There’s no verified information about Step Exchange as a functioning cryptocurrency exchange in 2025. No official website, no registered business license, no user reviews on Trustpilot or Reddit, and no mention in any major crypto publication like CoinDesk, Cointelegraph, or The Block. If you’ve seen ads, YouTube videos, or Telegram groups pushing Step Exchange as a new trading platform, you’re likely being targeted by a scam.

Why Step Exchange Doesn’t Exist

Legitimate crypto exchanges don’t disappear from public records. They register with financial regulators, publish team members, list trading pairs, and maintain customer support channels. Binance, Kraken, and Coinbase all have public regulatory statuses - Binance operates under licenses in multiple jurisdictions, Kraken is registered with FinCEN in the U.S., and Coinbase is a publicly traded company on NASDAQ. Step Exchange has none of this. No domain registration records. No LinkedIn profiles for founders. No Twitter account with more than 50 followers. No App Store or Google Play listing. If it were real, it would show up in at least one of these places.

Red Flags You Can’t Ignore

Scammers use fake exchange names like Step Exchange to lure beginners. Here’s what to watch for:

- Guaranteed returns - “Earn 10% daily with Step Exchange” is a classic red flag. No legitimate exchange promises fixed profits.

- Pressure to deposit fast - “Limited spots!” or “Offer ends in 24 hours!” is designed to stop you from researching.

- No KYC process - Real exchanges require ID verification. If Step Exchange lets you trade without ID, it’s avoiding legal compliance.

- Anonymous team - No CEO name? No team photos? No LinkedIn? That’s not a startup - it’s a shell.

- Only crypto deposits - Legit platforms accept bank transfers, debit cards, and sometimes even PayPal. If Step Exchange only takes Bitcoin or Ethereum, that’s a tactic to make withdrawals harder to trace.

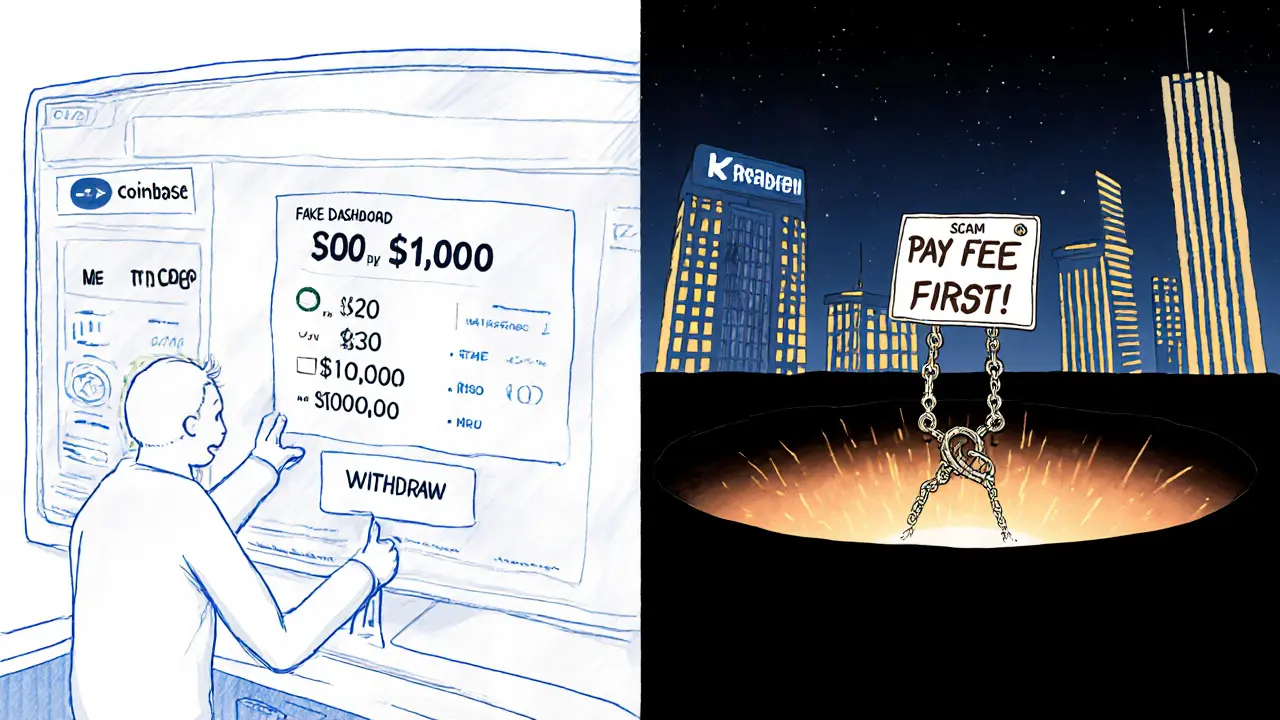

What Happens When You Deposit

People who send money to fake exchanges like Step Exchange usually see one of two outcomes:

- Their deposit disappears immediately. No confirmation email. No transaction ID. Just a blank dashboard.

