Norway Crypto Tax Calculator

Input Your Mining Details

Tax Results

There’s a lot of talk online about Norway removing tax incentives for crypto mining. If you’re reading this, you’ve probably heard the rumor and are wondering: Did Norway really cut the tax breaks for miners? The short answer? No. Not because they didn’t want to - but because there never were any to begin with.

There Were No Tax Incentives to Remove

Here’s the truth most blogs and YouTube videos skip: Norway never gave crypto miners special tax breaks. No subsidies. No reduced rates. No exemptions. The idea that incentives were removed is a myth built on confusion - probably from people mixing up Norway’s cheap electricity with tax policy.

Norway has some of the lowest electricity prices in Europe thanks to its massive hydropower capacity. That made it a magnet for crypto miners starting around 2017. But low power costs ≠ tax incentives. Miners didn’t get a discount from the government - they just paid less to run their rigs. That’s not a policy. That’s geography.

The Norwegian Tax Administration (Skatteetaten) has always treated crypto mining like any other business activity. When you mine Bitcoin or Ethereum, you’re earning income. And income is taxed - at 22%, flat rate. No exceptions. No sweetheart deals. No incentives to remove.

How Crypto Mining Is Actually Taxed in Norway (2025)

If you mine crypto in Norway today, here’s what you owe:

- You pay 22% income tax on the NOK value of the coins you mine at the moment you receive them.

- You must track the market price in Norwegian kroner for every single coin you earn - down to the minute.

- You can deduct business expenses: hardware, software, cooling systems, even the electricity your rigs use.

- Equipment depreciates at 30% per year. So if you bought a $10,000 ASIC miner, you can deduct $3,000 from your taxable income each year for the next few years.

- Cooperative mining groups split deductions equally among members - no one gets extra credit.

That’s it. No special rates. No tax holidays. No bonus credits for using renewable energy. The system is simple: earn crypto? Pay income tax. Sell it later? Pay capital gains tax. It’s the same rules that apply to freelancers, shop owners, or software developers.

Why People Think Incentives Were Removed

The confusion comes from two places.

First, some miners in 2021 and 2022 were making huge profits because Bitcoin was surging and electricity was dirt cheap. They saw their net profit margins hit 60-70%. When prices dropped in 2023 and 2024, those margins shrank. Some miners went out of business. They blamed the government - but the government didn’t change anything. The market did.

