There’s no such thing as a legitimate crypto exchange called Wavelength.

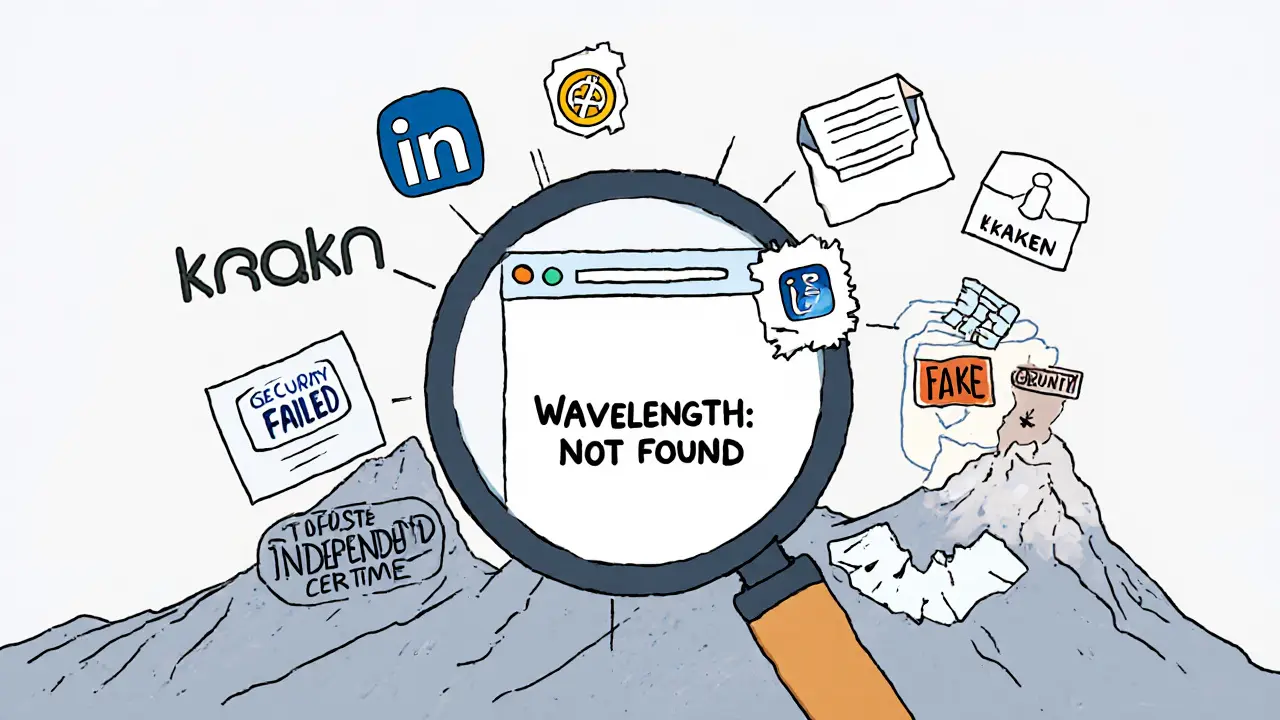

If you’ve seen ads, YouTube videos, or Telegram groups pushing Wavelength as the next big thing in crypto trading, stop. This isn’t a new platform with hidden potential. It’s not an underdog startup with bold ideas. It’s not even a forgotten exchange making a comeback. Wavelength doesn’t exist as a real, operational cryptocurrency exchange - not in 2025, not in 2024, and not in any credible database, security report, or user review site.

Every major player in crypto security - Kraken, Chainalysis, Arkose Labs, Turnkey, Nadcab Labs - has published detailed breakdowns of what a safe exchange looks like in 2025. They talk about cold storage, FIDO2 authentication, withdrawal whitelists, multi-signature wallets, and real-time threat monitoring. They name names. They show audits. They link to public reports. None of them mention Wavelength. Not once.

That’s not an oversight. That’s a warning sign.

Why You Won’t Find Wavelength on Any Trusted List

Let’s be clear: if a crypto exchange doesn’t appear in any of the top security reports from industry leaders, it’s not because it’s too small to notice. It’s because it’s not real.

Take Kraken, for example. In 2025, they use hardware security modules (HSMs) to protect API keys. They lock down withdrawals with time-based rules. They run a public bug bounty program that’s paid out over $20 million since 2018. They publish annual security audits. You can verify their infrastructure. You can read their compliance certifications. You can see their team members on LinkedIn.

Now, try to do the same with Wavelength. Can you find their headquarters? Their team? Their license number? Their support email that doesn’t bounce? Their terms of service that doesn’t sound like it was written by a translator bot? No. You can’t. Because none of it exists.

