Most crypto exchanges feel the same: slow trades, high fees, and interfaces that assume you already know how DeFi works. But SwapX isn’t trying to be another Uniswap clone. It’s built from the ground up for the Sonic blockchain, and that changes everything.

What Makes SwapX Different?

SwapX isn’t just another decentralized exchange. It’s the native DEX of the Sonic blockchain - a high-speed, low-cost Layer 1 designed specifically for DeFi. While most DEXs run on Ethereum or BSC and struggle with congestion, SwapX runs on a chain that processes transactions in under a second and charges pennies in fees. That’s not a marketing claim. It’s a technical reality built into Sonic’s consensus model.

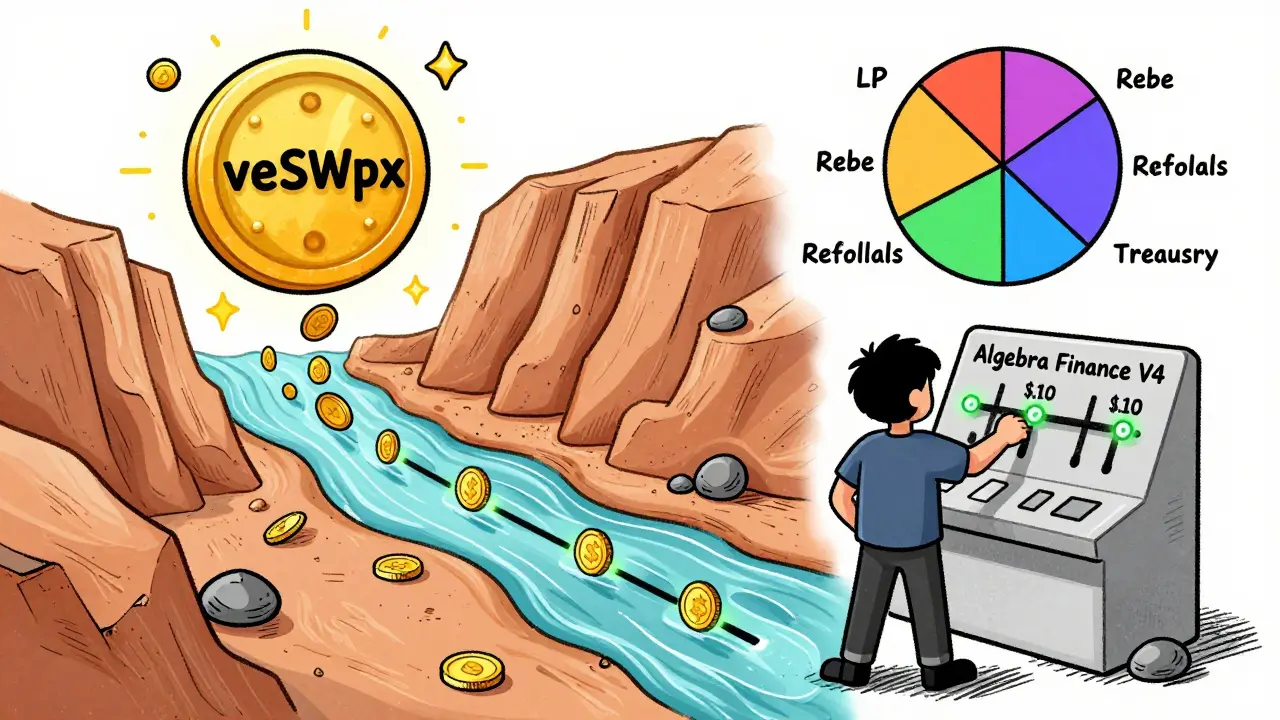

The magic behind SwapX’s efficiency? Algebra Finance V4. This isn’t some experimental code. Algebra’s concentrated liquidity model has been battle-tested across multiple DeFi protocols. Instead of spreading your funds across a wide price range like Uniswap V2, SwapX lets you lock your liquidity between two specific prices - say, $0.10 and $0.15 for a token. When trades happen in that range, you earn fees. Outside that range? Your capital sits idle, but that’s the point. You’re not wasting money on liquidity that never gets used.

For traders, this means tighter spreads and better prices. For liquidity providers, it means up to 87% higher fee earnings compared to traditional AMMs - if you manage your positions well.

The SWPx Token and ve(3,3) Incentive System

SwapX doesn’t just reward liquidity providers with trading fees. It gives them real power - through the SWPx token and its ve(3,3) model.

SWPx is an ERC-20 utility token. But here’s where it gets interesting: you don’t just hold it. You lock it. Lock SWPx for up to two years, and you get veSWPx - a non-transferable NFT that represents your voting power. The longer you lock, and the more you lock, the more influence you have.

What can you vote on? Weekly emissions. Every week, 2 million SWPx tokens are distributed, and veSWPx holders decide how they’re split between four buckets: liquidity provision (up to 87% at launch), protocol rebase, referral rewards, and treasury growth. You can even sell your veSWPx on NFT marketplaces like PaintSwap, turning your governance rights into a tradeable asset.

