SPHYNX Staking Calculator

How It Works

Estimate your potential staking rewards in SPHYNX tokens based on current market conditions. Remember: SPHYNX has low liquidity and high volatility. This tool doesn't guarantee returns, but provides a rough estimate.

There’s no such thing as a Sphynx Labs crypto exchange-at least not in the way you might expect. If you’re looking for a centralized platform like Binance or Coinbase where you deposit fiat, buy crypto with a credit card, and withdraw to your wallet, you won’t find it here. Sphynx Labs is something else entirely: a mobile-first DeFi ecosystem built around its own token, SPHYNX. And that changes everything.

What Sphynx Labs Actually Is

Sphynx Labs isn’t an exchange. It’s an all-in-one DeFi app. Think of it as a Swiss Army knife for crypto users who want to trade, stake, farm yields, swap tokens, and even buy NFTs-all inside a single Android app. The app, last updated in June 2025, has a 4.9-star rating from over 1,300 reviews on Google Play. That’s impressive. But ratings don’t tell the whole story.The core of the system is the SPHYNX token. It’s not just a currency-it’s the fuel for everything in the ecosystem. You need it to pay for swaps, unlock staking rewards, access the launchpad, or even use the cross-chain bridge. Total supply? Fixed at 1.5 billion tokens. No more will ever be created. As of late September 2025, the market cap sat at $1.13 million. That’s tiny. For comparison, even a small-cap altcoin like SHIB has a market cap over $4 billion. SPHYNX is in the deep end of the crypto pool.

How the Sphynx DeFi App Works

The app is where you interact with the whole system. It’s not just a wallet. It’s a full trading terminal wrapped in a clean, intuitive interface. Here’s what you can actually do:- Swap tokens across multiple blockchains using the built-in bridge

