Stop-Loss Calculator for Crypto Trading

Stop-Loss Calculator

Calculate optimal stop-loss levels based on your entry price and risk tolerance

Results & Risk Analysis

Stop-Loss Type Analysis

Select your stop-loss type to see analysis

When you buy Bitcoin or Ethereum, you’re not just betting on price going up. You’re also betting that you won’t get wiped out when it crashes. That’s where stop-loss orders come in. They’re not magic shields. They’re automatic sell commands you set ahead of time to protect your money when things go south. Think of them like a seatbelt for your trades - you hope you never need it, but you’re glad it’s there when you do.

How Stop-Loss Orders Work

A stop-loss order is a rule you give your exchange: "Sell my coins if the price hits $X." You set the price, and when the market hits it, the system sells automatically. No need to stare at your screen at 3 a.m. Watching your portfolio bleed out. You’ve already told the machine what to do.

It sounds simple, but the real power isn’t in the idea - it’s in the execution. Crypto moves fast. Bitcoin can drop 15% in 20 minutes. Without a stop-loss, you’re left hoping the dip is temporary. With one, you lock in your loss before it gets worse. According to Crypto.com’s 2023 survey, 78% of professional traders use stop-losses. The ones who don’t? They’re often the ones posting about losing their life savings on Reddit.

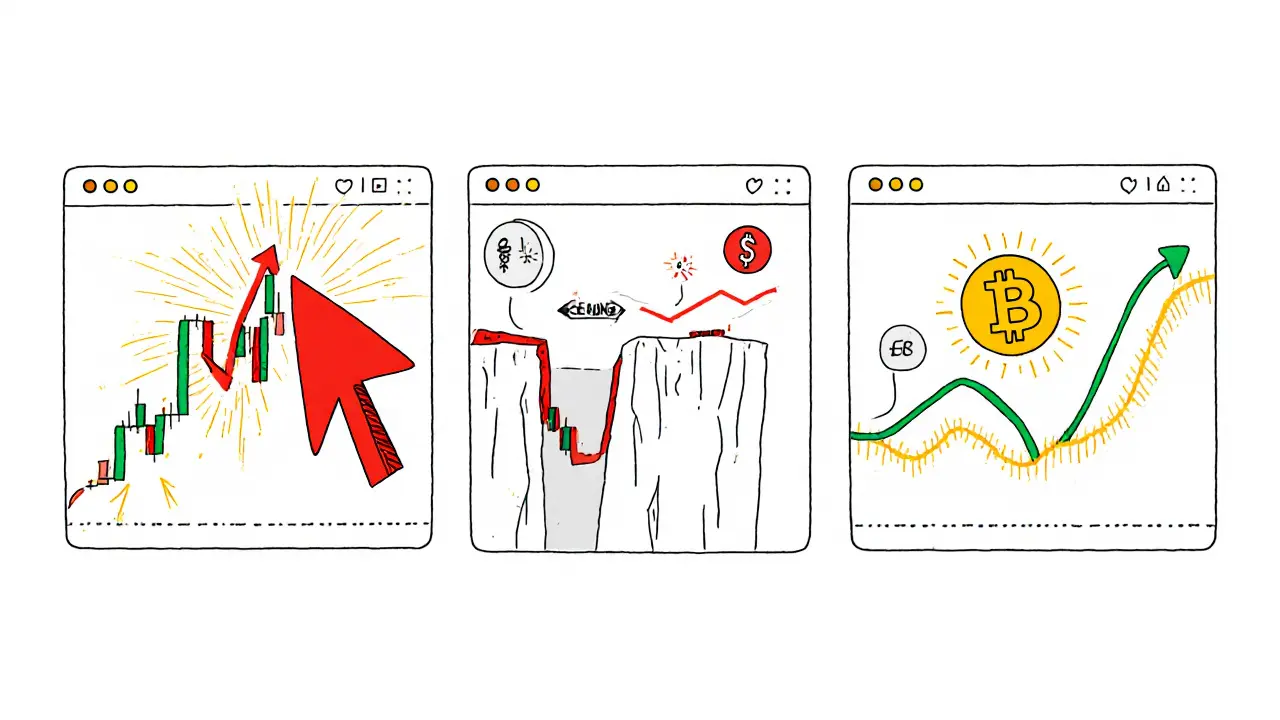

Types of Stop-Loss Orders

Not all stop-losses are the same. There are three main types, and picking the wrong one can cost you more than the trade itself.

