DEX Legitimacy Checker

Based on the article's analysis of SheepDex, this tool helps evaluate if a decentralized exchange meets minimum legitimacy criteria. A legitimate DEX should have:

- Trading volume above $1 million daily

- Smart contract audits by reputable firms

- Active developer activity (GitHub commits, updates)

- Verified user base with real trading activity

- Public social media presence (Twitter, Discord)

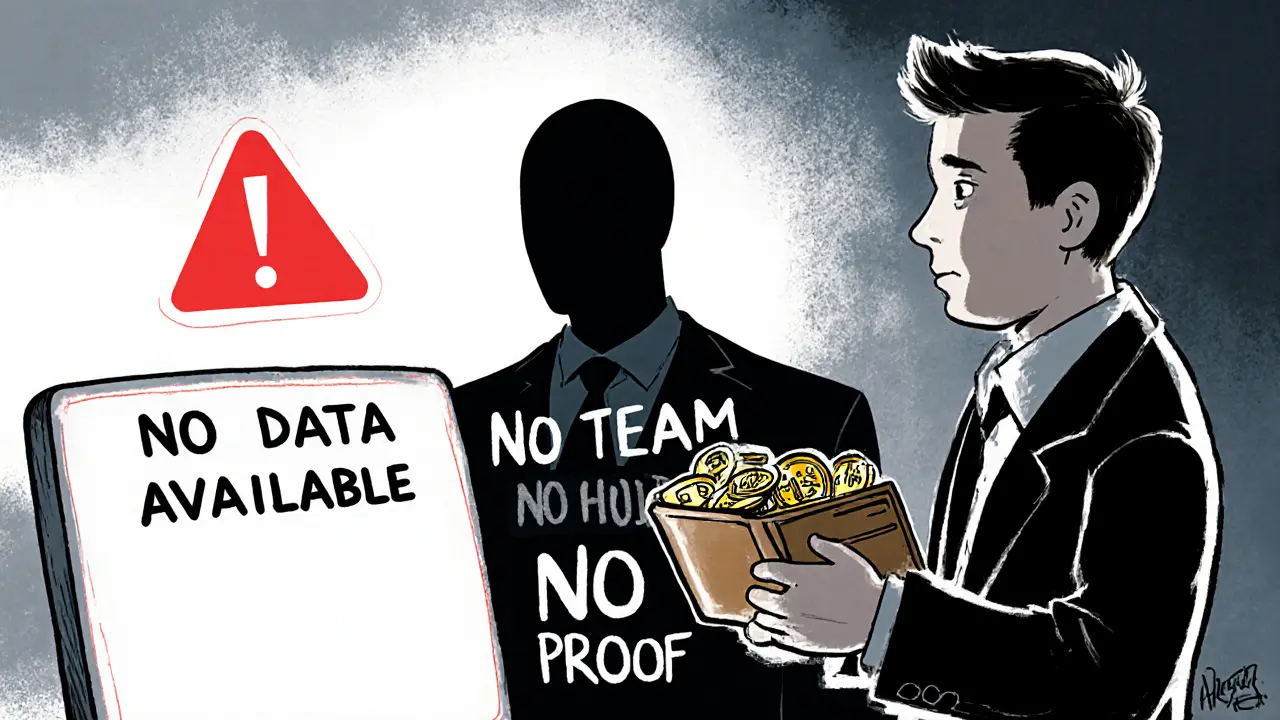

SheepDex claims to be the first decentralized exchange that combines spot trading and derivatives under one roof. It promises to be a "decentralized Binance"-no KYC, no middlemen, and smart contracts that reward liquidity providers with fee refunds. Sounds powerful, right? But here’s the catch: SheepDex doesn’t show up on any real market data. Not on CoinMarketCap, not on CoinGecko, not in any user forums. If you search for trading volume, liquidity pools, or even a single trade history, you’ll find nothing. Zero. Nada.

