Wrapped Token Fee & Tax Calculator

Wrap or Unwrap Calculator

Enter values to see results

Imagine owning Bitcoin but wanting to use it in Ethereum’s DeFi apps - lending, swapping, earning interest - without selling it. That’s where wrapping cryptocurrency comes in. It’s not magic. It’s not even complicated once you understand the basics. But if you don’t, you could lose money, get stuck with frozen tokens, or accidentally trigger a taxable event. This isn’t theory. People are doing this every day, and mistakes happen more often than you think.

What Wrapped Tokens Actually Are

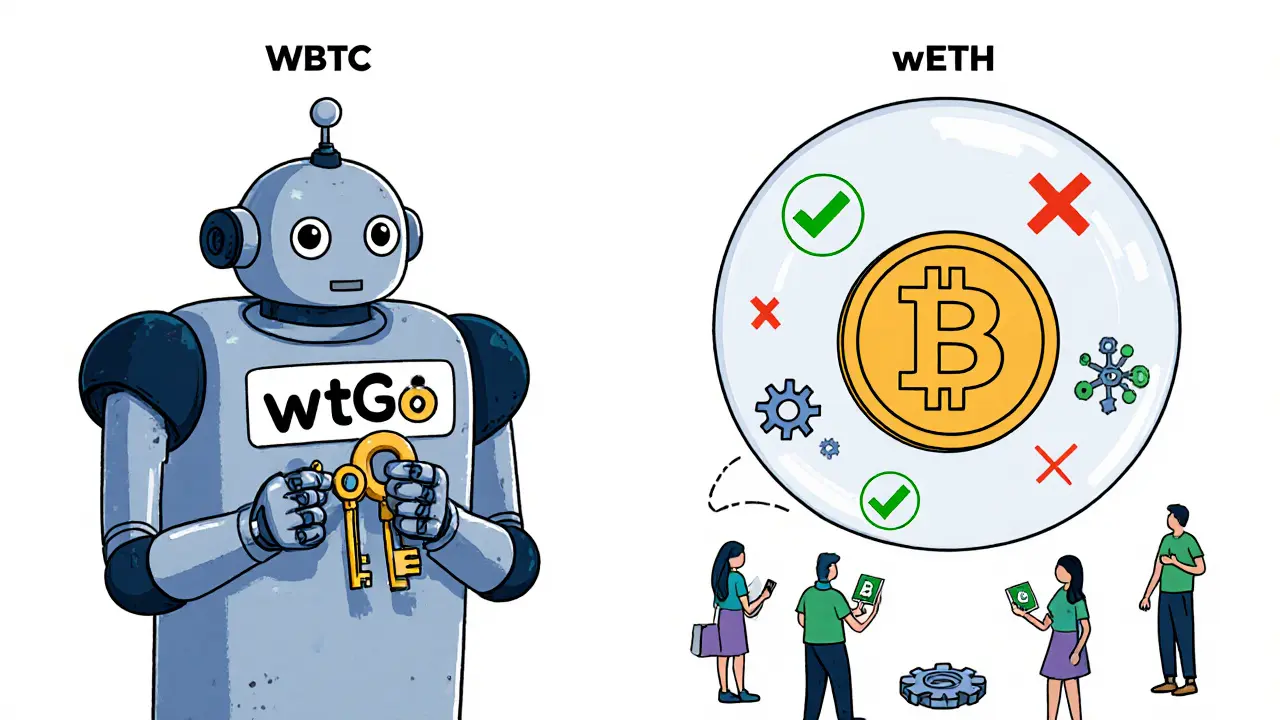

Wrapped tokens are digital copies of real crypto assets, locked in a vault and recreated on another blockchain. For example, Wrapped Bitcoin (WBTC) is Bitcoin locked on the Bitcoin network, with an equal amount of tokenized Bitcoin created on Ethereum. Every WBTC is backed 1:1 by real BTC. Same with Wrapped Ethereum (wETH) - it’s ETH wrapped into an ERC-20 token so it can be used in DeFi protocols that don’t accept native ETH.

You might wonder: Why not just use ETH directly? Because Ethereum’s smart contracts weren’t built to handle native ETH like a regular token. They need ERC-20 tokens. So wETH was created to bridge that gap. Without it, most DeFi apps wouldn’t work with ETH. That’s why over $1.7 billion in daily trades on decentralized exchanges use wETH.

