Poloniex Savings Calculator

How Poloniex Savings Works

Poloniex offers a savings program where you can earn interest on BTC, ETH, and USDT. Rates vary based on market conditions, but they've reached up to 8-10% APY on stablecoins in the past. Your funds are locked for 7-30 days depending on the coin.

Your earnings will appear here

Important: Poloniex requires a 7-30 day lock-up period for savings. Interest rates vary based on market conditions and coin type. This calculator uses 8% APY as a default rate for illustration purposes.

Poloniex isn't what it used to be - and that changes everything

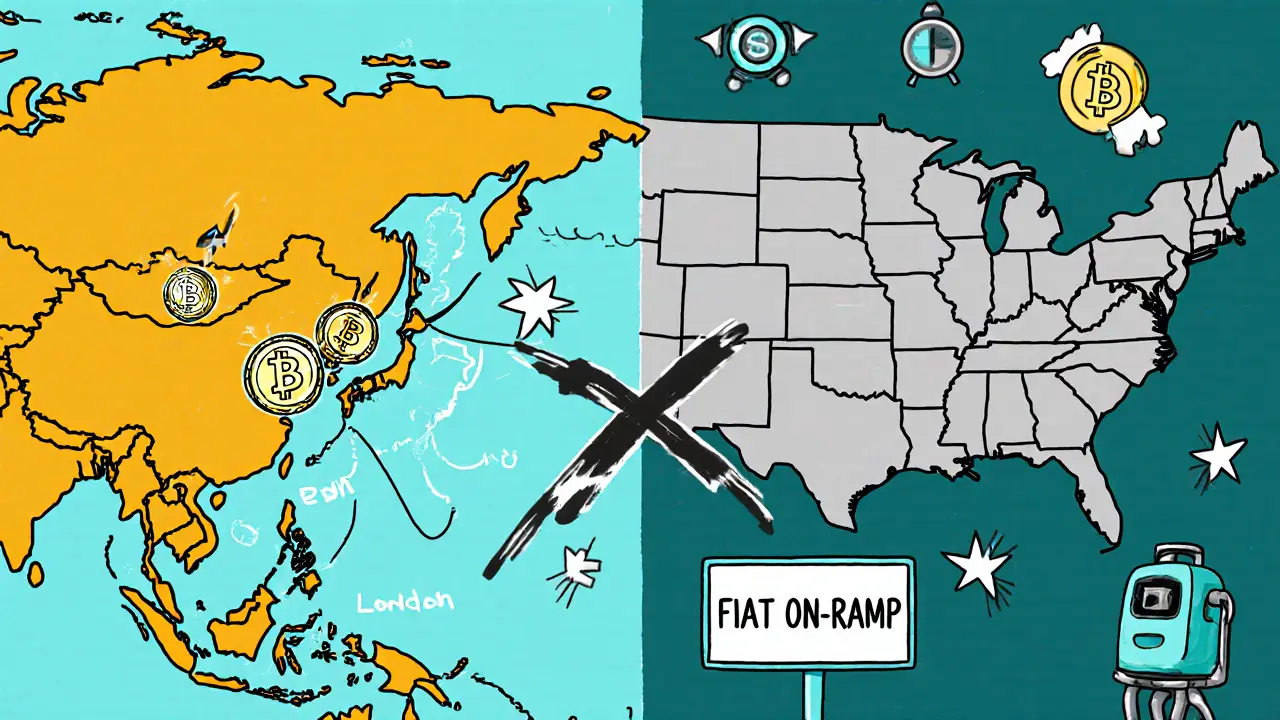

If you're looking for a crypto exchange to trade Bitcoin, Ethereum, or altcoins, you might have heard of Poloniex. It was once one of the biggest names in the space, especially back in 2017 when Bitcoin hit $20,000. But today, things are very different. Poloniex shut down its operations for U.S. users in October 2023. If you live in the United States, you can no longer sign up, deposit, or trade on the platform. Even if you had an account before, you had to move your funds out by the deadline. This isn’t a minor update - it’s a full exit from one of the world’s largest crypto markets.

What Poloniex still offers (if you’re outside the U.S.)