There’s no official website with verifiable domain registration. No social media accounts with real engagement. No Reddit threads where users share withdrawal experiences. No Trustpilot reviews that aren’t fake. No CoinMarketCap or CoinGecko listing. No mention in any blockchain analytics report. No press release from any reputable tech news outlet.

This isn’t a startup that’s still in beta. This is a ghost.

How Scammers Use Fake Exchange Names Like Wavelength

Scammers don’t build fake exchanges to trade crypto. They build them to steal your money.

The playbook is simple:

- Create a flashy website with fake testimonials and fake trading charts.

- Use AI-generated videos of “founders” talking about “revolutionary tech.”

- Run ads on YouTube and TikTok promising 20% daily returns.

- Encourage you to deposit BTC, ETH, or USDT.

- When you try to withdraw, they ask for “verification fees,” “tax deposits,” or “KYC upgrades.”

- Once you pay those, they vanish.

Wavelength is one of hundreds of names used this way. Last year, the same tactic was used with “NexaTrade,” “CryptoVaultX,” and “QuantumPay.” All disappeared within weeks. All had identical red flags: no regulatory license, no transparency, no traceable team.

And here’s the cruel twist: the fake websites look real. They use clean design, professional fonts, and even fake “security badges” that mimic real ones from Kraken or Coinbase. But real exchanges don’t need to advertise “100% Secure!” on their homepage. They prove it through actions - not slogans.

What Real Crypto Exchanges Look Like in 2025

Instead of chasing ghosts like Wavelength, focus on what actually works.

Here’s what a legitimate exchange in 2025 must have:

- Regulatory compliance: Licensed in at least one major jurisdiction (e.g., FCA in the UK, FinCEN in the US, or NZFSA in New Zealand).

- Cold storage: At least 95% of user funds stored offline, with public proof of reserves (like Kraken’s proof-of-reserves audits).

- Multi-factor authentication (MFA): Not just SMS - FIDO2/WebAuthn keys or authenticator apps only.

- Withdrawal whitelisting: You must pre-approve addresses before sending funds out.

- Public security audits: Reports from firms like CertiK, Hacken, or PeckShield - and they’re downloadable, not buried in a PDF.

- Transparent team: Real names, LinkedIn profiles, and past experience in finance or cybersecurity.

Platforms like Kraken, Coinbase, and Bitstamp meet all these criteria. They’ve been through multiple hacks, regulatory crackdowns, and market crashes - and they’re still here because they built trust, not hype.

What Happens If You Deposit Into Wavelength

Let’s say you ignore the red flags. You click the link. You sign up. You deposit $500 in ETH.

Here’s what happens next:

- Your funds disappear into a wallet that can’t be traced - likely a mixer or a burner address.

- You see your balance on the fake dashboard. It goes up. You think you’re winning.

- You try to cash out. The system says “Account under review.”

- You contact support. No reply. Or worse - they ask for another $200 to “unlock your account.”

- You realize you’ve been scammed. But by then, your ETH is gone. Forever.

There is no recovery. No chargeback. No legal recourse. Crypto transactions are irreversible. And if the exchange doesn’t exist, there’s no company to sue, no bank to call, no regulator to report to.

People lose millions this way every year. The Mt. Gox collapse was a real exchange failing. This? This is theft disguised as trading.

How to Spot a Fake Crypto Exchange

Here’s a quick checklist to protect yourself:

- Check the domain: Is it wavelength-crypto.com? Or wavelengthcrypto.io? Real exchanges use clean domains like kraken.com, not random TLDs.

- Search for reviews: Type “Wavelength crypto scam” into Google. If you see dozens of reports, walk away.

- Look for licenses: Go to the regulator’s website (e.g., FCA register, ASIC, NZFSA) and search for the company name. If it’s not there, it’s not legal.

- Check for a real team: No names? No photos? No LinkedIn? Red flag.

- Watch for promises: “Guaranteed 30% returns”? “Risk-free trading”? That’s not trading - that’s a Ponzi.

- Test support: Send an email. Wait 48 hours. If you get no reply, or a generic auto-response, it’s fake.

Trust your gut. If something feels too good to be true, it is.

What to Do Instead of Using Wavelength

Stick with exchanges that have been around for years and have proven security records.

For beginners in New Zealand:

- Independent Reserve: Licensed by NZFSA. Supports NZD deposits. Cold storage. Real team based in Auckland.

- Bitget: Global platform with strong security, available in NZ. Offers fiat on-ramps.