WBTC is even bigger. As of Q3 2023, it locked up $5.2 billion in value - over 90% of all wrapped Bitcoin. That’s more than most altcoins. But here’s the catch: WBTC isn’t decentralized. It’s controlled by a single custodian, BitGo, and a group of 20+ approved merchants. If something goes wrong with them, your WBTC could be at risk.

The Wrapping Process: Step by Step

Wrapping crypto isn’t like sending a regular transaction. It’s a multi-step handoff between you, a merchant, and a custodian. Here’s how it actually works:

- You choose how much Bitcoin you want to wrap into WBTC and pick a merchant (like Coinbase, Kyber, or Aave).

- You send your BTC to that merchant’s wallet.

- The merchant forwards your BTC to the custodian (BitGo for WBTC).

- BitGo locks your BTC in a secure multi-sig wallet and mints an equal amount of WBTC on Ethereum.

- BitGo sends the new WBTC back to the merchant.

- The merchant sends WBTC to your Ethereum wallet.

The whole thing usually takes 15 to 30 minutes. But it’s not instant. Network congestion, custodian verification, and gas fees all add delays. On Ethereum, expect to pay $1.25 to $3.50 in gas fees per wrap. That’s not cheap - especially if you’re wrapping small amounts.

Most people use exchanges like Coinbase or MetaMask’s built-in tool to wrap. They hide the complexity. But if you’re using a smart contract directly, you need to know what you’re doing. One wrong address, and your tokens could vanish.

Unwrapping: Getting Your Original Crypto Back

Unwrapping is the reverse. You send your WBTC back to the merchant. They send it to BitGo. BitGo burns the WBTC, unlocks your original BTC, and sends it back to you. Simple in theory. Messy in practice.

Unwrapping often takes longer - 25 to 45 minutes - because custodians have extra checks. They verify the request, confirm the burn, and make sure no fraud happened. Reddit users report that 9 out of 37 unwrapping attempts took 3 to 7 days. Why? Custodian delays. Human review. Backlogs.

And here’s the scary part: if you send WBTC to a wallet that doesn’t support ERC-20 tokens - say, a Bitcoin wallet - you lose it. There’s no undo button. One user lost $12,000 this way. Recovery took 14 days and a lot of begging to BitGo’s support team.

WBTC vs. wETH vs. renBTC: Which One Should You Use?

Not all wrapped tokens are the same. Their design affects your safety, speed, and trust.

| Token | Type | Custody Model | Market Share (WBTC Equivalent) | Best For |

|---|---|---|---|---|

| WBTC | ERC-20 | Centralized (BitGo) | 92.7% | High liquidity, institutional use |

| wETH | ERC-20 | Decentralized (0x Labs smart contract) | N/A (native ETH conversion) | DeFi interactions on Ethereum |

| renBTC | ERC-20 | Decentralized (Darknodes) | 4.2% | Users avoiding single custodians |

wETH is the safest in terms of decentralization. No middleman. No custodian. Just a smart contract that locks ETH and mints wETH. If the contract runs, you’re fine. WBTC is the most liquid - if you’re trading or lending in DeFi, it’s the default choice. renBTC is a good middle ground, but it’s fading fast. Only 4.2% of wrapped Bitcoin uses it now.

Don’t be fooled by “trustless” labels. Some wrapped tokens claim to be decentralized but still rely on hidden central points. Always check who controls the keys.

Security Risks You Can’t Ignore

Wrapped tokens are convenient, but they’re also a single point of failure. In July 2023, the Multichain bridge was hacked - $32 million vanished. That wasn’t WBTC or wETH, but it showed how fragile these bridges can be.

Trail of Bits audited 12 wrapped token projects. Seven had real-time reserve proofs you could verify on-chain. Five didn’t. That means 18.7% of wrapped assets had no public proof they were backed. If you’re holding WBTC, you’re trusting BitGo to hold your BTC. If BitGo gets hacked, or if they mismanage reserves, your WBTC becomes worthless.

And here’s the kicker: the SEC is watching. In September 2023, they started asking custodians if wrapped tokens count as securities. If they do, exchanges might have to shut down wrapping services overnight. That’s not speculation - it’s happening.

