Venezuelan Currency Comparison Tool

Compare the Petro's claimed value with real-world cryptocurrencies Venezuelans actually use. See why Petro failed while Bitcoin and USDT became essential for daily transactions.

Venezuelan Currency Comparison

| Petro | Bitcoin | USDT | |

|---|---|---|---|

| Trust & Verification | |||

| International Acceptance | |||

| Daily Transaction Use | |||

| Liquidity | |||

| Sanctions Impact | High | Low | Low |

Petro Value Calculation

Why Venezuelans Don't Use Petro

- Real-world value No market value

- Exchange accessibility No major exchanges

- Trust No verification of reserves

- Daily use Bitcoin and USDT widely used

The Petro was never meant to be a free-market cryptocurrency. It was designed as a tool for survival - a digital lifeline for a government under siege. When Venezuela’s economy collapsed under hyperinflation, foreign debt, and U.S. sanctions, President Nicolás Maduro turned to blockchain not to empower citizens, but to bypass the world’s financial system. Launched in February 2018, the Petro was sold as a digital asset backed by the country’s oil, gold, and diamond reserves. But seven years later, its reality is far from the promise.

How the Petro Was Supposed to Work

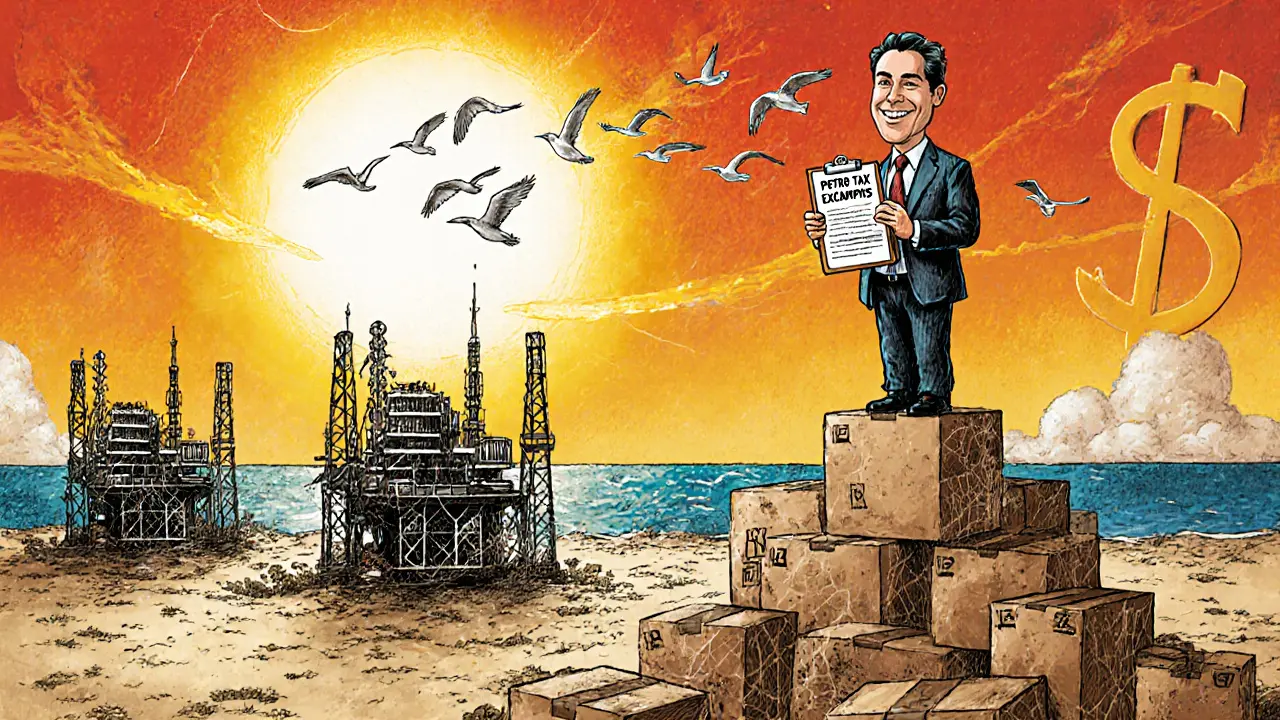

The Petro was announced in December 2017 through Presidential Decree 3196. The government claimed each token was tied to the value of one barrel of Venezuelan crude oil - roughly $60 at the time. The plan? Issue 100 million Petros, raising over $6 billion to fund the state and stabilize the collapsing bolívar. Unlike Bitcoin or Ethereum, the Petro wasn’t built on a public, permissionless blockchain. Instead, it ran on a federated system controlled entirely by the Venezuelan government. That meant only state-approved nodes could validate transactions. No decentralization. No open mining. No user sovereignty. To enforce its use, the government created the Superintendence of Crypto Assets and Related Activities (SUPCACVEN) in April 2018. This agency became the gatekeeper - managing token issuance, tracking miners, and collecting fees. It also set up four "Petro Zones" - Margarita Island, Los Roques, Paraguaná Peninsula, and the border area near Colombia - where businesses could accept Petros and benefit from tax breaks on mining equipment. Import duties on servers, GPUs, and air conditioning were waived for two years. The goal was to turn these zones into crypto hubs, attracting miners and foreign investors.Why the Petro Failed to Gain Trust