- Stop-Market Order: This is the most basic. When the price hits your stop level, it turns into a market order and sells at whatever price is available. Fast? Yes. Guaranteed price? No. During the March 2020 crash, some traders saw their stop-losses trigger at 12% below their set price because there were no buyers at the expected level. Slippage kills.

- Stop-Limit Order: This one has two prices: the stop trigger and the limit price. You say: "Sell if it hits $18,000, but only if I get at least $17,500." Sounds safer? It is - until the market crashes past your limit without filling your order. In that case, you’re stuck holding a coin that’s now down 30%, and your stop never executed. Bitstamp documented this exact scenario with Ethereum in 2022.

- Trailing Stop-Loss: This one moves with the price. You set a distance - say, 8% - and the stop-loss follows the price up. If Bitcoin climbs from $60,000 to $70,000, your stop-loss moves from $55,200 to $64,400. You lock in gains without having to adjust manually. Altrady’s backtesting showed trailing stops delivered 23.7% better risk-adjusted returns during Bitcoin’s 2022 bull run. But here’s the catch: in sideways markets, they trigger too often. Ethereum’s consolidation in June 2023 caused 38% more false triggers for trailing stops under 5%.

Most exchanges - Binance, Coinbase, Kraken - let you choose between these. But they don’t always explain the risks. You need to know which one fits your style.

Where to Place Your Stop-Loss

Setting a stop-loss at $20,000 because it’s a "nice round number" is a rookie mistake. You’re just giving big players a target. This is called "stop-loss hunting." Traders with deep pockets watch for clusters of stops around round numbers, then push the price down just enough to trigger them - before buying back cheap.

Smart traders place stops below real support levels. These are prices where buyers have stepped in before - like previous swing lows, Fibonacci retracement zones, or areas with high trading volume. The Crypto Risk Management Handbook analyzed 12,000 professional trades and found that 68% of successful stop-losses were placed at these technical levels, not arbitrary numbers.

Another method? Use the Average True Range (ATR). It measures volatility. Bitpanda recommends setting your stop-loss at 1.5x the 14-period ATR. For example, if Bitcoin’s ATR is $1,200, your stop-loss would be $1,800 below your entry. This adapts to market conditions. A 3% fixed stop might be too tight in a calm market and too wide in a crash. ATR adjusts.

The Dark Side of Stop-Losses

Stop-losses aren’t foolproof. They can backfire.

First, exchanges aren’t always reliable. During the Silvergate Bank collapse in March 2023, Binance had 247 reported cases where stop-loss orders didn’t trigger - because the system was overloaded. Kraken went down for 22 minutes during a 20% Bitcoin drop. If your stop-loss is on an exchange, and the exchange is down? Your protection vanishes.

Second, too-tight stops get triggered by noise. TradingView data from Q3 2023 showed that 73% of stop-losses under 3% on altcoins triggered unnecessarily during 15-minute chart periods. You get shaken out, then the price rebounds. You lose twice: once on the trade, once on the emotional replay.

Third, relying on exchange-based stops means trusting a company with your safety. Andreas Antonopoulos warned in 2022 that this creates centralization risk. During "Black Thursday" in March 2020, some exchanges took 45 minutes to process orders. Your stop-loss was set - but the system was too slow to save you.

That’s why some traders are turning to on-chain stop-losses - smart contracts that run directly on the blockchain, like those being developed with Chainlink oracles. But they’re expensive. Right now, triggering one on Ethereum costs $15-$20 in gas fees. For small traders, that’s not worth it. But it’s the future.

When to Use Partial Liquidation

Some traders don’t want to sell everything. They’d rather cut their position in half when the stop triggers. This is called partial liquidation - closing 50% or 75% of your position, leaving the rest open for a potential rebound.

It’s a smart middle ground. You lock in some profit or limit your loss, but you don’t miss the next rally. Bitpanda’s research shows this approach reduces emotional stress. But it’s harder to track. Your position becomes messy. Taxes get complicated. You need good records.

Use partial stops if you believe the dip is temporary but you’re not sure. Full stops are for when you’re wrong and need out. Partial stops are for when you’re unsure - and want to stay in the game.

What the Data Says

Studies back this up. A University of Chicago Booth School study found traders using stop-losses had 19.3% better risk-adjusted returns over 18 months. But only if their stops were wider than 7%. Stops tighter than 5%? They performed worse than no stop at all - because they got triggered too often.

