Bitcoin Hash Rate & Profitability Calculator

How It Works

This calculator helps you understand Bitcoin mining profitability and projected hash rate growth. Enter your mining parameters and see how different scenarios could affect your operations.

Results

By April 2025, the Bitcoin network hit a milestone no one expected just five years ago: 1 Zetahash per second. That’s 1,000,000,000,000,000,000,000 calculations every second. It’s not science fiction-it’s real. And if current trends hold, we could be looking at nearly 7 ZH/s by 2030. But here’s the thing: that number doesn’t tell the whole story. What really matters is what’s driving it, who’s benefiting, and what could stop it.

Why Hash Rate Matters More Than You Think

The hash rate isn’t just a number on a chart. It’s the backbone of Bitcoin’s security. Every time a miner solves a cryptographic puzzle, they’re locking in transactions and protecting the network from attacks. The higher the hash rate, the harder-and more expensive-it is for anyone to take over the network. That’s why miners, investors, and even governments pay attention. Back in 2018, the entire Bitcoin network ran at just 14 EH/s. Today, it’s over 900 EH/s on average, with brief spikes past 1 ZH/s. That’s a 65x increase in just seven years. And it’s not slowing down. The network adjusts difficulty every 2,016 blocks-roughly every two weeks-to keep block times at 10 minutes. So if more miners join, the puzzle gets harder. If miners shut off, it gets easier. It’s self-correcting. But the trend is clear: more power, more machines, more money flowing in.What’s Driving the Growth?

Three things are pushing hash rate up: price, hardware, and energy. Bitcoin’s price is the biggest motivator. When Bitcoin hits $60K, miners rush to buy new machines. When it drops below $30K, some shut down. That’s why projections tie hash rate growth directly to price forecasts. AInvest predicts Bitcoin could hit $1.16 million by 2030. If that happens, even older ASICs like the WhatsMiner M20S-designed to be profitable at $5,000-would still make money. That keeps older machines running and new ones coming online. Hardware is getting faster and cheaper per unit of power. The latest Antminer S21 and WhatsMiner S21 Pro deliver over 200 TH/s while using less than 3,000 watts. That’s a 30% efficiency gain over just two years. Miners are upgrading faster than ever. HIVE Digital Technologies, one of the biggest operators, grew its hashrate by 267% in just ten months in 2025, hitting 22 EH/s. They’re not alone. Companies like Bitmain and Bitfury are shipping thousands of new ASICs every month. Then there’s energy. You can’t mine Bitcoin without electricity. And where you get it matters. In Kazakhstan and parts of Texas, miners pay as little as $0.045 per kWh. On the U.S. East Coast? It’s over $0.12. That’s a 170% difference. So miners are relocating. Many are moving to places with cheap, surplus power-like hydro plants in Canada or geothermal sites in Iceland. Some are even partnering with wind farms in Texas to use energy that would otherwise go to waste.The Projections: Three Scenarios for 2030

Not everyone agrees on how fast hash rate will grow. There are three main models:- Conservative (35% CAGR): 2,543 EH/s by 2030. This assumes regulatory crackdowns, energy limits, and slower hardware adoption. It’s the most cautious view.

- Base Case (45% CAGR): 4,128 EH/s. This is what most industry analysts expect. It factors in steady price growth, moderate hardware innovation, and stable regulations.

- High Growth (52.5% CAGR): 6,891 EH/s. This is GoMining’s projection, based on the explosive growth since 2018. If Bitcoin hits $1 million and ASIC efficiency keeps improving, this is possible.

The Halving Effect: What Happens in 2028?

The next Bitcoin halving is scheduled for April 2028. That’s when the block reward drops from 3.125 BTC to 1.5625 BTC per block. Historically, this causes a short-term drop in hash rate. Miners with inefficient machines can’t cover costs anymore. They turn off their rigs. The network difficulty drops to compensate. But here’s the twist: this time, it might be different. In 2020, Bitcoin was at $7,000. In 2024, it hit $70,000. The market is bigger. More institutional money is in. Miners now have access to cheaper capital and better hedging tools. So instead of a crash, we might see a shallow dip-then a faster rebound. The network has proven it can absorb shocks. After China’s 2021 mining ban, hash rate dropped 50% in months… and then doubled within a year.Who’s Winning? Who’s Getting Left Behind?