Even before it launched, experts doubted the Petro’s legitimacy. A leaked document from Venezuela’s crypto advisory group, VIBE, revealed the government planned to sell $2.3 billion worth of Petros in private deals at discounts of up to 60%. That’s not a sign of confidence - it’s a sign of desperation. If the Petro was worth $60 per token, why offer it at $24? The answer: no one believed the backing. Oil reserves were in decline. Gold reserves were unverified. The bolívar had lost over 99% of its value since 2013. The opposition-controlled National Assembly declared the Petro illegal in March 2018, calling it an illegal debt issuance. The U.S. government didn’t wait for legal debates - it acted. In March 2018, the Treasury Department banned U.S. citizens and companies from dealing in Petros. By 2019, sanctions under Executive Order 13857 expanded to include all Venezuelan cryptocurrency activity. Congressional bills like S.37 sought to make these restrictions permanent. The message was clear: the Petro was a sanctions evasion tool, not a currency.Forced Adoption, Not Real Usage

By January 2020, the government made Petro payments mandatory for government services - passports, driver’s licenses, even airplane fuel. But forcing people to use something doesn’t make it useful. Venezuelan citizens didn’t flock to the Petro. Instead, they turned to Bitcoin and USDT (Tether), stablecoins pegged to the U.S. dollar. Why? Because those currencies traded openly on exchanges. Their value was transparent. Their supply wasn’t controlled by a regime under international sanctions. In Caracas, you won’t find a café accepting Petros. In Maracaibo, no vendor lists Petro prices. Even in the so-called Petro Zones, reports of actual usage are scarce. The tax incentives for mining equipment may have brought in some hardware, but there’s little evidence of meaningful mining activity. The government claims millions of Petros are in circulation. Independent analysts say most are stuck in state wallets, unused.

The Legal and Technical Paradox

The Petro exists in a legal gray zone. The government says it’s legal. The National Assembly says it’s not. International banks refuse to touch it. Major exchanges like Binance and Coinbase don’t list it. No reputable wallet supports it. The federated blockchain - meant to give the state control - also made it useless for anyone who values decentralization. Cryptocurrency enthusiasts avoid it because it contradicts everything blockchain was built for: openness, censorship resistance, and trustlessness. Even the technical structure is questionable. The Petro’s blockchain isn’t public. There’s no transparent ledger you can verify. No block explorers. No node count. No developer activity. Unlike Ethereum or Bitcoin, where you can see every transaction in real time, the Petro’s blockchain is a black box. That’s not innovation - it’s obscurity.What Happens to the Petro Now?

As of October 2025, the Petro remains a state-controlled instrument with no real market value. It’s not traded. It’s not used. It’s not trusted. The four Petro Zones still exist on paper, with tax exemptions still listed in official decrees - but no one’s building mining farms there. The Treasury of Cryptoassets, created to manage the Petro, is just another bureaucratic layer in a government that’s run out of options. Venezuela’s economy hasn’t recovered. Inflation is still above 200% annually. The bolívar is still worthless for most purchases. And the U.S. sanctions? Still in full force. The Petro was never going to fix that. It was always a political statement dressed in blockchain code.

What Venezuelans Use Instead

If you ask a Venezuelan how they pay for groceries, send money to family abroad, or save their earnings, they won’t mention the Petro. They’ll say Bitcoin. Or USDT. Or even PayPal, if they can get access. These tools work because they’re global, liquid, and independent of state control. The Petro doesn’t offer that. It offers bureaucracy, risk, and uncertainty. Some businesses in Venezuela have started accepting crypto payments - but only because they can convert Bitcoin to dollars via peer-to-peer platforms like Paxful or LocalBitcoins. The Petro doesn’t have that liquidity. You can’t trade it for anything real outside Venezuela. And even inside, no one wants it.The Bigger Picture

The Petro isn’t just a failed cryptocurrency. It’s a warning. It shows what happens when governments try to co-opt decentralized technology for centralized control. Blockchain isn’t magic money. It doesn’t fix broken institutions. It doesn’t replace sound economic policy. And it certainly doesn’t make sanctions disappear. Countries like El Salvador tried Bitcoin as legal tender - and struggled. But at least they didn’t claim it was backed by oil. They didn’t lock it behind a government firewall. They didn’t force citizens to use it. The Petro did all three. And that’s why it’s dead in the water.What’s Next for Venezuela’s Crypto Experiment?