Another study from UC Berkeley showed traders under 30 use stop-losses 37% less than those over 40. Why? Younger traders tend to be more emotional. They hold on, hoping for a rebound. Older traders treat trading like investing - they manage risk first.

And institutional adoption? It’s skyrocketing. The 2023 Global Crypto Adoption Index found 83% of institutional investors now require stop-losses. That’s up from 62% in 2021. If the pros are using them, you should too.

How to Set One Up Right

Here’s a simple checklist:

- Choose your stop type: Trailing if you’re in a trend. Stop-market if you’re in a crash scenario. Stop-limit if you want control over the exit price - but know the risk of non-execution.

- Set the distance: Use ATR (1.5x) or technical support levels. Avoid round numbers.

- Test it: Backtest your stop level on TradingView for the last 3 months. Did it trigger too often? Did it miss big drops?

- Don’t move it: Once set, don’t chase the market. Moving your stop-loss down after a drop is called "averaging down" - it’s how people lose everything.

- Use partial liquidation if you’re unsure. Close 50% and let the rest ride.

And remember: stop-losses aren’t about predicting the future. They’re about surviving it.

What’s Next for Stop-Losses?

The next big shift is automation. Coinbase is testing AI-powered stop-loss suggestions that analyze real-time market structure - like order book depth and volume spikes - to recommend optimal levels. Binance already offers "stop-loss insurance" during extreme volatility, guaranteeing execution within 2% of your trigger price, backed by their $1 billion SAFU fund.

On-chain stop-losses are coming too. They’ll remove exchange risk, but gas fees and speed are still hurdles. By 2026, Bernstein Research predicts 92% of active crypto traders will use some form of automated stop-loss. The question isn’t if you’ll use one. It’s whether you’ll use it well.

Right now, the best stop-loss isn’t the fanciest one. It’s the one you set, forget, and trust.

Do stop-loss orders always work in crypto trading?

No. Stop-losses can fail during extreme volatility, exchange outages, or when prices gap below your trigger level. Stop-market orders can execute far below your intended price. Stop-limit orders might not fill at all if the market crashes too fast. They reduce risk, but they don’t eliminate it.

Should I use a stop-loss on every crypto trade?

If you’re trading with real money, yes. Even if you’re only risking $100, a stop-loss protects you from emotional decisions. The only exception is if you’re doing short-term scalping with very tight timeframes - but even then, you should have a risk limit.

What’s the best percentage to set for a stop-loss?

There’s no universal number. For swing trading, 7-10% is common. For day trading, 1-3% might work. But the best method is using ATR (Average True Range) - set your stop at 1.5x the 14-period ATR. This adjusts for volatility. Stops under 5% often trigger too often during normal price swings.

Can I get hacked if I use stop-loss orders?

Not directly. Stop-losses themselves don’t create security risks. But if your exchange gets hacked or goes offline - like what happened during the FTX collapse - your stop-loss may not execute. Always use reputable exchanges with strong security and insurance funds like Binance’s SAFU or Coinbase’s FDIC-insured USD balances.

Do stop-loss orders affect my taxes?

Yes. Every time a stop-loss triggers, it counts as a taxable event. You realize a capital loss, which you can use to offset gains. If you use partial liquidation, you’ll have multiple taxable events from one trade. Keep detailed records - use tools like Koinly or CoinTracker to track your trades and tax liability.

Can I use stop-loss orders on decentralized exchanges (DEXs)?

Not natively - yet. Most DEXs like Uniswap don’t support stop-losses. But projects are building on-chain versions using smart contracts and oracles like Chainlink. These are still experimental, expensive (gas fees), and slow. For now, use centralized exchanges if you want reliable stop-losses.

Stop-loss orders won’t make you rich. But they’ll keep you in the game long enough to get there.

stop losses are just a myth lol i lost 80% on shiba last week and still hold 💀

this is actually one of the clearest explanations i've read. i used to think stop-losses were for losers until i lost half my portfolio in a flash crash. now i set them religiously. thanks for the ATR tip too.

wait so if i use a trailing stop on eth during a sideways market, it just keeps getting triggered? that sounds brutal. how do you even sleep at night?