For users outside the U.S., Poloniex still runs. It supports around 100+ cryptocurrencies, including major ones like BTC, ETH, XRP, and LTC. It doesn’t offer direct bank deposits or fiat on-ramps. That means you can’t buy crypto with USD, EUR, or NZD directly on Poloniex. You need to buy crypto elsewhere - say, on Coinbase or Kraken - and then transfer it over. This adds a step for beginners, but it’s not unusual for institutional-focused platforms.

What Poloniex does well is crypto-to-crypto trading. It has deep liquidity on major pairs like BTC/ETH and ETH/USDT. The platform’s API is built for high-frequency trading. It has low latency and high rate limits, which is why hedge funds and algorithmic traders still use it. If you’re running bots or making dozens of trades a minute, Poloniex’s infrastructure can handle it better than many newer exchanges.

Security: Trusted, but with scars

Poloniex has a reputation for being one of the more secure exchanges - and for good reason. All withdrawals and API access require two-factor authentication (2FA). It doesn’t allow withdrawals without SMS or Google Authenticator verification. One verified G2 user called it “one of the safest and most reliable crypto exchanges founded in the USA.”

But here’s the catch: Poloniex has had security breaches in the past. In 2014, shortly after launch, it lost over 12% of its Bitcoin holdings in a hack. That’s a long time ago, and the platform has since hardened its systems. Still, that history lingers in reviews. Users who’ve been around since 2015 remember it. Newer traders don’t. So if security is your top priority, you’ll want to weigh that past against current practices.

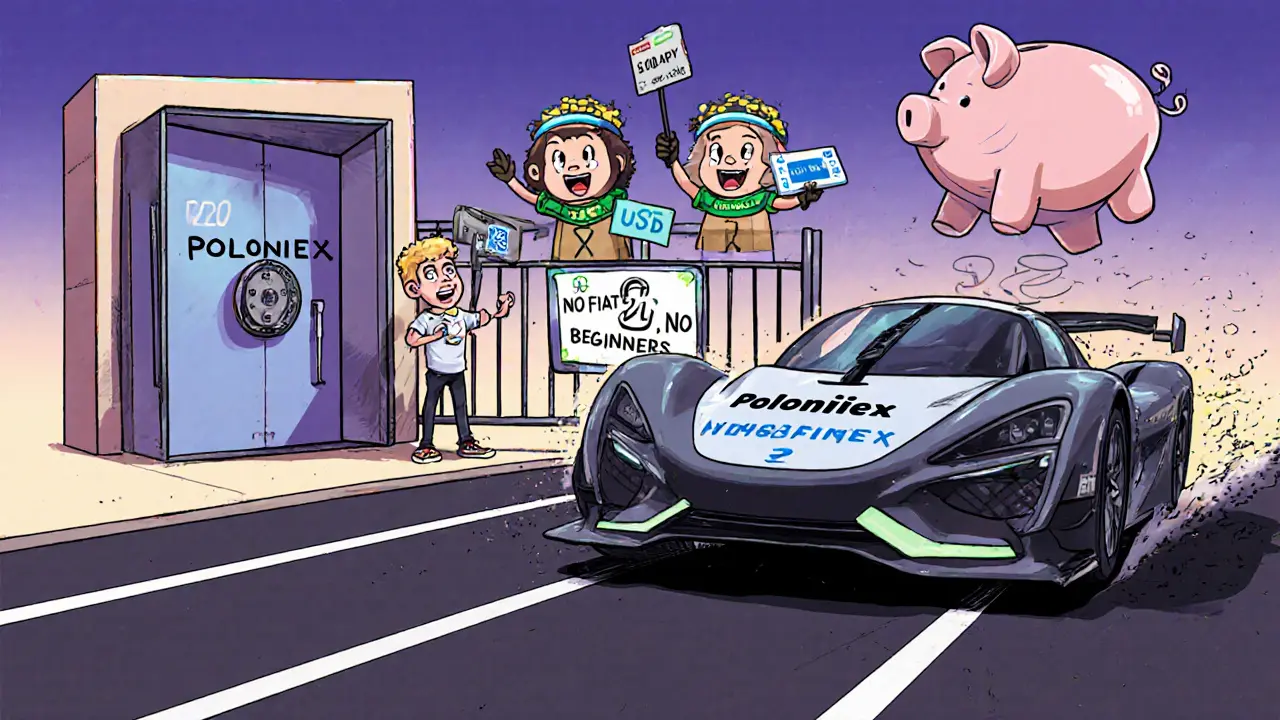

The big downside: No fiat, no U.S. users, and limited coins

Poloniex’s biggest limitations aren’t technical - they’re strategic. First, no fiat. That’s a dealbreaker for most retail traders. If you don’t already own crypto, you can’t start here. You need to buy it on another exchange, then send it over. That’s two sets of fees, two sets of wallet addresses, and two chances to make a mistake.