- Set stop-loss and limit orders-something you rarely see in mobile DeFi apps

- Stake SPHYNX to earn more SPHYNX

- Join yield farming pools to earn rewards from other tokens

- Buy and sell NFTs directly inside the app

- Access a launchpad for new tokens entering the ecosystem

- Track live charts with advanced technical indicators

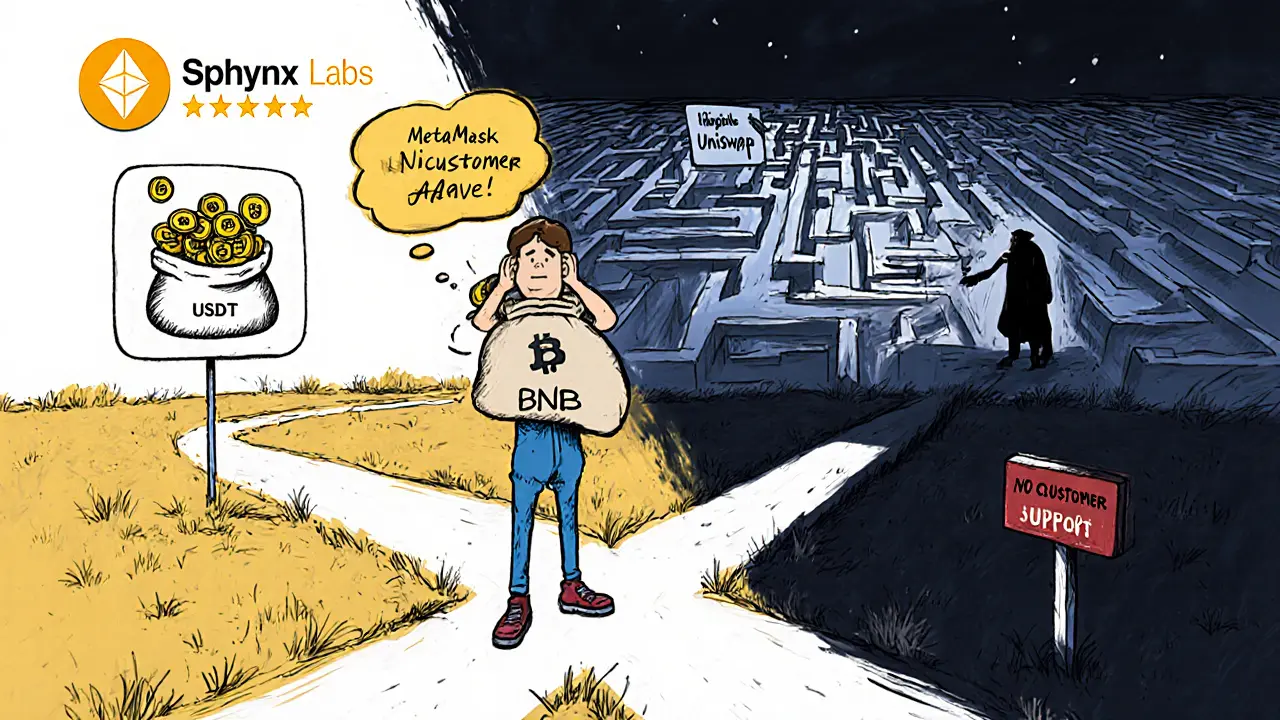

It’s a lot. And that’s the appeal. Most DeFi platforms make you jump between 3-5 different apps to do all this. Sphynx tries to bundle it all. For someone who’s tired of juggling MetaMask, Uniswap, and a staking site, that’s tempting.

Where You Can Actually Buy SPHYNX

Here’s the catch: you can’t buy SPHYNX directly from Sphynx Labs. The app lets you swap other tokens for SPHYNX, but to get it in the first place, you need to go elsewhere. The token trades on a handful of decentralized and centralized exchanges. Bybit is one of the most reliable. You’ll need to complete basic KYC, deposit USDT or BTC, then place a market or limit order. It’s straightforward-but not simple.Other places to find SPHYNX include LetsExchange.io, which lists over 5,700 tokens. But here’s the problem: liquidity is thin. On 3Commas, the 24-hour trading volume was just $414. That means if you tried to buy $5,000 worth, you’d likely move the price hard against you. Slippage could eat up 10% or more of your order. This isn’t Bitcoin. This is a micro-cap token with almost no trading depth.

Price History and Market Outlook

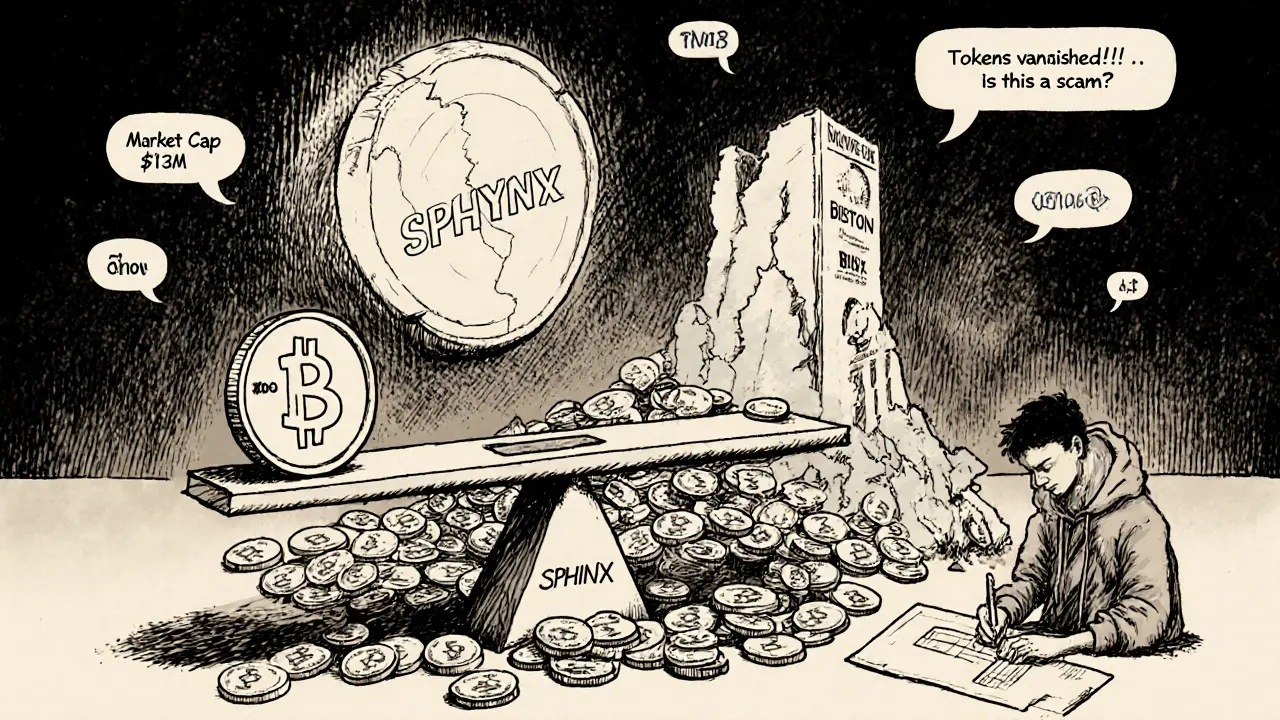

SPHYNX has been on a rollercoaster. It hit an all-time high of $0.0095 in April 2024. That’s nearly 12 times its current price. Since then, it’s been mostly downhill. By September 3, 2025, it dropped to a low of $0.000645. As of late October 2025, it’s hovering around $0.00082-$0.00089.Technical indicators don’t look good. The price is trading below both the 50-day and 200-day moving averages. That’s a classic bearish signal. The 14-day RSI is at 48.5-neutral, but not bullish. CoinCodex predicts a 25% drop to $0.00054 by the end of October. WalletInvestor sees $0.0005 as the average price through 2029. That’s not a growth story. It’s a survival story.