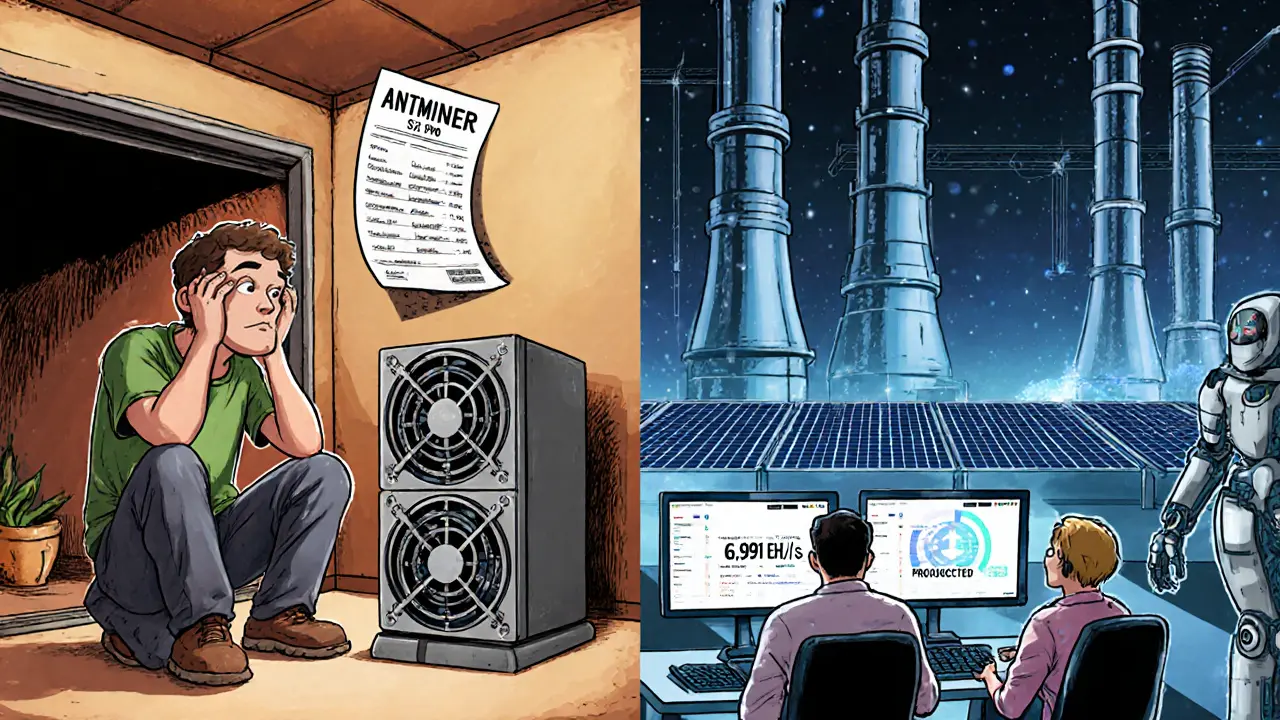

The mining industry is no longer a hobbyist scene. Over 83% of Bitcoin’s hash rate now comes from professional, industrial-scale operations. That’s up from 67% in 2020. The small miners with old rigs? They’re being squeezed out. If you’re running a single Antminer S19 in your garage with electricity at $0.15/kWh, you’re probably losing money. But if you’re a company like HIVE or Bitfury, with access to $0.04/kWh power, AI-optimized cooling, and bulk hardware deals? You’re thriving. The winners in the next five years won’t just be the ones with the most machines. They’ll be the ones with:- Access to cheap, renewable energy

- Efficient, next-gen ASICs

- Strong relationships with mining pools (F2Pool, Slush Pool, Foundry USA)

- Location in stable regulatory zones (U.S., Canada, parts of Europe)