I CAN’T BELIEVE PEOPLE STILL TRUST EXCHANGES WITH THEIR STOP-LOSSES!!! WHAT IF IT GOES DOWN?! WHAT IF THEY GET HACKED?! WHAT IF THE CEO JUST VANISHES?!?!?!?!?!!? I’ve been using on-chain stops for 2 years now and I sleep like a baby… even if it costs me $20 in gas.

Love this breakdown. I used to set stops at round numbers like $30k for BTC - felt like I was being smart. Turns out I was just painting a target on my back. Now I use ATR + swing lows. Game changer.

stop losses are for people who dont believe in bitcoin maxis and dont have the balls to hold through the pain

You’re all missing the real win: partial liquidation. I set 50% stop-loss at ATR-1.5x and let the other half ride with a trailing stop. Keeps me from FOMOing back in after getting shaken out. Tax headaches? Sure. But I’ve doubled my returns since switching. Also, never use stop-limit on altcoins - they’ll ghost you when you need them most.

Americans think they can outsmart the market with fancy charts. In China, we just hold. No stops. No stress. Just patience. This post is overcomplicated.

The empirical data presented here is compelling. The University of Chicago study’s findings regarding risk-adjusted returns and the correlation between stop-loss tightness and performance degradation are statistically significant. One must consider the behavioral economics component as well - emotional attachment to positions undermines rational risk management.

As a professional trader from Mumbai, I can confirm: stop-losses are non-negotiable. I use trailing stops with 2.5x ATR on BTC and 3x on altcoins. Avoid round numbers. Never move your stop. And never, ever use stop-limit on low-volume coins. I’ve seen traders lose 90% because their limit price was ignored during a flash crash. Discipline beats intuition every time.

I used to think stop-losses were weak. Then I watched my buddy lose his rent money on a 30% drop he thought was ‘just a dip’. He still hasn’t recovered. I set mine now - not because I’m scared, but because I’m smart. You don’t need to be a genius to survive crypto. You just need to not be dumb.

This was really helpful. I’ve been nervous about using stop-losses because I didn’t want to miss a rebound. But partial liquidation makes so much sense - it’s like saying ‘I’m not sure, but I’m not out yet’. I’m going to try this next time.

OMG I CRIED WHEN MY STOP-LIMIT DIDN’T TRIGGER. I WAS SO SURE IT WOULD SAVE ME. NOW I JUST HOLD AND PRAY. GOD IS MY STOP-LOSS. 🙏😭

Wow. So you’re telling me that people who don’t use stop-losses are just dumb? That’s rich coming from a guy who probably still thinks ‘diamond hands’ is a real strategy. I’ve been shorting since 2017 and I’ve never set a stop. I just wait for the FOMO crowd to panic and then buy the dip. You’re all just feeding the whales.

Thank you for this comprehensive guide. It’s rare to see such thoughtful, data-driven advice in the crypto space. I’ve shared this with my mentees in the youth trading program. Risk management isn’t just about money - it’s about preserving mental health and long-term participation. Well done.

Wait… so you’re saying I should use ATR? But what if the ATR is wrong?! What if the market’s just… different?! I mean, I’ve been trading since 2015, and I’ve NEVER used a stop-loss, and I’ve made 12x my money!! So… why are you even here?!

I’m from Nigeria and we don’t have access to most of these exchanges. We use P2P and manual sells. But I still set mental stops - like, if it drops 15%, I sell half. Keeps me from getting emotional. This post made me feel less alone. Thanks.

The entire premise of this article is flawed. Stop-loss orders are a product of capitalist market manipulation designed to extract liquidity from retail traders. They are not protective mechanisms - they are predatory tools engineered by institutional actors who monitor order book clustering and exploit retail psychology. The notion that one can ‘manage risk’ through exchange-based triggers is a neoliberal fantasy. True risk management involves decentralization, self-custody, and rejection of centralized financial infrastructure. The fact that you’re recommending Binance and Coinbase as ‘reputable’ is itself a failure of critical thought. The only safe stop-loss is one written in code on a blockchain you control - and even then, it’s still a compromise.

I really appreciate how you broke down the different types of stop-losses. I didn’t realize stop-limit could fail to execute at all. I’ve been using stop-market on everything and just assumed it was ‘safe’. Now I’m going back to adjust my settings. Thanks for the clarity - and for not just saying ‘use a trailing stop’ like every other influencer.

I lost my entire life savings because I trusted a stop-loss. Now I just hold. No tech. No charts. Just me, my bitcoin, and my faith. You people are overcomplicating it.