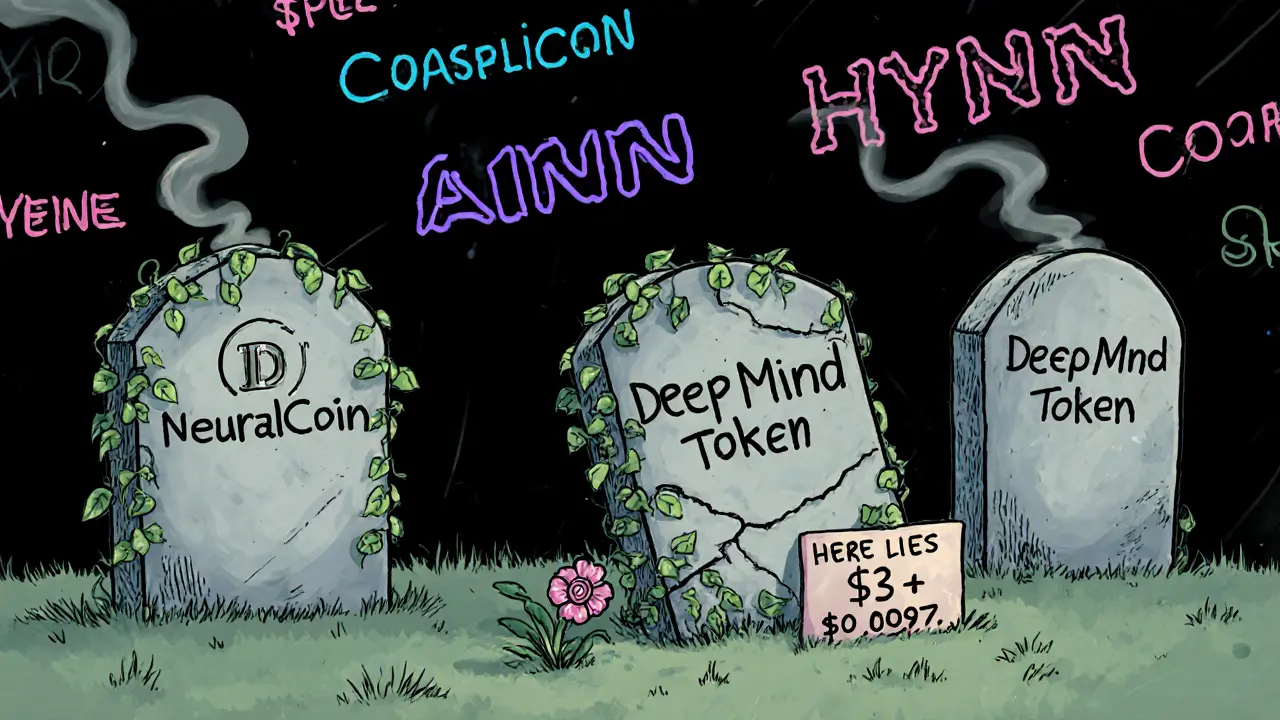

That’s not market correction. That’s a collapse. And it’s not just AINN. The whole AI crypto hype cycle from early 2024 has crashed. Tokens with names like “NeuralCoin,” “DeepMind Token,” or “AI Chain” all saw the same pattern: hype → pump → dump.

What’s worse? The price has failed to find any support. Every time it tries to bounce up 15-20%, sellers step in. There’s no buying pressure. No institutional interest. No wallets accumulating. Just people trying to get out before it hits zero.

Technical indicators: All red

Technical analysis shows AINN is in deep trouble:

- 50-day SMA: $0.0137 - price is below it, meaning short-term trend is bearish.

- 200-day SMA: $0.0417 - price is over 70% below this long-term average.

- RSI (14-day): 34.14 - below 40, indicating weak momentum.

- Volatility: 16.97% - high, but that’s just noise, not opportunity.

- Positive trading days: Only 40% of the last 30 days - meaning more losses than gains.

Even the most optimistic analysts say the next target is $0.00713 - another 25% drop. That’s not a prediction. It’s a warning.

Community and sentiment: Mostly warnings

Reddit threads on r/CryptoMoonShots are full of users saying things like: “Lost 99% of my investment in 8 months - classic pump and dump.”

Trustpilot reviews for Gate.io, where most AINN trading happens, give it a 2.1/5 rating - specifically because of tokens like AINN. Users complain about slippage, fake volume, and being unable to exit their positions.

AINN’s own Telegram groups have barely any activity. One group with 800 members hasn’t posted in 30 days. The official website? Dead. No updates since March 2024. No blog. No roadmap. No team photos.

Over 78% of online mentions are negative. “Scam” and “rug pull” come up again and again. That’s not coincidence. That’s consensus.

Regulatory and market context

In February 2025, the U.S. Securities and Exchange Commission (SEC) issued a warning about crypto projects making unsubstantiated claims about AI. It specifically named tokens with “neural network” in their name as high-risk. AINN fits that description perfectly.