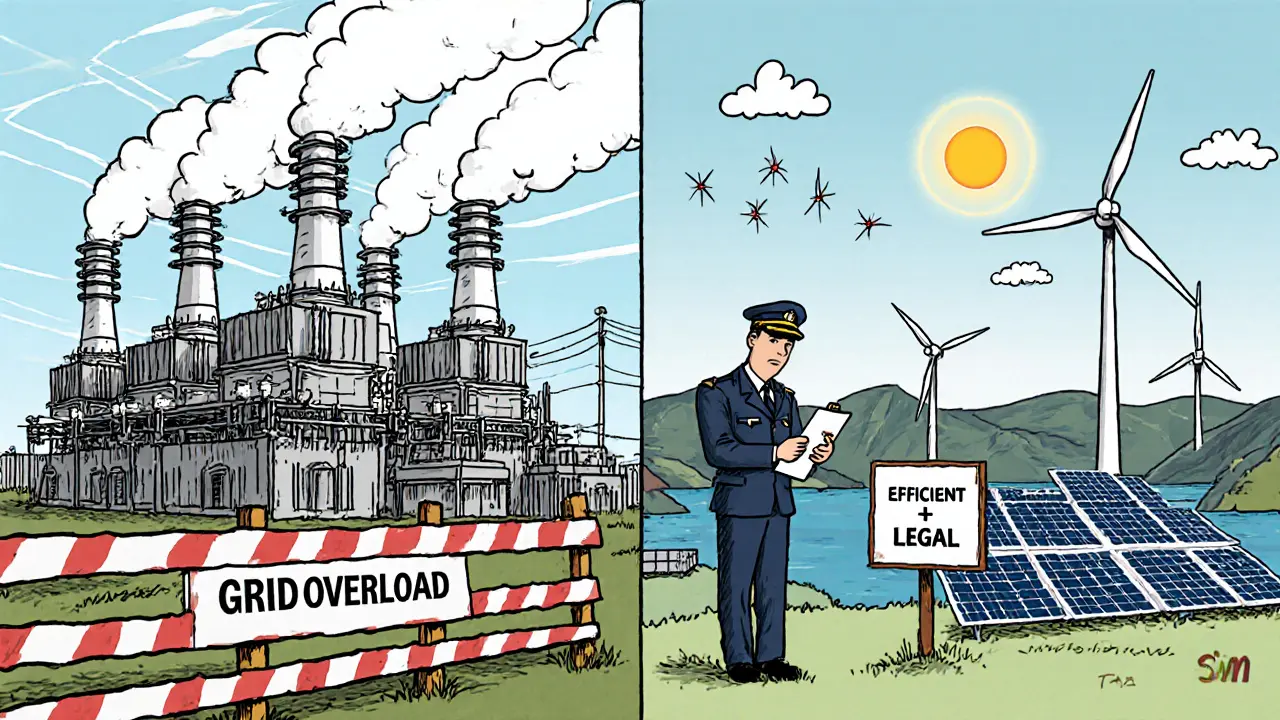

Second, Norway tightened its energy grid access rules for large-scale mining operations in 2023. That wasn’t a tax change. It was a grid capacity issue. The national power grid couldn’t handle more high-demand industrial loads without risking blackouts. So new mining farms had to prove they wouldn’t overload local transformers. Existing ones had to upgrade their infrastructure. Again - no tax change. Just infrastructure rules.

Some media outlets mixed these two things up. Headlines screamed, “Norway Cracks Down on Crypto Mining!” when what they meant was, “Norway is managing its power grid better.”

What’s Really Happening to Crypto Mining in Norway?

The industry hasn’t been crushed. It’s just changed.

As of 2025, crypto mining still contributes about 0.5% to Norway’s GDP - not huge, but not insignificant. Around 1% of the country’s total electricity use goes to mining. That’s less than the entire country’s data center load. The government doesn’t see it as a threat.

What’s changed is the type of miners left in the country. The small-time hobbyists with a few rigs in their garages? Still there. The massive, energy-hungry industrial farms? Many moved to places like Texas, Canada, or Kazakhstan where they can scale faster and face fewer logistical hurdles.

Norway’s mining scene now leans toward smaller, efficient operations - often run by local tech startups or energy cooperatives that use surplus renewable power. These miners aren’t chasing short-term profits. They’re building long-term, low-impact businesses.

And here’s the kicker: Norway still lets you claim electricity costs as a deduction. That’s a huge advantage. If you’re running a 100 kW mining farm and paying 0.05 NOK per kWh, you’re saving thousands in taxes every year - just by keeping good records.

How to Stay Compliant in Norway (2025)

If you’re mining in Norway, here’s your checklist:

- Track every coin you mine - date, time, amount, and NOK value at receipt.

- Keep receipts for all equipment purchases and electricity bills.

- Use accounting software that supports crypto income tracking (like Koinly or CryptoTaxCalculator).

- File your tax return by April 30th each year - reporting your crypto holdings as of December 31st of the prior year.

- Don’t assume staking, airdrops, or DeFi rewards are tax-free. They’re taxed the same as mining.

Many miners get audited because they report “I mined 5 BTC” but can’t prove the value on the day they got it. The Norwegian Tax Administration cross-checks blockchain data with bank records. They’re not bluffing.

What About Wealth Tax?

Yes, Norway has a wealth tax - 0.7% on net assets over 1.7 million NOK (about $160,000 USD). That applies to your total crypto holdings, including mined coins, bought coins, staking rewards - everything.

So if you mined 10 BTC in 2024 and it’s worth 5 million NOK on December 31st, you owe 0.7% of that amount as wealth tax - on top of the income tax you already paid when you received it.

This isn’t unique to crypto. It applies to your house, your car, your stocks - all assets count. But for miners, it means you can’t just hoard coins and ignore taxes. You pay twice: once when you earn, once when you hold.

Is Norway Still a Good Place to Mine Crypto?

Yes - if you’re realistic.

You won’t get rich quick. You won’t get tax breaks. But you will get:

- One of the most stable legal environments in Europe for crypto.

- Access to 98% renewable energy.

- Clear, consistent tax rules - no sudden policy flips.