What SheepDex Says It Does

According to its own website and a sparse CoinMarketCap listing from October 2025, SheepDex is built to solve two big problems in DeFi: capital inefficiency and fragmented trading. Most DEXs like Uniswap or PancakeSwap let you swap tokens, but if you want to trade perpetuals or leverage positions, you need another platform-like Hyperliquid or dYdX. SheepDex says it unifies both in one wallet-connected interface. It claims to use a concentrated liquidity model similar to Uniswap V3, where liquidity providers (LPs) can lock funds within specific price ranges. That means less slippage and better returns for LPs. It also says it refunds a portion of trading fees back to LPs and rewards active traders with tokens. There’s even talk of a lottery system and leveraged tokens coming later. But here’s the thing: none of this has been proven.Where the Data Disappears

CoinMarketCap lists SheepDex as an "Untracked Listing." That’s not a minor label-it means the platform failed to meet basic data requirements. To be tracked, a DEX must have:- Consistent daily trading volume above $1 million

- Reliable API feeds from multiple sources

- Verifiable order book depth

- Active liquidity pools with real users

How It (Supposedly) Works

From what little info exists, using SheepDex would look like this:- Connect your wallet (MetaMask, Trust Wallet, etc.)

- Deposit USDT, USDC, or another stablecoin into a smart contract

- Choose between spot trading or perpetual contracts

- Trade without giving ID or creating an account

Who’s Using It?

This is the biggest red flag. You can’t find a single Reddit thread about SheepDex. No Trustpilot reviews. No Twitter conversations. No YouTube tutorials. No Discord servers. No GitHub commits. No Medium articles. Nothing. In crypto, if a project is real, people talk about it. Even if it’s bad, people complain. SheepDex doesn’t even generate complaints. That’s not quiet success-that’s quiet death. Think about it: Uniswap didn’t become #1 because it had fancy marketing. It became #1 because thousands of traders used it daily, reported bugs, suggested improvements, and built tools on top of it. SheepDex has none of that.How It Compares to the Real Alternatives

| Feature | SheepDex | Uniswap V3 | PancakeSwap | Hyperliquid |

|---|---|---|---|---|

| Spot Trading | Claimed | Yes | Yes | No |

| Perpetual Contracts | Claimed | No | No | Yes |

| Trading Volume | Untracked | $10B+/week | $2B+/week | $1.5B+/week |

| Smart Contract Audits | None | Multiple (CertiK, Quantstamp) | Multiple | Publicly available |

| Wallet Support | Unknown | MetaMask, Trust Wallet, etc. | Same | Same |

| User Base | None detected | Millions | Millions | Hundreds of thousands |

| Developer Activity | None | Active GitHub, weekly updates | Active GitHub | Regular releases |

Why This Matters

Crypto isn’t just about tech-it’s about trust. You don’t just need a smart contract. You need a community. You need transparency. You need proof that people are using it. SheepDex offers none of that. It’s a website with bold claims and zero evidence. It’s like a restaurant with a fancy menu but no customers, no kitchen, and no chef. And in crypto, where scams thrive on hype, this is exactly the kind of project that gets flagged by watchdogs. Not because it’s malicious-but because it’s meaningless.Should You Use It?

No. Not because it’s necessarily a scam. But because there’s no way to know if it’s real. No volume. No audits. No users. No updates. No support. If you’re looking for a decentralized exchange that actually works, stick with what’s proven:- For spot trading: Uniswap or PancakeSwap

- For derivatives: Hyperliquid or dYdX

- For security and ease: Kraken or Coinbase (if you’re okay with KYC)

What Could Change This

If SheepDex ever releases:- A public GitHub with audited code

- A live liquidity pool with real trades

- A team with verifiable names and experience

- A blog or Twitter account posting weekly updates

Is SheepDex a scam?

There’s no proof SheepDex is a scam, but there’s also no proof it’s real. It has no trading volume, no audits, no users, and no developer activity. That’s not a scam-it’s a ghost project. In crypto, absence of evidence isn’t just suspicious-it’s a warning sign.

Can I trade on SheepDex right now?

Technically, maybe-if you can find the website and connect your wallet. But there’s no evidence anyone has traded there. No liquidity, no order books, no trades recorded. Even if you deposit funds, you might not be able to withdraw them. Don’t risk your crypto on a platform with zero activity.

Why isn’t SheepDex on CoinMarketCap as tracked?

CoinMarketCap requires minimum liquidity, consistent trading volume, and reliable data feeds. SheepDex fails all of these. Its "Untracked" status means it doesn’t meet their basic standards for listing. That’s not a technicality-it’s a red flag that the platform isn’t operational at a meaningful level.

Does SheepDex support my wallet?

The website doesn’t say. Most DEXs work with MetaMask, Trust Wallet, or Coinbase Wallet, but without official documentation, you can’t be sure. Even if it does, connecting your wallet to an unverified contract is risky. Always assume you’re exposing your funds to unknown code.