Second, the coin selection is narrow. While exchanges like Binance or Crypto.com list over 250 coins, Poloniex sticks to about 100. That’s not because it’s outdated - it’s by design. The team says they focus on quality over quantity. They avoid low-liquidity, speculative tokens that often turn out to be scams. One trader on G2 said: “I actually like that they don’t list every new meme coin. It keeps me from getting scammed.”

But that same trader also admitted: “I wish they added more DeFi tokens and newer projects.” If you’re into niche DeFi coins, NFT-related tokens, or Layer 2 solutions like Arbitrum or Polygon, Poloniex might feel too conservative.

Passive earnings? Yes - but only if you’re patient

One feature Poloniex still offers that many exchanges don’t is a savings program. You can lock up your BTC, ETH, or USDT and earn interest. Rates vary by coin and market conditions, but they’ve been as high as 8-10% APY on stablecoins in the past. That’s competitive with what you’d get on Celsius or BlockFi - before those platforms collapsed.

The catch? You can’t withdraw instantly. Most savings options require a 7-30 day lock-up. If you need access to your funds quickly, this isn’t for you. But if you’re holding long-term and want to earn yield without trading, it’s a solid option.

Customer support: A weak spot

Don’t expect fast replies. Multiple reviews on G2 and Cryptoninjas.net mention poor customer support. Emails often go unanswered for days. Live chat is either offline or automated. If you run into a problem - say, a delayed deposit or a failed withdrawal - you’re on your own for a while. This isn’t a dealbreaker if you’re an experienced trader who knows how to handle transfers and security. But if you’re new to crypto and need help, Poloniex will frustrate you.

Who is Poloniex really for?

Poloniex isn’t for everyone. It’s not for beginners. It’s not for U.S. residents. It’s not for people who want to buy crypto with their credit card.

It is for:

- Non-U.S. traders who already own crypto and want deep liquidity on major pairs

- Institutional users running automated trading bots

- Long-term holders who want to earn passive interest without active trading

- Traders who value security over flashy features

If you fit that profile, Poloniex still works. But if you’re looking for a simple, all-in-one exchange to buy, trade, and sell crypto with fiat - keep looking.

What happened to Poloniex? Why did it leave the U.S.?

Poloniex didn’t just decide to quit the U.S. market because it wanted to. Regulatory pressure forced its hand. The SEC has been cracking down on exchanges that don’t comply with U.S. securities laws. Many platforms - including Binance and Coinbase - spent millions to get licensed. Poloniex chose a different path: exit cleanly.

That decision saved them legal costs, but it also cut off 40% of their potential user base overnight. The move signals that Poloniex is no longer trying to be a global retail giant. It’s narrowing its focus to professional, international traders who don’t need fiat support.

Alternatives if you’re outside the U.S.

If you’re outside the U.S. and want more coins or fiat options, consider:

- Binance - More coins, fiat on-ramps, lower fees, but stricter KYC

- Kraken - Strong security, good support, supports USD/EUR, but slower UI

- Bybit - Great for derivatives, high liquidity, no U.S. users, easy API

Poloniex still holds its own in API performance and institutional trust. But if you want simplicity, more coins, or fiat access, you’ll find better options.

Final verdict: Still relevant? Only for a niche

Poloniex isn’t dead. But it’s no longer a mainstream choice. It’s a specialized tool - like a high-end racing car. It’s fast, reliable, and built for experts. But if you’re not already on the track, you’ll struggle to get in.

For non-U.S. traders with crypto already in hand, who care about security and API performance - Poloniex still delivers. For everyone else? There are better, simpler, and more accessible exchanges today.

And if you’re in the U.S.? It’s too late. Move your assets. Find another platform. Poloniex won’t be coming back.

Is Poloniex still operational?