What Users Are Saying-The Good and the Bad

The Google Play reviews tell a split story. Half the users call it "the best all-in-one DeFi app I’ve used." They love the UI, the speed, and the fact that they don’t need to switch apps. One wrote: "I’ve tried 7 different wallets. This is the only one that does everything without crashing." But the other half? They’re furious. Several users report sending tokens into the swap function and never getting them back. One user said: "I sent 500 SPHYNX to swap for ETH. The app said it was processing. Three days later, my tokens vanished. No refund. No help. This is a scam." Is it a scam? Maybe not. But DeFi is unforgiving. If you send a transaction and it fails, your tokens can get stuck in a liquidity pool or burned by a smart contract glitch. The app doesn’t have customer service. No phone number. No email ticket system. Just a Discord server with 2,000 people asking the same question.Security and Privacy

Sphynx Labs claims it doesn’t collect any user data. That’s good. No tracking. No selling your info. But here’s the trade-off: you’re fully responsible. If you lose your seed phrase? Gone forever. If you send funds to the wrong address? Gone forever. If a smart contract bug eats your tokens? No one’s coming to fix it.The app uses standard wallet encryption and doesn’t hold your private keys. That’s the right way to do DeFi. But for a beginner? It’s terrifying. There’s no safety net. No FDIC insurance. No chargebacks. Just code-and code can fail.

Who Should Use Sphynx Labs?

This isn’t for everyone. If you’re new to crypto, stay away. The risks are too high, the support too thin, and the rewards too uncertain.But if you’re already deep into DeFi-someone who’s used Uniswap, Compound, and Aave before-then Sphynx Labs might be worth a small test. Allocate $50. Not $500. Not $5,000. $50. See how the app feels. Try swapping a small amount. Stake a little. See if the interface is truly smoother than your current setup.

If you’re looking for a quick flip? Don’t. The market is bearish. The volume is low. The momentum is down. This isn’t a pump-and-dump coin. It’s a long-shot project trying to build something real.

Final Verdict

Sphynx Labs isn’t a crypto exchange. It’s a risky, ambitious DeFi experiment with a slick app and a struggling token. The features are impressive. The user base is growing. But the market doesn’t believe in it yet.There’s potential here. The roadmap includes more chains, more NFT integrations, and a desktop version. If they execute, SPHYNX could rise. But if they don’t? It’ll fade into obscurity like hundreds of other micro-cap DeFi tokens.

Bottom line: don’t invest because of the 4.9-star rating. Don’t buy because you saw it on a YouTube video. Do your own research. Understand the risks. And only put in what you’re prepared to lose.

Is Sphynx Labs a real crypto exchange?

No, Sphynx Labs is not a traditional crypto exchange. It’s a mobile DeFi app that lets you swap, stake, farm, and trade tokens-all within one platform. You can’t deposit fiat or buy crypto with a credit card. To get SPHYNX tokens, you need to trade for them on other exchanges like Bybit or LetsExchange.io.

Can I trust Sphynx Labs with my crypto?

It depends. The app doesn’t hold your private keys, which is good. But there’s no customer support, no chargebacks, and no insurance. Some users report losing funds during swaps. If you’re experienced with DeFi and understand how smart contracts work, you can use it cautiously. If you’re new, avoid it. Never put in more than you can afford to lose.

Where can I buy SPHYNX tokens?

SPHYNX tokens are available on decentralized and centralized exchanges like Bybit and LetsExchange.io. You’ll need to complete basic KYC on Bybit, deposit USDT or BTC, and then place a trade. The token is not listed on major exchanges like Binance or Coinbase. Trading volume is very low, so expect slippage on larger orders.

Is SPHYNX a good investment in 2025?

Based on current data, SPHYNX is not a strong investment. The price is down over 90% from its all-time high. Technical indicators are bearish, and most analysts predict further declines through 2025 and beyond. The market cap is tiny, liquidity is low, and user trust is mixed. Only consider it if you’re speculating with a very small amount and understand the high risk.

Why are some users saying Sphynx Labs is a scam?