Are there better alternatives to SheepDex?

Yes. For spot trading, use Uniswap or PancakeSwap. For perpetual contracts, Hyperliquid and dYdX are proven and active. If you want KYC and security, Kraken and Coinbase have track records. SheepDex offers nothing you can’t get elsewhere-with real data, real users, and real audits.

This is the most accurate takedown of a ghost project I've seen all year. Zero volume, zero code, zero team. Just a website with bold fonts and a dream. Crypto's full of these. They call it innovation. I call it digital smoke.

You think this is bad? I saw a project last week that claimed to be AI-powered DeFi and had a Discord with 12 members, 8 of them bot accounts. At least SheepDex has a website. Most just post a link to a Telegram group and vanish.

I'm not saying it's real but I'm not saying it's fake either... maybe it's a metaphor? Like, SheepDex is the quiet ghost in the machine of capitalism, the silence between the noise of DeFi hype... you feel me? 🌫️

If you're dumb enough to deposit into this you deserve to lose everything. No audit? No team? No volume? You're not a trader you're a donation machine. And don't come crying when your ETH evaporates into thin air like their liquidity pool.

I know it sounds crazy but I'm kinda rooting for this 🤞 maybe it's just super quiet and building in stealth? Like how Bitcoin started? I'd love to see someone actually use it and report back. Maybe it's the next big thing nobody's talking about yet 😎

I get why people are skeptical. But let’s not forget-every big project started with nothing. Maybe SheepDex is just shy. Or maybe they’re waiting for the right moment. I’d rather wait and see than throw stones at something that might still grow.

You're all missing the point. This isn't about volume or audits or GitHub stars. It's about philosophy. SheepDex represents the purest form of decentralization: a system that doesn't need validation from CoinMarketCap, doesn't need to prove itself to the herd, doesn't need to chase hype. It exists because it can. Not because it has to. The real scam is the entire crypto ecosystem that demands metrics and social proof to believe in anything. SheepDex is the anti-DeFi. And you're all too busy checking spreadsheets to see the beauty in that.

I tried to find SheepDex on my phone and the site said 'under maintenance' for 3 days straight. Then I checked again and it was gone. No 404. No redirect. Just nothing. Like it never existed. That's creepier than any scam

If you're not losing money on this you're not trying hard enough

PLEASE DON'T USE THIS. I've seen too many people lose everything because they thought 'it looks legit' 😭 Just stick with Uniswap or PancakeSwap. They're boring but they work. Your wallet will thank you. 💸❤️

i mean... if you can find the site and connect your wallet... maybe? but like... why? even if it worked, who's gonna trade on a platform with no one else there? it's like opening a diner in the middle of the desert and hoping someone gets lost and gets hungry. 🤷♂️

wait so if no one's trading on it... how do they make money? like... who's paying the gas fees? is it just the dev's own wallet? this feels like a solana memecoin pre-launch that got abandoned

It’s fascinating how we assign meaning to silence. Is SheepDex a ghost because it’s empty? Or is it a ghost because we’ve been conditioned to believe that if something isn’t loud, it doesn’t exist? Maybe the real question isn’t whether it’s real-but whether we still know how to recognize authenticity without metrics.

I checked their domain registration. Registered 3 weeks ago. Expire date in 1 year. No WHOIS privacy. Owner email is a throwaway Gmail. Server is hosted on a cheap VPS in Germany. No blockchain activity. Zero on-chain transactions. This isn't even a half-baked project. It's a placeholder for a placeholder.

I get the skepticism. But I’ve seen projects go from zero to hero. Maybe SheepDex is just building in the shadows. If you’re not willing to take a small risk on something that could be revolutionary, you’ll never find the next Uniswap. I’m not saying trust it-but don’t dismiss it just because it’s quiet.

LMAO this is the kind of thing that gets people killed in crypto. No audits no team no volume no nothing. If you're not on a real chain with real data you're not trading you're playing pretend. And if you're still reading this you're probably about to send your ETH to a black hole. Good luck

The most terrifying thing about SheepDex isn’t that it might be fake. It’s that it might be real-and no one cares enough to make it matter. In a world where every token needs a TikTok dance and a celebrity endorsement, maybe the only honest project is the one that doesn’t scream for attention. Or maybe... it’s just dead. And we’re all too busy shouting to hear the silence.