Yes, Poloniex is still operational - but only for users outside the United States. As of October 15, 2023, the exchange shut down all services for U.S. residents. If you’re in the U.S., you can no longer access your account or make trades. International users can still log in, trade crypto-to-crypto, and use the savings feature.

Can I deposit USD or EUR on Poloniex?

No, Poloniex does not support fiat deposits. You cannot deposit U.S. dollars, euros, or any other government-backed currency. You must first buy cryptocurrency on another exchange - like Coinbase, Kraken, or Binance - and then transfer it to your Poloniex wallet. This adds complexity, especially for beginners.

How many cryptocurrencies does Poloniex support?

Poloniex supports around 100+ cryptocurrencies, including Bitcoin, Ethereum, Cardano, Solana, and major stablecoins. This is fewer than competitors like Binance or Crypto.com, which offer over 250. Poloniex intentionally limits its listings to avoid low-quality or scam tokens, focusing on established projects with strong liquidity.

Is Poloniex safe to use?

Poloniex has strong security features, including mandatory 2FA for withdrawals and API access. Many professional traders consider it reliable. However, it has a history of security breaches - most notably in 2014, when it lost over $12 million in Bitcoin. Since then, it has improved its systems significantly. Still, if you’re storing large amounts long-term, consider moving funds to a hardware wallet.

Does Poloniex offer interest on crypto holdings?

Yes, Poloniex offers a savings program where you can earn interest on BTC, ETH, USDT, and other supported coins. Rates vary, but they’ve reached up to 10% APY on stablecoins in the past. However, your funds are locked for 7 to 30 days, depending on the coin. You can’t withdraw instantly, so this is best for long-term holders, not active traders.

Why did Poloniex shut down U.S. operations?

Poloniex exited the U.S. market in October 2023 due to increasing regulatory pressure from the SEC. Unlike exchanges that spent millions to comply with U.S. laws (like Coinbase), Poloniex chose to shut down its U.S. services entirely. This allowed them to avoid legal costs and fines, but it also removed access for millions of potential users. The move reflects a broader trend of crypto platforms retreating from strict regulatory environments.

Is Poloniex good for beginners?

No, Poloniex is not ideal for beginners. It lacks fiat on-ramps, has a complex interface designed for traders, and offers poor customer support. If you’re new to crypto and want to buy Bitcoin with a credit card or bank transfer, use Coinbase, Kraken, or Binance instead. Poloniex is built for experienced users who already own crypto and need fast, secure trading with institutional-grade APIs.

What are the best alternatives to Poloniex?

If you’re outside the U.S. and want more coins or fiat access, try Binance (best overall), Kraken (best for security and support), or Bybit (best for derivatives). If you’re in the U.S., Coinbase and Kraken are your best options for compliance and ease of use. Poloniex’s strengths - API performance and security - are matched by these platforms, with better user experience and broader features.

Poloniex was never for me anyway. I needed to buy crypto with my debit card and they made it too hard. I switched to Kraken and never looked back. Simple as that.

The notion that regulatory compliance is a sign of weakness is a fallacy born of ignorance. The state does not exist to serve your speculative whims. The withdrawal of Poloniex from the U.S. market is not a defeat but a refinement of purpose. To demand fiat access is to demand the dissolution of boundaries between capital and control. The platform remains a temple for those who understand that crypto is not a casino but a protocol.

U.S. users got shafted because Poloniex didn't want to pay the mafia tax. The SEC is just another cartel. If you're smart you move your assets offshore and keep trading. Why play by their rules when you don't have to?

I've used Poloniex for years and never had an issue. The interface is clunky but the API is rock solid. If you're trading bots or doing serious volume, this is still one of the best. The lack of fiat is annoying but it forces you to think like a real trader not a retail shopper. Also the 2FA is non-negotiable and that's a good thing.

They left the U.S. because the government forced them to. But did you know the SEC has been secretly working with Binance? The real reason Poloniex shut down is they found out the U.S. government was planting backdoors in all major exchanges. They didn't want their code compromised. That's why they vanished. You think it's about regulation? No. It's about surveillance.