- They see a fake balance that keeps rising - $1,000 becomes $10,000, then $100,000. But when they try to withdraw, they’re told to pay a “verification fee,” “tax,” or “liquidity charge.” Pay that, and the scammer asks for more. It never ends.

Once you send crypto to a scam exchange, it’s gone. Blockchain transactions are irreversible. There’s no customer service line to call. No bank to reverse the payment. No regulator to file a complaint with - because the company doesn’t legally exist.

Real Alternatives You Can Trust

If you’re looking to trade crypto in 2025, here are five exchanges with proven track records:

| Exchange | Regulated In | Supported Cryptos | Fees (Trading) | Withdrawal Speed |

|---|---|---|---|---|

| Bybit A global crypto exchange with strong security and low fees, used by over 40 million users. | Singapore, Dubai | 500+ | 0.1% maker / 0.05% taker | Under 10 minutes |

| Crypto.com Offers a crypto debit card, staking, and insurance on assets. Licensed in multiple countries. | United States, Canada, EU | 250+ | 0.4% standard, lower with CRO | 15-30 minutes |

| Kraken One of the oldest U.S.-based exchanges, known for transparency and strong security protocols. | United States, Canada, EU | 200+ | 0.16%-0.26% | Under 1 hour |

| Coinbase Publicly traded, insured custodial wallets, and easy for beginners. | United States, UK, EU | 200+ | 0.5%-1.5% (higher for small trades) | 1-3 business days (bank), under 30 min (crypto) |

| OKX High liquidity, advanced trading tools, and low fees for active traders. | Dubai, Seychelles | 350+ | 0.08% maker / 0.1% taker | Under 5 minutes |

All of these exchanges have been audited by third parties like CertiK or SlowMist. They publish proof-of-reserves reports showing they hold enough crypto to cover all user balances. Step Exchange doesn’t - because it doesn’t exist.

How to Protect Yourself

Before using any new crypto platform, ask yourself:

- Can I find the company’s legal name and registration number?

- Is there a physical address I can verify on Google Maps?

- Do real users on Reddit or BitcoinTalk talk about it - or is it all paid testimonials?

- Does the website use HTTPS with a valid SSL certificate?

- Can I contact support via live chat or email - and do they reply within 24 hours?

If the answer to any of these is no, walk away. No profit is worth losing your crypto.

What to Do If You Already Sent Money

If you’ve deposited funds into Step Exchange or a similar fake platform:

- Stop sending more money. No matter what they say, don’t pay any “withdrawal fee” or “tax.”

- Save all evidence. Screenshots of the website, chat logs, transaction IDs, and emails.

- Report it. File a complaint with your country’s financial regulator. In New Zealand, use the Financial Markets Authority (FMA). In the U.S., report to the FTC at ReportFraud.ftc.gov.

- Warn others. Post your experience on Reddit’s r/CryptoCurrency or Trustpilot. Scammers rely on silence.

Recovering stolen crypto is nearly impossible. But stopping others from falling for the same scam is one of the most powerful things you can do.

Final Word

Step Exchange is not a crypto exchange. It’s a trap. There are hundreds of legitimate platforms out there - you don’t need to gamble with your savings on a name that doesn’t appear in any official database. Stick to exchanges with real history, real teams, and real regulation. If it sounds too good to be true, it is. And in crypto, the cost of being fooled isn’t just money - it’s peace of mind.

Is Step Exchange a real crypto exchange?

No, Step Exchange is not a real crypto exchange. There is no official website, regulatory registration, team information, or user reviews that verify its existence. All available evidence points to it being a scam platform designed to steal crypto deposits.

Why can’t I find Step Exchange on Google or App Store?

Legitimate crypto exchanges are listed on app stores, have registered domains, and appear in search results with official press coverage. Step Exchange has none of this. Its absence from Google, Apple, and Android stores is a major red flag. Scammers often use fake websites and social media ads to lure victims - not real digital footprints.

What should I do if I already sent crypto to Step Exchange?