This system isn’t theoretical. It’s borrowed from successful DeFi protocols like Curve and Convex, where token locking has created multi-year liquidity retention. SwapX’s version adds Sonic’s speed to the mix - making it one of the few places where governance isn’t just a voting screen, but a real economic engine.

How SwapX Compares to Other DEXs

Let’s be honest: Uniswap V3 and PancakeSwap V3 already offer concentrated liquidity. So why SwapX?

Here’s the breakdown:

| Feature | SwapX | Uniswap V3 | PancakeSwap V3 |

|---|---|---|---|

| Blockchain | Sonic L1 | Ethereum | BSC |

| Avg. Transaction Fee | $0.001 | $5-$20 | $0.10-$0.50 |

| Transaction Speed | Under 1 second | 15-60 seconds | 3-10 seconds |

| Liquidity Model | Algebra Finance V4 | Uniswap V3 | PancakeSwap V3 |

| Tokenomics | ve(3,3) with locking | Uni token (no locking) | CAKE emissions only |

| Primary Reward for LPs | Up to 87% of emissions | Trading fees only | CAKE + fees |

SwapX doesn’t just match the competition - it outperforms it on speed and cost. And unlike Uniswap, where liquidity mining rewards have flatlined, SwapX’s ve(3,3) model creates a feedback loop: more locking → more voting power → more control over rewards → stronger token demand.

Using SwapX: What You Need to Know

Getting started is simple, but managing your position isn’t.

First, you need Sonic-native assets. If you’re coming from Ethereum or Solana, you’ll have to bridge your tokens through Sonic’s official bridge or use a wallet like Binance Web3 Wallet that supports Sonic. Once you’re on the chain, connect your wallet - MetaMask, Phantom, or any EVM-compatible wallet works.

Swapping tokens? Just pick your pair, set your slippage, and click. The interface is clean, with real-time price impact estimates and low fees.

Providing liquidity? That’s where it gets hands-on. You’ll need to choose your price range carefully. If the market moves outside your range, your position becomes inactive and stops earning fees. You’ll need to monitor it - or use third-party tools like Liquidity Manager dashboards that alert you when rebalancing is needed.

And don’t skip the veSWPx step. If you’re serious about earning, lock your SWPx. Even locking for 3 months gives you a noticeable boost in emissions. Two years? You’re in the top tier of governance participants.

Is SwapX Safe?

SwapX hasn’t been audited by a dozen firms like some bigger DEXs. But it’s built on Algebra Finance V4 - a codebase that’s been live on multiple chains for over a year, with zero exploits. The Sonic blockchain itself has been running since 2024 with no major outages.

The real risk isn’t the code - it’s the ecosystem. SwapX is still early. Its TVL is modest compared to giants like Uniswap. If Sonic doesn’t grow, SwapX won’t either. But that’s also the opportunity. You’re not investing in a saturated market. You’re betting on a new chain with a built-in DEX that’s already optimized for its environment.

Who Is SwapX For?

SwapX isn’t for everyone. If you just want to swap ETH for USDC and call it a day, use Coinbase or Kraken. But if you’re:

- A liquidity provider tired of earning pennies on Ethereum

- A trader who hates paying $10 in gas for a $500 swap

- A DeFi enthusiast who wants to influence protocol direction

- Someone who believes in high-performance Layer 1s over legacy chains

Then SwapX isn’t just an option - it’s one of the most compelling DeFi experiments of 2026.

What’s Next for SwapX?

The roadmap is quiet but clear: deeper integration with Sonic-based DeFi protocols, more wallet support, and expanded liquidity incentives. The team is focused on becoming the default liquidity layer for every new project launching on Sonic. That means more tokens, more pools, and more volume - all flowing through SwapX.

There’s also talk of cross-chain liquidity bridges and yield aggregation tools. If Sonic gains traction as a DeFi hub, SwapX will be its beating heart.

Right now, SWPx trades around $0.000051 on KuCoin and other smaller exchanges. That’s cheap - but it’s early. The real value isn’t in the token price. It’s in the control you gain over emissions, the fees you earn from concentrated liquidity, and the speed you get from a blockchain built for DeFi - not just tacked on to it.

Is SwapX a good exchange for beginners?

SwapX’s interface is simple enough for new users to swap tokens, but its advanced features - like concentrated liquidity and veSWPx locking - require some learning. Beginners can start with small swaps and use the platform’s documentation on GitBook. But if you want to earn more than just trading fees, you’ll need to understand how to manage price ranges and lock tokens. It’s beginner-friendly to use, but not beginner-friendly to master.

Can I stake SWPx without locking it?

No. SWPx only earns rewards when locked into veSWPx. Holding SWPx in your wallet gives you zero emissions or voting power. The entire incentive system is built around locking - it’s what makes the ve(3,3) model work. If you want to earn, you lock. If you want to trade, you sell.