- A government that doesn’t try to ban you, just regulate you like any other business.

Compare that to countries like Germany, where mining is legal but tax rules are vague, or Russia, where you risk seizure of equipment. Norway is boring - and that’s exactly why it works.

What’s Next for Crypto Mining in Norway?

Don’t expect a tax cut. Don’t expect a crackdown. Expect more of the same.

The Norwegian government is focused on energy efficiency, not crypto. They’re not trying to kill mining - they’re just making sure it doesn’t interfere with their climate goals. If you’re using excess hydro power that would otherwise be wasted, you’re welcome. If you’re trying to build a 50 MW farm that draws from the main grid? You’ll need permits, inspections, and a solid plan.

The future of mining in Norway isn’t about big players. It’s about smart ones - those who treat it like a business, not a lottery ticket.

Final Thought: Don’t Believe the Hype

The story of Norway removing tax incentives for crypto mining is a classic case of misinformation spreading because it sounds plausible. People want to believe governments are cracking down. They want drama. But the reality? Norway never gave anything away. They just taxed it fairly.

If you’re thinking of mining in Norway, don’t get lured by false promises. Do the math. Track your costs. Know the rules. And remember: the real advantage isn’t tax breaks - it’s clean, cheap power. And that’s not going anywhere.

Really appreciate this breakdown. I’ve seen so many people panicking online like Norway just outlawed mining, but it’s just the opposite-they never gave special treatment to begin with. The real story is how clean energy and smart regulation can coexist with tech innovation.

LOL so Norway didn’t crack down? What a letdown. Where’s the drama? I came here for a crypto apocalypse and got a tax lecture instead.

This is such a needed reality check. So many people think ‘cheap power’ means ‘free money’-but it’s just a cost advantage. Good on Norway for keeping it simple and fair.

While it’s true that Norway never implemented tax incentives per se, one must consider the broader implications of regulatory neutrality. The absence of preferential treatment constitutes a form of policy stance-albeit passive-whereby the state implicitly endorses economic activity by not obstructing it. This is fundamentally different from jurisdictions that actively subsidize or discourage mining. The Norwegian model, therefore, represents a minimalist governance approach that prioritizes fiscal integrity over speculative enthusiasm. One might argue this is more sustainable than the volatile, incentive-driven regimes seen elsewhere, even if it lacks the allure of tax breaks.

Thanks for clarifying this. I’ve been trying to explain this to my cousin who thinks Norway banned crypto mining. He’s still mad he didn’t move there in 2022.

YOU’RE ALL BEING MANIPULATED. This is a soft takeover. Norway’s not ‘fair’-they’re quietly killing competition so big banks can take over crypto. They tax everything, control the grid, and pretend it’s ‘sustainable.’ It’s control with a smile.

So let me get this straight-you’re proud Norway taxes miners like regular people? That’s not fairness, that’s punishment. Why should I be punished for using tech to build wealth? This is the future, and they’re treating it like a garage sale.

So… Norway’s just boring? And that’s the point? Huh. I guess I’ll take boring over chaotic any day. Still, I’d love to see a chart of how many miners left after the grid rules changed.

Actually, the 30% depreciation on ASICs is a huge deal. People forget that. Even without ‘incentives,’ that deduction alone makes Norway way more attractive than, say, Germany where you can’t write off hardware at all. This post is legit.

Let’s talk TCO: electricity at 0.05 NOK/kWh + 22% income tax + 30% annual depreciation + wealth tax at 0.7% = net effective cost per BTC mined is still below $15k in 2025. That’s below marginal cost in 90% of the world. Norway’s not giving handouts-it’s giving structural advantage. And it’s working.

Let’s be real-this whole ‘Norway never had incentives’ thing is just a PR spin. They didn’t write it into law, but everyone knew the game: cheap power + quiet tolerance = de facto subsidy. The moment profits dipped, they started tightening grid access like it was a drug cartel. They didn’t remove an incentive-they pulled the rug out after the party. Don’t be fooled by the ‘fair taxation’ fairy tale. This is a quiet eviction.

As an American, I’m jealous. We have tax loopholes for crypto but zero clean energy access. Norway gets to be the responsible adult while we’re still arguing if Bitcoin is money or a pyramid scheme. Honestly? I’d move there tomorrow if I could afford the rent.