The Big Risks Nobody Talks About

Hash rate projections look great on paper. But reality has a way of messing up models. First, regulation. The U.S. is still debating federal mining rules. The EU’s Crypto-Asset Regulation (MiCA) could force miners to prove their energy sources are truly renewable. If compliance costs jump 150%-as AInvest warns-many operations won’t survive. Second, geopolitics. Kazakhstan’s government has cracked down on mining exports. Texas has had power grid emergencies. China’s ban in 2021 showed how fast a country can shut down mining. If another major mining hub gets hit, hash rate could drop 20-30% overnight. Third, energy limits. Can the grid handle this? Some utilities in Texas and Georgia are already warning that mining could strain local infrastructure. If regulators cap mining power usage, growth could stall. And yes-quantum computing. MIT’s 2025 report says Bitcoin’s SHA-256 algorithm is safe until at least 2040. But if someone breaks it sooner? That’s a black swan event. No projection model accounts for that.What This Means for You

If you’re a miner: focus on efficiency. Upgrade to S21 Pro or equivalent. Find cheap power. Don’t chase hype. Profitability is about cost per TH, not total hash rate. If you’re an investor: look beyond Bitcoin’s price. The hash rate tells you how much confidence the network has. A rising hash rate means miners believe in Bitcoin’s future. It’s a leading indicator. If you’re just curious: understand that Bitcoin’s security isn’t based on magic. It’s based on physics, electricity, and economics. The more power it uses, the more secure it becomes. That’s why the hash rate matters.What Comes After 2030?

By 2030, Bitcoin mining might look nothing like it does today. Companies are already repurposing mining farms into AI data centers. HIVE is converting Tier-1 data centers in Sweden into high-performance computing hubs. Why? Because Bitcoin mining generates heat and power. AI training needs both. It’s a natural fit. We might see mining become part of the energy grid itself-using excess renewable power to mine Bitcoin, then selling the heat to nearby buildings. That’s not sci-fi. It’s happening now in Iceland and Canada. The future of Bitcoin’s hash rate isn’t just about more machines. It’s about smarter integration-with energy, with technology, with the real economy.What is the current Bitcoin hash rate as of 2025?

As of November 2025, Bitcoin’s 7-day average hash rate is around 929 EH/s, with the 1-day average briefly surpassing 1 ZH/s (1,000 EH/s) in April 2025. This represents over 65 times the network’s size in 2018.

What is the projected Bitcoin hash rate for 2030?

Projections vary. Conservative models estimate 2,500-3,000 EH/s. The base case is around 4,100 EH/s. The most aggressive projection-based on 52.5% annual growth since 2018-suggests nearly 6,900 EH/s by 2030. This depends heavily on Bitcoin’s price, hardware efficiency, and regulatory conditions.

How does Bitcoin’s halving affect hash rate?

After each halving, block rewards are cut in half, reducing miner revenue. This typically causes a short-term drop in hash rate as less efficient miners shut down. But historically, the network recovers within months as Bitcoin’s price rises and newer, more efficient hardware enters the market. The 2028 halving may see a smaller dip due to stronger institutional support and better financial tools.

Is Bitcoin mining becoming more sustainable?

Yes. According to the Bitcoin Mining Council’s Q3 2025 report, 56.1% of global Bitcoin mining now uses sustainable energy sources-up from 38% in 2021. Many miners are now powered by hydro, wind, geothermal, and even flared natural gas that would otherwise be wasted.

Can I still mine Bitcoin profitably in 2025?

It’s extremely difficult for individuals using old hardware or paying high electricity rates. Profitability now requires modern ASICs (like the S21 Pro), electricity under $0.05/kWh, and access to reliable mining pools. Most profitable mining is done by large-scale operators with industrial infrastructure.

What role do ASICs play in hash rate growth?

ASICs (Application-Specific Integrated Circuits) are the only hardware that can mine Bitcoin profitably today. Each new generation-like the Antminer S21 or WhatsMiner M50-delivers more hash power per watt. Their efficiency gains are the main reason hash rate keeps rising even as Bitcoin’s price fluctuates.