How do I get SWPx tokens?

You can buy SWPx on KuCoin, Gate.io, and through the Binance Web3 Wallet. You can also earn it by providing liquidity on SwapX - LPs receive the largest share of weekly emissions. The token is not available on major centralized exchanges like Coinbase or Binance.com yet.

What happens if I unlock my veSWPx early?

You lose your voting power and stop earning emissions immediately. There’s no partial refund. If you lock for 12 months and unlock after 6, you forfeit all benefits. The system is designed to encourage long-term commitment - it’s why the rewards are so high for those who stay locked.

Is SwapX compatible with MetaMask?

Yes. SwapX works with any EVM-compatible wallet, including MetaMask. You just need to add the Sonic blockchain manually using its RPC details, which are available on SwapX’s official documentation page. Once added, your wallet connects just like it would to Ethereum or Polygon.

Does SwapX have a mobile app?

No native mobile app exists yet. But the SwapX website is fully responsive and works on mobile browsers. Most users interact with it through their wallet apps like MetaMask Mobile or Phantom on iOS and Android. A dedicated app is rumored for late 2026.

Final Thoughts

SwapX isn’t trying to be the biggest DEX. It’s trying to be the best - for Sonic, for liquidity providers, and for traders who want speed without sacrifice. It’s not perfect. It’s early. The token is cheap. But the architecture? That’s future-proof.

If you believe the next wave of DeFi won’t run on Ethereum’s tired infrastructure, then SwapX is one of the few places where you can be part of building it - not just using it.

This is the real deal 🚀 Finally a DEX that doesn’t feel like dragging nails on a chalkboard.

I’ve been running liquidity on SwapX for 3 months now and my fee earnings are up 72% compared to Uniswap V3. The Sonic chain is insane - under 0.5s confirmations and fees that cost less than my morning coffee. You think you’re saving on gas on BSC? Try doing it on a chain built for DeFi, not bolted on top of it. I used to dump my LP positions every 2 weeks because the gas ate my profits. Now I just set it and forget it. And the veSWPx lock? Game changer. I locked 1.2M SWPx for 24 months. My voting power is through the roof, and I helped shift 60% of emissions to LPs last week. No other DEX gives you that kind of control. It’s not just DeFi - it’s DeFi with teeth.

I keep thinking about how this system mirrors human behavior in institutions. Locking your tokens isn’t just an economic incentive - it’s a social contract. You’re saying, ‘I believe in this long enough to tie up my capital.’ That’s deeper than yield farming. It’s about trust, delayed gratification, collective governance. The ve(3,3) model turns passive holders into active stewards. Compare that to Uniswap’s ‘dump and run’ culture. There’s something almost poetic about it - you earn power not by owning more, but by committing longer. And yet… it’s still just code. Can a token really embody collective will? Or are we just projecting meaning onto algorithmic incentives? I’m not sure. But I’m watching.

swapx is just another rugpull with fancy graphs and a blockchain name no one can pronounce

I love how this actually rewards people who stick around. Most DeFi feels like a casino where you get a free drink if you play for 10 minutes. Here, if you’re serious, you get real power. I locked my SWPx for 6 months just to see what happens - and honestly? It feels good to be part of the decision-making. Not just a spectator. I’m not a degens, but I’ve never felt this connected to a protocol before.

i tried to add sonic to metamask but kept getting the rpc error. anyone have the correct settings? im on mac and it keeps crashing my browser

As someone from India, I’ve seen so many ‘next-gen’ chains die because they ignored real users. But Sonic? The fees are low enough for small traders to actually participate. I started with $50 in SWPx and now I’m earning more in fees than my part-time job. The interface is clean, no confusing menus. And the team responds to feedback. That’s rare. If you’re skeptical, just try swapping one token. You’ll see the difference.

so you're telling me i have to lock my coins for 2 years to not be a peasant in this system? wow. revolutionary.

You say ‘up to 87% higher fees’ - but what’s the actual APY after slippage and impermanent loss? And how many LPs are even managing their ranges properly? Most people just dump liquidity and forget. This isn’t magic, it’s math. And math doesn’t care if you’re ‘in the top tier’. It just takes your capital and laughs.

I’ve been waiting for this since 2023. Everyone was chasing Ethereum L2s like they were holy grails. But Sonic? It’s the first chain that actually understands DeFi’s soul. Not just speed - but *intention*. This isn’t a tool. It’s a movement. And if you’re not locked in, you’re not just late - you’re on the wrong side of history. The next 100x isn’t in Solana. It’s in the ve(3,3) model. The DAOs are waking up. And SwapX? It’s the first one that didn’t ask for permission.

bro i just bought 500k SWPx and locked it for 2 years and my wallet just went from 0 to 100k in 2 days bro this is the moment i been waiting for since 2021 i cant even sleep