Tax Implications: You Owe Money

Wrapping or unwrapping isn’t just a technical move. It’s a taxable event.

The Australian Taxation Office (ATO) made this clear in June 2023: when you wrap BTC into WBTC, you’re exchanging one asset for another. If WBTC is worth $180,000 and your BTC was worth $165,000, you’ve made a $15,000 capital gain. You owe tax on it. Same if you unwrap. You’re selling WBTC to get BTC back.

This applies in most countries. The U.S. IRS treats it the same way. Many users don’t realize this until tax season. Keep records of the market value at the time of wrapping and unwrapping. Use Etherscan or CoinGecko to track prices. Don’t assume your exchange will report it for you.

How to Do It Safely

If you’re new to wrapping:

- Use trusted platforms like Coinbase, MetaMask, or Uniswap. Don’t interact with random smart contracts.

- Always check the official contract address. WBTC’s real contract is listed on wbtc.network. Fake ones look identical. 95% of scams use fake contracts.

- Wait for network congestion to drop. Gas fees spike during bull runs. Use GasNow to time your transactions.

- Test with small amounts first. Wrap 0.01 BTC, not 1 BTC.

- Keep a record of every wrap and unwrap - date, amount, value, and transaction ID.

Experienced users always check Etherscan before sending. Look for the token symbol, contract address, and total supply. If it doesn’t match the official source, don’t proceed.

The Future: Will Wrapped Tokens Last?

WBTC is already shifting. In September 2023, the WBTC DAO approved adding Fireblocks and Copper as new custodians. That’s a step toward decentralization. But it’s still centralized - just with more backup.

The Ethereum Foundation is working on a protocol upgrade that could make wETH obsolete. If ETH becomes a proper token inside smart contracts, we won’t need to wrap it anymore. That’s the endgame.

But for now? Wrapped tokens are essential. They connect Bitcoin to DeFi. They let you earn yield on assets that weren’t meant to be used that way. The total value locked in wrapped tokens hit $14.3 billion in Q3 2023. That’s not going away overnight.

Some experts say wrapped tokens are a temporary bridge. Others say they’ll stay because they’re simple, liquid, and trusted. The truth? They’re here to stay - but the ones with the least centralization will survive longest.

What Happens If the Custodian Fails?

Imagine BitGo goes offline. Or gets hacked. Or refuses to release BTC. What happens to your WBTC?

Nothing - until you try to unwrap. Then you’re stuck. There’s no automatic recovery. No blockchain rollback. You’re dependent on a company’s cooperation.

That’s why Gauntlet Network calls WBTC a “single point of failure” that could trigger $5 billion in DeFi liquidations if it fails. That’s not fearmongering. It’s math. WBTC is used in Aave, Compound, Curve - all major DeFi protocols. If WBTC drops in value or becomes unusable, those protocols crash.

That’s why institutions like BlackRock are using WBTC - they can handle the risk. Retail users? They should tread carefully. Use it for yield. Don’t use it as your main store of value.

Is wrapping cryptocurrency the same as exchanging it?

Yes, legally and technically, wrapping is an exchange. You’re trading one asset (like BTC) for another (WBTC). That triggers a capital gains tax event in most countries. Even if the value hasn’t changed, you still need to report it as a disposal and acquisition.

Can I unwrap WBTC anytime I want?

Technically yes, but practically, no. While the smart contract allows it, the custodian (BitGo) must manually verify and approve each unwrapping request. Delays of 1-7 days are common. You can’t force it. If you need fast access to your BTC, don’t rely on WBTC.

Is wETH safer than WBTC?

Yes, in terms of decentralization. wETH uses a smart contract with no custodian - no single company controls the keys. WBTC relies entirely on BitGo. If BitGo fails, WBTC fails. wETH can’t be frozen or seized by a third party. But both are pegged 1:1, so value risk is similar.

Why do I need wETH if I already have ETH?

Ethereum’s native ETH can’t be used directly in most DeFi smart contracts. They’re built to handle ERC-20 tokens. wETH is ETH wrapped into an ERC-20 format so it can be swapped, lent, or staked in protocols like Uniswap, Aave, or Compound. Without wETH, you can’t participate in most of Ethereum’s DeFi ecosystem.