While Poloniex may no longer serve U.S. residents, its legacy as a pioneer in institutional-grade crypto infrastructure remains intact. The platform's commitment to security protocols, particularly its mandatory two-factor authentication and withdrawal verification processes, established a benchmark that many newer exchanges still struggle to match. The absence of fiat on-ramps is not a flaw but a deliberate architectural choice to minimize regulatory entanglement and preserve operational integrity. For those who prioritize stability over convenience, Poloniex remains a paragon of disciplined design.

I started with Poloniex back in 2016 and it was the only place I could trade altcoins without paying insane fees. Even after they left the U.S., I still use it for my offshore holdings. The savings program gave me 9% on USDT last year. Not bad for just holding. Just make sure you use a strong 2FA and don't leave big balances there long-term.

They left the U.S. because they were caught laundering money for shadow governments. The 2014 hack? That was a cover. The real breach was when they handed over user data to the CIA. You think they'd let a U.S. exchange stay open without backdoors? Please. They pulled out because they knew they were about to be exposed. Check the blockchain - the Bitcoin they lost in 2014 was never touched. It was moved to a wallet controlled by a shell company in the Caymans.

Honestly I miss Poloniex. I used to run my arbitrage bots on it and the latency was insane. Like 12ms on BTC/ETH. Now I'm on Bybit and it's fine but not the same. The savings program was the real gem though. I made more from interest than trading last year. Just gotta lock it up for a month and forget about it. No drama, no stress.

I moved to Nigeria last year and Poloniex was my first exchange there. No KYC, no hassle, just trade. I love that they don't list every scam coin. I lost money on one once on Binance and never again. Poloniex keeps it clean. The support is slow but if you know what you're doing you don't need help. Just send your coins and go.

The API performance on Poloniex was unparalleled. I used to run 1500 trades per minute on it. The order book depth on ETH/BTC was liquid enough to move $20m without slippage. Other exchanges pretend they can do that but they can't. The fiat gap? Irrelevant. If you're trading at that level you already have crypto. And the 2FA? Mandatory. No exceptions. That's why I trusted them even after 2014.

I understand why people are upset about the U.S. exit, but let's not forget what Poloniex actually did right. They didn't chase trends. They didn't list every meme coin that popped up. They focused on security and liquidity. That's rare. For those of us who lost money on shady platforms, this was a breath of fresh air. It's not perfect but it was honest.

Oh wow look at this. Poloniex is still "relevant" for "experts". Meanwhile real traders are on Binance or OKX with 500 coins, 0.01% fees, and live chat. Poloniex is like using a rotary phone in 2024. The only people still using it are the ones who don't know any better. And the savings program? That's just a Ponzi waiting to happen. Remember Celsius?

I tried poloniex once and my deposit took 3 days. I think they lost it. Then I emailed support and got a auto reply that said "check our faq". I gave up. Now I use kraken and its way better. Just saying.

If you have crypto and need fast trades, Poloniex still works. No fluff. No ads. Just trading. The savings program is great if you're patient. And yeah, support is slow but you don't need it if you know what you're doing.

I used to trade on poloniex back in the day. The interface was a mess but the trades went through. I miss the old days. Now everything's got a mobile app and a discord server. Poloniex was real. No gimmicks.

Poloniex represents a fading era of crypto - one where technical excellence and operational discipline were valued over marketing campaigns and influencer partnerships. While its user interface may appear archaic to the modern retail trader, its infrastructure remains among the most resilient in the industry. The absence of fiat on-ramps is not a deficiency but a philosophical stance: that crypto trading should remain an intentional, self-directed activity. For those who align with this ethos, Poloniex endures as a quiet monument to the original spirit of decentralization.

Poloniex’s decision to exit the U.S. market was a principled one. Many exchanges compromised their security and autonomy to comply with regulatory demands. Poloniex chose integrity over expansion. Their savings program, though illiquid, is one of the few remaining mechanisms that allows users to earn yield without exposing themselves to the counterparty risk of centralized lending platforms. For non-U.S. traders who prioritize long-term asset preservation over instant gratification, Poloniex remains a trustworthy steward.

Poloniex didn't leave the U.S. because of the SEC. They left because they got bought out by a shadowy Chinese firm and the U.S. users were too much of a liability. The 2014 hack? That was a distraction. The real story is they sold your data to a private intelligence agency. You think your trading history is private? It's not. They're all connected. Just wait - the next crypto crash will be triggered by a leak from Poloniex's old servers.