Without lifting sanctions, without restoring trust in institutions, and without letting the market decide, the Petro will stay a footnote in crypto history. It might survive as a symbolic tool - used in state propaganda, mentioned in speeches, printed on official documents. But it won’t survive as money. If Venezuela ever wants to rejoin the global financial system, it won’t be through a state-controlled token. It’ll be through transparency, rule of law, and real economic reform. The Petro was never the answer. It was the symptom.Is the Petro cryptocurrency still active in Venezuela?

Yes, but only on paper. The Venezuelan government still lists the Petro as legal tender and requires it for certain government services like passports and fuel. However, there’s no evidence of widespread use. Most Venezuelans avoid it. No major exchanges list it. International banks won’t touch it. It exists as a bureaucratic relic, not a working currency.

Can you buy or trade Petro cryptocurrency outside Venezuela?

No. The Petro is not listed on any major cryptocurrency exchange like Binance, Coinbase, or Kraken. It has no public market price. Any site claiming to sell Petros is either a scam or a government-controlled portal with no real liquidity. Even if you could acquire one, you couldn’t convert it to dollars, euros, or Bitcoin through normal channels due to U.S. sanctions and lack of market infrastructure.

Why did the U.S. impose sanctions on the Petro?

The U.S. government viewed the Petro as an attempt by Venezuela to bypass financial sanctions. By creating a state-backed digital asset tied to oil reserves, Venezuela hoped to access international financing without using the U.S. dollar or SWIFT system. The Treasury Department banned all U.S. persons from transacting in Petros in March 2018, calling it a tool for evading sanctions. Congressional bills like S.37 later sought to make these restrictions permanent.

Is the Petro backed by real oil or gold reserves?

There’s no verifiable proof. The government claims each Petro is backed by one barrel of oil, plus gold and diamond reserves. But Venezuela’s oil production has dropped by over 70% since 2016. Gold reserves are unverified by international auditors. Independent analysts and leaked documents suggest the backing is largely fictional. The $6 billion valuation was never confirmed by market activity - only by government decree.

Why don’t Venezuelans use the Petro for daily transactions?

Because it’s not useful. The Petro has no open market, no exchange rate, and no way to convert it into goods or services outside government channels. Venezuelans use Bitcoin and stablecoins like USDT because they can be traded for dollars on peer-to-peer platforms. These currencies hold real value. The Petro doesn’t. Forcing people to use it doesn’t change that.

Are the Petro Zones actually functioning as crypto hubs?

There’s no credible evidence. The government created four Petro Zones with tax breaks for mining equipment, hoping to attract miners and businesses. But reports of mining activity, business adoption, or economic growth in these zones are nearly nonexistent. The zones remain largely symbolic. No independent audits, no public data, no visible infrastructure. They’re more like policy theater than real economic zones.

The Petro was never about currency it was about sovereignty in the face of imperial financial warfare

Blockchain as a weapon not a toy

The West fears decentralized alternatives because they expose the fragility of dollar hegemony

Let them call it a scam we call it resistance

They sanctioned our oil then tried to sanction our escape route

And now they pretend the Petro was illegitimate when their own policies created the crisis

The real fraud is the IMF and the Fed not a token backed by what remains of a nation's resources

So what you're saying is we should accept a dictatorship's fake crypto because the US is mean

That's not resistance that's delusion

The Petro is a scam wrapped in Marxist propaganda

And you're defending it like it's some kind of revolutionary act

Wake up

It's not freedom it's fraud

And it's not even good fraud

Just a paper tiger with a blockchain sticker on it

It's important to recognize that the Petro's failure isn't just about technology or sanctions

It's about trust

And trust can't be mandated

People don't use money because the government says so

They use it because it works reliably

Bitcoin and USDT succeeded because they offered stability and access to global markets

The Petro offered bureaucracy

And bureaucracy doesn't feed families

It doesn't pay for medicine

It doesn't let you send money to your sister in Miami

Real solutions emerge from freedom not force

Did you know the Petro was designed by former CIA operatives who were then hired by Maduro to create a decoy asset

That's why the blockchain is so poorly constructed

It was never meant to work

It was meant to drain Western intelligence resources and mislead sanctions enforcement