How do I verify a wrapped token contract is real?

Go to Etherscan and search for the token symbol (e.g., WBTC). Compare the contract address with the official list on wbtc.network or the platform you’re using (like Coinbase). If the address doesn’t match, it’s fake. Also check the token supply - real WBTC has a fixed, verifiable supply. Fake tokens often have random, changing amounts.

What’s the cheapest way to wrap crypto?

Use a centralized exchange like Coinbase or Kraken. They bundle the wrapping process and cover gas fees for you. If you’re using a decentralized method, wait for low congestion (usually late at night UTC) and use a gas estimator like GasNow. Avoid wrapping during bull runs - fees can spike 5x.

If you’re using wrapped tokens, treat them like a tool - not a store of value. They’re useful for DeFi, but they come with custodial risk, tax consequences, and delays. Know what you’re getting into. Check the contract. Track your taxes. Start small. And never assume it’s as safe as holding Bitcoin on your own wallet.

So let me get this straight - I lock my BTC in some corporate vault, pay $3 in gas, and get a token that’s ‘backed’ by a company that’s already been audited by exactly zero people I trust? And you call this innovation? 😴

Meanwhile, my 8-year-old niece can tell you that if you don’t control the keys, you don’t own the asset. But hey, at least WBTC looks pretty on your DeFi dashboard, right?

Honestly, I get why people are nervous about wrapped tokens - but they’re still the only way most of us can earn yield on BTC right now. I started with 0.01 WBTC just to test the waters, and now I’m earning 5% APY on it in Aave. Yeah, it’s not perfect, but it’s way better than letting my BTC sit idle.

Just don’t wrap your life savings on a Friday night during a bull run. And always double-check the contract address. I’ve seen too many people lose it to fake contracts.

Wrapped tokens are like emotional support crypto - they make your Bitcoin feel included in the Ethereum party, but deep down, it’s still just a lonely ghost in a smart contract mansion.

BitGo holds the keys, the tax man holds the receipts, and your peace of mind? Well, that’s on loan from a 20-person DAO that probably still uses Excel to track reserves.

But hey, if you’re into existential crypto anxiety with a side of 1.7B in daily volume - welcome to the club, baby. 🌌

Think about it - we’re living in a post-identity world where your digital self is now a wrapped version of your original truth. WBTC isn’t just a token - it’s a metaphor for the modern human condition: fragmented, mediated, and perpetually dependent on a third party to validate your existence.

Every time you wrap BTC, you’re not just converting assets - you’re surrendering sovereignty to a corporate altar. And yet, we do it willingly because the yield is good and the interface is smooth.

Is this progress? Or are we just building a beautiful prison with DeFi wallpaper?

The real question isn’t whether WBTC is safe - it’s whether we’ve forgotten how to be free.

And if we’re honest - we haven’t even noticed we’re already locked in.

Yesss!!! 🙌 So glad someone finally broke this down without the jargon overload!

I wrapped 0.02 BTC last week using MetaMask and it was SO easy - took like 20 mins and the gas was only $1.80 😍

Now I’m earning interest on it in Curve and honestly? It feels like magic 🪄

Just remember: always check the contract address on wbtc.network - I almost sent mine to a fake one and had a heart attack 😅

You got this, newbies! Start small, stay curious, and don’t panic when it takes 45 mins to unwrap - it’s worth it!

Wrapping cryptocurrency is a taxable event. This is not a suggestion. It is a legal fact under IRS guidelines 2023-27. Failure to report may result in penalties up to 20% of the capital gain, plus interest.

Additionally, custodial risk is non-negligible. WBTC’s centralized model violates the core tenets of decentralization, yet remains dominant due to liquidity inertia.

Recommendation: Use wETH for Ethereum-native interactions. Avoid WBTC unless institutional-grade risk tolerance is present.

Oh wow, so now we’re supposed to trust a company called BitGo with our Bitcoin because ‘it’s the most liquid’? That’s like trusting a used car salesman because his dealership has the biggest sign.

And you call this ‘progress’? We’re just moving the same old banking problems into crypto with prettier UIs.

Meanwhile, the SEC is sniffing around like a bloodhound - and you’re out here optimizing your gas fees?