Some users report sending tokens into the app’s swap function and never receiving the output. This could be due to failed transactions, high gas fees, or smart contract issues. In DeFi, if a transaction doesn’t go through, funds can get stuck or burned. The app doesn’t have a support team to reverse errors, which leads frustrated users to call it a scam. It’s not necessarily fraudulent-but it’s unforgiving for beginners.

Does Sphynx Labs have a desktop version?

As of October 2025, Sphynx Labs only has a mobile app available on Android via Google Play. There is no official desktop or web version yet. The developers have mentioned plans for a desktop app in future updates, but no release date has been confirmed.

How does staking work on Sphynx Labs?

You can stake SPHYNX tokens directly in the app to earn more SPHYNX as rewards. The APY (annual percentage yield) isn’t fixed-it changes based on network activity and liquidity. Rewards are distributed daily. There’s no lock-up period, so you can unstake anytime. But remember: staking doesn’t protect you from token price drops. If SPHYNX falls 50%, your staked balance might be worth less even if you earn more tokens.

Next Steps

If you’re still interested after reading this:- Download the Sphynx DeFi App from the Google Play Store (only available on Android).

- Use a small amount of crypto-like $20-$50 worth of USDT or BNB-to test the swap function.

- Read the privacy policy and understand that no one can recover your funds if you make a mistake.

- Check real-time price data on CoinCodex or Bybit before trading.

- Never invest more than you’re willing to lose.

If you’re not comfortable with self-custody, high volatility, or zero customer support, walk away. There are safer, simpler ways to get into crypto. Sphynx Labs isn’t one of them.

so i downloaded the app and swapped 10 usdt for sphynx and now my tokens are just... gone? like i see the tx on etherscan but the app says "pending" for 3 days?? wtf is this??

of course it’s a scam. no legit project would let you lose funds without a help desk. this is why crypto is just a pyramid scheme with fancy UIs. they’re harvesting seed phrases and selling them on dark web forums. i’ve seen the logs.

the beauty of DeFi is that it removes intermediaries and forces you to become your own bank. if you can't manage your keys or understand slippage then you shouldn't be here. sphynx offers a rare mobile-first experience for power users. yes the token is micro-cap but that's where the alpha hides. look at early UNI holders. the real question isn't whether this works-it's whether you're ready to do the work.

4.9 stars?? lmao. that’s just the 1300 people who got free airdrops and didn’t lose their funds yet 😏. the other 5000 who got rug-pulled? they’re too busy crying in discord to leave reviews. also, why is the logo a cat? 🐱

you all are missing the point. this isn’t about crypto. it’s about control. the system wants you to believe you’re free by using an app that takes your tokens and vanishes them. the real scam is letting corporations like google host your wallet. we’re all just nodes in a surveillance economy. 🌑

let me break this down for the clueless: if your token’s market cap is under $2M and 24h volume is $400, you’re not investing-you’re donating to a dev’s vacation fund. the app looks pretty, sure. but look at the contract address. no audits. no team. no github commits since April. this is a glorified honeypot. don’t touch it with a 10-foot pole.

the only thing worse than losing money on this is the delusion that anyone cares enough to fix it. no support. no updates. no transparency. just a 4.9-star rating built on confirmation bias and bot reviews. you’re not a pioneer-you’re a lab rat.

if you’re new to DeFi, start with a small amount. $20. $50. test the swap. see how the interface feels. read the docs. understand that if you mess up, no one’s coming to save you. but if you’re careful, this could be a glimpse of what self-custody looks like in the future. be kind to yourself as you learn.

wait so you can buy sphynx on bybit? i just tried and the order kept failing. i think i typed the wrong address or something? also why is the website down? is it just me?

the fact that people still think this is a good idea is why crypto is doomed. you’re trading a token with less liquidity than my coffee order for a ‘decentralized future’? i’ve seen better UX on a 2015 android app. also, who names their token SPHYNX? sounds like a bad fantasy novel.

you think this is bad? wait till you find out the dev’s real name is ‘John Smith’ and he lives in a basement in Ohio. the whole thing’s a front for a crypto laundering scheme. i’ve got screenshots. the blockchain is rigged. they’re using shell wallets to fake volume. you’re being played.

i’ve been using sphynx for 6 months. lost $30 on a failed swap, but i learned so much. now i check every tx on etherscan, i use gas estimators, i understand slippage tolerance. it’s not a product-it’s a classroom. the app doesn’t care if you win or lose. but if you pay attention? you’ll outgrow 90% of the people who think this is a ‘get rich quick’ app. i’m still here. still learning. still holding. not because i believe in the price-but because i believe in the process.