Hash rate isn't power. It's trust made visible.

It's wild to think that what started as a hobbyist experiment is now running on more computing power than the top 500 supercomputers combined. 🤯 We're not just mining Bitcoin-we're building a new kind of global infrastructure. And it's running on wind, water, and waste heat. Who knew crypto would become the most efficient energy arbitrage system on Earth?

Love how this post breaks it down. It’s not about how much power Bitcoin uses-it’s about how smartly it uses it. The fact that miners are turning stranded energy into security? That’s not a bug, it’s a feature. Keep going.

Let’s be real-this is just a massive electricity drain disguised as innovation. The U.S. grid can’t handle this. We’re trading our future for digital glitter. And don’t get me started on the environmental cost.

Who controls the hash rate? Who owns the ASIC factories? Who funds the mining pools? This isn't decentralization. This is corporate centralization with a blockchain label. The government knows this. They're waiting for the right moment to strike. You think you're free? You're just a node in a controlled system.

So let me get this straight-we’re celebrating a machine that uses more electricity than Norway just to prove it can’t be hacked? Brilliant. The only thing more secure than Bitcoin is my therapist’s couch.

Hash rate projections are just fantasy math. The real problem is that no one actually knows how much power is being used because miners lie about their energy sources. And you think the EU is going to let this slide? Wake up. This is a bubble with a circuit board

I appreciate how the post highlights the shift from individual miners to industrial players. It’s not just about tech-it’s about access. The same thing happened with solar panels. At first, anyone could install one. Now it’s corporations with contracts and tax incentives. Progress isn’t always fair, but it’s inevitable.

Miners are the unsung heroes of the internet. They keep the ledger alive with nothing but electricity and math. And yeah, some are big companies now. But that just means the network is stronger. More power, more security. Simple as that.

I used to think Bitcoin was just a speculative asset. Now I see it as a public utility. The hash rate is like the heartbeat of a living system. You don’t cheer for the heartbeat-you just hope it keeps going.

Everyone’s ignoring the real threat: what happens when the grid fails? Texas already had blackouts. What if the next one takes out half the hash rate? Then what? All this talk of efficiency means nothing when the lights go out. This whole thing is one storm away from chaos.

56% sustainable energy? That’s a lie. Most of it is greenwashed. They call it renewable because it’s idle wind-but they’re still burning coal in the background. Don’t believe the PR. Bitcoin mining is still a climate crime.

Interesting how you mention AI data centers repurposing mining rigs. That’s the real story here. Bitcoin mining isn’t dying-it’s evolving into something bigger. Heat + power + redundancy? That’s the future of edge computing. Maybe this was never about money. Maybe it was always about infrastructure.

Projections are meaningless without context. 7 ZH/s sounds insane until you realize it’s still less than 0.1% of global computing capacity. The real issue isn’t the hash rate-it’s the narrative. People treat this like it’s the next industrial revolution when it’s just a very expensive ledger.

Let’s not romanticize this. This isn’t innovation-it’s energy waste on a planetary scale. The fact that we’re celebrating a machine that consumes more than a small country is a moral failure. And the people who profit from it? They don’t care about security. They care about margins.

What’s being ignored is the feedback loop: higher hash rate → higher energy demand → higher electricity prices → miners relocate → regulatory backlash → market volatility. This isn’t linear growth. It’s a spiral. And the people who think it’s sustainable are either lying to themselves or selling something.

Every time someone says "Bitcoin is secure because of hash rate," I laugh. Security isn’t about numbers-it’s about trust. And trust isn’t built by electricity. It’s built by consensus. The moment governments decide to regulate the flow of power to miners, the entire narrative collapses. This isn’t a fortress. It’s a house of cards made of copper and silicon.

That’s a fair point, Finn. But here’s the twist-consensus doesn’t just come from people. It comes from cost. If it costs $10 billion to attack the network, and the reward is $2 billion? That’s not a hack. That’s a suicide mission. The hash rate isn’t just security-it’s economic deterrence. And that’s what makes it unbreakable.