Wake up. This isn’t finance. It’s a confidence trick with smart contracts.

I’ve used both WBTC and renBTC. WBTC is faster and cheaper for trading, but renBTC gives me peace of mind even if it’s slower.

I switched to renBTC after reading about the custodian risk - and honestly, the 2% lower liquidity hasn’t hurt me at all.

Just use Etherscan to verify the contract. It takes 30 seconds. Don’t skip it.

Also, gas fees are way lower after 2 AM EST. I time all my wraps then. Small habits, big savings.

Why do people still use WBTC? renBTC is decentralized, audited, and has better tokenomics. WBTC is just a centralized ponzi with a nice website.

And wETH? It’s not even wrapped - it’s just ETH with a different interface. Why are you even comparing them?

Also, tax implications are not optional. ATO and IRS treat wrapping as a disposal. You’re not ‘moving’ BTC - you’re selling it and buying WBTC.

Stop pretending this is risk-free. It’s not. Know your stuff before you touch it.

They say WBTC is backed 1:1 but how do you really know? What if BitGo is printing WBTC without holding BTC? What if the SEC already knows and just hasn’t shut it down yet?

And what if the whole thing is a pump by Wall Street to get retail to hand over their Bitcoin under the guise of ‘DeFi’?

They told us Bitcoin was untraceable then came KYC exchanges. They told us DeFi was permissionless then came wrapped tokens controlled by 20 people.

Wake up. This is the same game. They just changed the cards.

So you pay $3 to wrap your BTC into WBTC so you can earn 5% on it... and then you pay another $3 to unwrap it later?

That’s not DeFi. That’s a toll road run by a guy named BitGo.

Also, good luck explaining to the IRS why you ‘sold’ BTC to buy WBTC when you never touched your wallet.

Y’all are getting scammed and calling it innovation.

Just wrapped my first 0.05 BTC using Coinbase - took 18 mins, gas was $2.10, and I got my WBTC in my wallet with zero drama 🎉

Now I’m lending it on Aave and it’s earning me like $1.20 a day - not life-changing but hey, free money!

Don’t overthink it. Start small. Check the contract. Use trusted tools. And don’t panic if it takes a day to unwrap - it’s worth the wait.

You got this!! 💪

Man i just started learning all this and this post helped so much

i was scared to try wrapping cause i thought i’d lose my btc

but now i know to use coinbase and check the contract on wbtc.network

also i never knew wrapping was taxable 😳

thanks for the heads up

gonna try with 0.01 first and see how it goes

crypto is wild but you guys make it feel less scary

It is imperative to underscore that the custodial model of WBTC constitutes a systemic vulnerability within the decentralized finance ecosystem.

While liquidity is undeniably advantageous, the absence of true decentralization undermines the foundational ethos of blockchain technology.

One might posit that the continued reliance on centralized entities is a form of crypto-colonialism - where retail users are incentivized to surrender autonomy for convenience.

Therefore, prudent participants should prioritize protocols that employ trust-minimized architectures, such as wETH or renBTC, despite their lower liquidity profiles.

Financial innovation must not come at the expense of sovereignty.

Big respect for breaking this down so clearly - I’ve been confused about WBTC vs wETH for months.

I used to think they were the same thing, but now I get it: wETH is just ETH being nice and following the rules, WBTC is BTC pretending to be cool at the Ethereum party.

And yeah, taxes are real. I just filed last week and had to dig up 12 transaction IDs.

Start small, check the address, and don’t be afraid to ask questions. We’ve all been there.

Wow. You wrote an entire essay on how to be a crypto sheep.

‘Use Coinbase’? ‘Check wbtc.network’? Oh sweet, let me just trust the same institutions that got us into this mess.

And you call this ‘safe’? You’re not using wrapped tokens - you’re just renting your Bitcoin to a bank that uses a blockchain.

Real crypto is self-custody. Everything else is a corporate loyalty program with gas fees.

Actually, I just unwrapped my WBTC yesterday - took 3 days because BitGo was backlogged. But I got my BTC back, no issues.

And yeah, the tax stuff is real - I used Koinly to track everything and it auto-generated my IRS form.

Just don’t treat this like a game. It’s real money, real taxes, real risk.

But if you’re careful? It’s one of the best ways to make your BTC work for you.