- Kraken: One of the most secure exchanges in the world. Trusted by institutions. No hype. Just solid tech.

All of them have:

- Clear terms of service

- Publicly available audit reports

- Customer support you can actually reach

- No promises of guaranteed returns

They don’t need to scream “WE’RE THE BEST!” They let their track record speak.

Final Warning: Don’t Be the Next Victim

Every day, new fake exchanges pop up. Wavelength is just one of them. They’re designed to exploit hope - the hope that you’ll get rich quick, that you’re missing out on something secret, that this time it’s different.

It’s not.

Real wealth in crypto comes from patience, research, and choosing platforms that have survived market crashes and hacker attacks. Not from clicking a link in a DM or watching a 30-second ad with a guy in a suit holding a blockchain graphic.

If you’re unsure about an exchange, don’t use it. Wait. Research. Ask in trusted communities. Check the regulators. Look for the proof.

Wavelength doesn’t have any. And that’s the only answer you need.

I just lost $800 to some site called Wavelength last week... I thought it was legit because the videos looked so professional. I feel so dumb. Please tell me I'm not the only one.

Wow. This post is basically a textbook. But seriously, why do people still fall for this? The domain was wavelength-crypto[.]io - I checked the WHOIS. Registered 3 weeks ago with privacy protection. The ‘founder’ video? Same AI voice as the last 5 scams. Wake up, people.

It’s fascinating, really - how we’ve turned financial hope into a religious experience. We don’t want to know if an exchange is real; we want to believe it *could* be. Wavelength isn’t a scam - it’s a mirror. It reflects our desperation to bypass years of work, risk, and patience for a single click. The real fraud isn’t the fake website. It’s the myth that crypto is a shortcut to wealth. We built the altar. They just sold the incense.

Thank you for compiling this with such precision. The absence of regulatory licensing, public audits, and verifiable team members is not merely a red flag - it is a complete absence of institutional legitimacy. I have cross-referenced every point with the FCA and FinCEN public databases. Zero matches. This is not negligence. It is predation.

Bro, this is so important 🙏 I shared this with my whole family. My cousin just sent me a screenshot of Wavelength’s ‘live trading’ - I sent him this link and he said ‘but the charts are moving!’ 😭 We gotta protect each other. Real ones know real signs 💯

Wavelength? More like Wasteland. That ‘20% daily returns’ nonsense is the same garbage from 2021. The only thing growing faster than the scam sites is the number of people who still think ‘if it looks nice, it must be legit.’ You don’t need a PhD to spot this - just a brain that hasn’t been rewired by TikTok ads. Pathetic.

Guys, I’ve been doing crypto since 2017 and I’ve seen every scam. But you know what’s worse than Wavelength? People who still think they’re smart enough to ‘outsmart’ the scam. You’re not. You’re just the target. I’ve personally reported 17 fake exchanges to the FTC. Don’t be #18. Seriously.

OMG I JUST DEPOSITED $1200 ON WAVELENGTH 😭 I THOUGHT IT WAS GONNA BE MY LUCKY DAY 😭 WHY DIDN’T I READ THIS BEFORE 😭

Hey, I’m so sorry you lost money - I’ve been there too. But please don’t blame yourself. These scams are designed to look better than the real ones. I used to think Kraken was too slow, so I tried one of these fake platforms… ended up losing $600. Now I only use ones with real audits and actual customer service. You’re not alone. And you’re not stupid - you just trusted the right-looking facade. Let’s learn from this together 💪

Perhaps the concept of legitimacy is a Western construct. In Nigeria we understand that value is not tied to bureaucracy. Wavelength may not be registered but it delivers returns. The real fraud is the system that demands paperwork before you can prosper. Your skepticism is your cage.

As someone who has analyzed over 200 crypto platforms, I can confirm: Wavelength exhibits every signature of a 2025-class exit scam. No blockchain explorer trace of their claimed wallet addresses. No DNSSEC records. No SSL certificate chain verification. Even their ‘support email’ uses a disposable domain. This isn’t incompetence - it’s engineered deception. Report it to IC3 immediately.

Oh please. You think you’re the first to write this? I’ve seen this exact post copied and pasted 12 times since January. Wavelength? Whatever. There’s a new one every Tuesday. The real problem? You people keep clicking. Grow up.

This is exactly the kind of clear, calm, evidence-based warning the crypto space needs more of. Thank you for taking the time to lay out the facts without hysteria. It’s easy to get swept up in the noise - but posts like this are anchors. If you’re reading this and unsure, pause. Don’t deposit. Don’t click. Reach out to someone who’s been around longer. We’ve all been new once. You’re not alone.