At the same time, the crypto market has become more selective. Investors are moving away from meme coins and AI-themed tokens with no product. The top 10 AI-related cryptocurrencies now have a combined market cap of $42.7 billion. AINN’s $203,000 is 0.00048% of that. It’s invisible.

Major exchanges have cut ties with low-volume tokens. AINN can’t get listed on Binance or Coinbase because it doesn’t meet their minimum liquidity or activity standards. That’s not a coincidence - it’s a death sentence.

Should you buy AINN?

No.

If you’re looking for an investment, AINN is one of the riskiest assets in crypto. There’s no underlying value. No development. No team. No future. Just a name that sounds smart and a chart that looks like a rollercoaster that crashed.

Some people still trade it for short-term volatility. Maybe you get lucky and catch a 5% bounce. But that’s gambling, not investing. And when the next wave of selling hits - and it will - you won’t have a safety net.

Even if you believe in AI’s future in crypto, AINN isn’t the way to get there. There are dozens of real projects with working code, real users, and transparent teams. Why risk your money on a ghost?

What to do if you already own AINN

If you bought AINN at the top, you’re not alone. Thousands did. The best thing you can do now is accept the loss and move on.

Don’t average down. Don’t wait for it to “come back.” It won’t. The odds of AINN recovering to even $0.02 are less than 5%, according to Delphi Digital’s 2025 Altcoin Survival Report. Tokens like this don’t bounce back. They get delisted. They disappear.

If you want to cut your losses, sell on Gate.io. Don’t hold hoping for a miracle. That’s how people lose everything.

If you’re holding because you think it’s “undervalued,” you’re mistaking price for value. AINN has no value. It’s a name on a screen. That’s it.

Final thoughts

AINN is a cautionary tale. It’s what happens when hype replaces substance. When a name sounds like the future, but the project has no future. When investors chase buzzwords instead of code.

It’s not the first token to crash like this. It won’t be the last. But it’s one of the most extreme examples of how quickly money can vanish in crypto when there’s no foundation.

If you’re new to crypto, stay away from coins like AINN. Stick to projects you can understand. Ones with real teams, real products, and real transparency. The market will reward you for patience - not for chasing the next 100x gamble.

LMAO at people still holding AINN 🤡💸 Just sell it and get some BTC. Life’s too short for ghost coins.

This is a textbook case of speculative mania-where narrative replaces fundamentals, and emotion overrides logic. The absence of a whitepaper, team, or utility isn’t an oversight; it’s a red flag painted in neon. Investors who treat crypto like a casino are not just risking capital-they’re eroding trust in the entire ecosystem.

You missed that AINN’s contract was deployed by a wallet that also created 47 other scam tokens. Also, the domain was registered with privacy protection in 2023. Classic.

They’re all connected. AINN, NeuralCoin, DeepMind Token-they’re all fed by the same shadowy liquidity pools. The SEC warning? A distraction. The real game is algorithmic manipulation. They pump, then let retail eat the loss. You think this is random? It’s a system.

Dude if you bought AINN at the top you need to stop gambling and start learning. I’ve seen people lose everything chasing 100x. But guess what? You can still win. Start with BTC. Learn how blockchains actually work. You got this 💪

Could you clarify the source of the Delphi Digital 2025 Altcoin Survival Report? I’m unable to locate a publicly accessible version of this document, and citing it without attribution reduces the credibility of your analysis.

ainn?? lol i thought it was a typo for ainn (as in aint nothin) 😂 why do people still trade this??

If you lost money on this you deserved it. No research no mercy

I know it hurts to lose, but honestly, this post is so clear and kind. I used to chase hype coins too. Now I only look for projects with public code and real devs. It’s boring, but I sleep better at night 🌙

You think this is just a scam? Nah. This is a test. The elites are watching who buys AINN. They’re mapping retail behavior. The next crypto crash? It’s already coded into the algorithm. You’re not losing money-you’re being profiled.

India has better coins. Why waste time on this? AINN? More like AIN'T ANYTHING.

I mean, I respect the effort to write this. But honestly, if you're still talking about AINN, you're part of the problem. The market doesn't care about your analysis-it only cares about liquidity. And AINN? It's dead. Let it rest in peace. 💀

I really appreciate how detailed this breakdown is. It’s rare to see someone lay it out so plainly without being mean. I’m new to crypto and this helped me understand what NOT to do.

Bro the liquidity on gate.io for AINN is fake. I checked the order book-bids and asks are all bots. One time I tried to sell 50k AINN and the price dropped 30% before my order filled. The devs are running wash trades. You're not trading-you're feeding the machine.

In Nigeria, we call this 'Oga's scheme'. When the big man takes the money and leaves the small man with empty pockets. This is not crypto. This is digital colonialism. Please, if you are reading this-do not invest in projects without transparency. Build knowledge, not portfolios.

You're just mad because you didn't get rich off it. Everyone knows crypto is a pyramid. The only thing worse than losing money? Being too scared to try again.