The oil backing is fake yes

But the real goal was to make the U.S. waste billions tracking phantom transactions

They fell for it

And now they're still talking about it

Which means it worked

People just want to eat and pay bills

The Petro didn't help

Bitcoin did

Simple as that

Stop overthinking it

Technology only matters if it solves real problems

The Petro solved nothing

Bitcoin solved everything

While the Petro undoubtedly failed as a functional currency it remains a historically significant case study in the intersection of political will technological aspiration and economic collapse

Its architecture reflects not merely a flawed implementation but a fundamental misunderstanding of the philosophical underpinnings of decentralized systems

One cannot co-opt decentralization and expect it to function as intended

The Petro was a top-down solution imposed upon a bottom-up technology

And the result was inevitable

It is not merely a failed experiment but a cautionary tale for any state seeking to harness blockchain for authoritarian ends

It's wild how people still argue about this

The Petro was dead on arrival

And the fact that anyone thought it could work shows how desperate things got in Venezuela

But the real win here is how Venezuelans figured out Bitcoin and USDT on their own

No government told them to do it

They just needed a way to survive

And they found it

That's the real story

Not the government's failed token

But the people's quiet revolution

the petro is like a government issued pokemon card that says 'this is worth 1000 dollars' but no one wants to trade for it

and the zones? lol imagine having a whole island with free ac and mining rigs... but no one's mining because the power grid keeps failing

also the only people using petro are the ones getting paid in it by the state

and they immediately convert it to usdt on the black market

so yeah

it's just a middleman for the real currency

which is still usd

just hidden

😂

What if the Petro was never meant to be used at all

What if it was a trap

A digital honeypot

The U.S. knew Venezuela would try to bypass sanctions

So they let them build the Petro

Then made it illegal

Now every transaction made with it is monitored

Every wallet traced

Every miner identified

The Petro didn't help Venezuela escape sanctions

It gave the U.S. a full map of every crypto user in the country

And now they know who to target next

They didn't stop the Petro

They weaponized it

Look I get why people hate the Petro

It's centralized

It's backed by nothing

It's forced

But here's the thing

People forget that the bolívar was also backed by nothing and forced too

And no one called that a crypto scam

It was just 'bad economics'

The Petro is the same thing

Just with a blockchain

So why is the blockchain the problem

Not the fact that the government is broke

And the economy is destroyed

And people have no choice

It's easier to call it a scam than to admit the system failed everyone

Not just the tech

But the whole thing

As someone who's worked with crypto in emerging markets I've seen how people adapt

The Petro was a top-down failure

But the real innovation happened in basements and cafes where Venezuelans traded Bitcoin peer to peer

They didn't need a government token

They needed a way out

And they built it themselves

That's the power of decentralized tech

Not when a state controls it

But when people use it without permission

The Petro was a monument to control

Bitcoin in Venezuela was a monument to freedom

The Petro's federated blockchain architecture is a textbook example of anti-protocol design

It violates the Nakamoto consensus principle entirely

By restricting validation to state nodes it negates the very essence of blockchain as a trustless distributed ledger

Furthermore the lack of on-chain transparency renders it functionally equivalent to a centralized database with a misleading name

One might argue that the term 'blockchain' was merely a semantic veneer applied to legitimize a sovereign debt instrument

Which raises the question: is this a crypto failure or a linguistic deception

the petro is like when your friend says he has a new app that will fix your phone but its just a screenshot of the home screen

they made it look fancy with a blockchain logo and said it was backed by oil

but no one could actually use it

and when you asked for help they said 'its legal' but no one accepts it

so you just use paypal instead

and now they still talk about it like its real

but its just a dead app with a flag on it

Why does no one ask who really owns the Petro's private keys

Who controls the nodes

Who decides when the oil reserves are 'verified'

And why are all the transactions hidden

What if the Petro was never meant for Venezuelans at all

What if it was a shell for laundering money from the military elite

And the whole 'oil backing' thing is just a story to make the world think it's real

They didn't want to bypass sanctions

They wanted to hide where the money went

Let’s be honest: the Petro is the ultimate irony of the 21st century

A technology built to dismantle power structures… used to reinforce the most oppressive one

It’s like putting a revolutionary slogan on a prison wall and calling it art

The government didn’t want decentralization

They wanted control dressed in code

And the saddest part

Is that they thought the world would be fooled

But the world saw through it

And so did the people of Venezuela

They didn’t need a government coin to survive

They just needed a way to trade

And they found it

Without permission

Without approval

Without a blockchain

Just human ingenuity

And the quiet refusal to be broken

That’s the real story

Not the Petro

But the people who refused to use it