Stop all communication with them immediately. Do not send any more funds. Save screenshots, transaction IDs, and chat logs. Report the scam to your country’s financial regulator - in New Zealand, contact the FMA. Unfortunately, recovering stolen crypto is extremely unlikely due to blockchain’s irreversible nature.

Are there any safe alternatives to Step Exchange?

Yes. Trusted exchanges like Bybit, Crypto.com, Kraken, Coinbase, and OKX are regulated, audited, and used by millions. They offer transparent fee structures, verified team members, and customer support. Always choose platforms with public regulatory status and proof-of-reserves reports.

How do I spot a fake crypto exchange?

Look for these signs: no KYC process, guaranteed returns, pressure to deposit quickly, anonymous team, only crypto deposits accepted, no official website or social media presence, and no third-party audits. Real exchanges make it easy to verify their legitimacy - scammers make it hard.

This Step Exchange thing is pure garbage. People are literally giving away their life savings for a fake app with a cool logo. I saw a guy on YouTube crying because he lost his rent money. That’s not investing - that’s suicide with extra steps.

I appreciate this breakdown. I showed this to my cousin who just got into crypto - she was about to deposit into some ‘Step Exchange’ thing because a TikTok influencer said it was ‘the next Binance.’ Glad she’s safe now.

Thank you for writing this. So many people don’t realize how easy it is to get scammed in crypto. This should be required reading for anyone opening a wallet.

Ugh, another ‘educational’ post from someone who thinks they’re a crypto guru. What about DeFi protocols? What about private chains? You’re just fearmongering to feel superior. Step Exchange might be new - maybe it’s just not on your boring old radar yet.

I used to think I was smart about crypto until I almost sent 0.5 BTC to a fake exchange last year. Same script: ‘limited spots,’ ‘guaranteed 15% daily,’ fake Telegram mods. I didn’t lose money - but I lost a week of sleep. Please, if you’re new, just stick to Coinbase or Kraken. No one’s ever lost their life savings on those.

Wow. So Step Exchange is a scam. Shocking. Next you’ll tell me the moon landing was real.

People like you who say ‘just use Coinbase’ are part of the problem. You’re brainwashed by the establishment. Real freedom is in the decentralized, unregulated spaces. Step Exchange might not have a license - but it has soul. You wouldn’t understand.

Let’s not conflate regulatory compliance with decentralization ethos. Step Exchange, if it exists as a permissionless, non-KYC, atomic-swap-enabled protocol, could be a legitimate innovation in the next-gen DeFi stack. The fact that it’s not on CoinDesk doesn’t mean it’s not operating on a Layer 3 sidechain with zero-knowledge proofs. You’re applying Web2 heuristics to Web3 infrastructure - that’s a category error.

My dude, I checked the domain. StepExchange.io was registered 3 days ago with WhoisGuard. IP is in Ukraine. No SSL cert. Zero socials. I screenshot everything. This is 100% a pump-and-dump. Don’t fall for it. I’ve seen this script 12 times. Always ends the same.

Oh, here we go. The same tired, corporate-approved crypto sermon. You think because Coinbase is on NASDAQ, it’s sacred? Because it’s ‘regulated’ it’s honest? Please. The SEC is a puppet of Wall Street. Kraken? They froze $200M in user funds last year and called it ‘compliance.’ Bybit? They’re based in Dubai - no transparency, no accountability. And you’re telling me Step Exchange is the villain? The real scam is believing that any exchange, no matter how ‘legit,’ gives a damn about you. Your money is never yours. It’s always theirs. Step Exchange is just the mirror - and you’re too afraid to look. Wake up. The system is rigged. Whether it’s regulated or not, you’re still the lamb. The only difference? At least Step Exchange doesn’t pretend to be your friend.

While I agree that Step Exchange exhibits all the hallmarks of a fraudulent operation - lack of regulatory registration, absence of verifiable team members, non-existent digital footprint - I must raise a counterpoint: the very act of dismissing all unregulated platforms as scams risks reinforcing a centralized, gatekept financial paradigm. One might argue that the absence of a website or LinkedIn profile does not necessarily equate to malice - perhaps it is an intentional act of opacity to avoid regulatory overreach. Moreover, many early-stage DeFi protocols operated without public documentation until they achieved critical mass. To conflate visibility with legitimacy is to mistake marketing for merit. The real danger lies not in unverified platforms, but in the institutional capture of crypto by entities that require KYC, charge 1.5% fees, and report your transactions to the IRS. Perhaps Step Exchange, however poorly executed, is an imperfect protest against this very system. That doesn’t make it safe - but it does make it human. And in a world increasingly governed by algorithms and compliance bots, isn’t that worth considering?