Ethfinex Fee Calculator

Compare Your Trading Costs

Calculate how much you'd save by trading on Ethfinex versus industry average

Your Savings

Ethfinex: 0.10% maker / 0.20% taker • Industry Avg: 0.25% taker

Note: Wire transfers take 1-5 business days

When you're looking for a crypto exchange that doesn’t nickel-and-dime you on trades, Ethfinex used to stand out. But in 2025, is it still a smart choice? With giants like Binance and Coinbase dominating the market, smaller exchanges like Ethfinex have to earn every user - and they do it with one clear edge: low fees.

How Ethfinex Keeps Trading Costs Low

Ethfinex uses a maker-taker fee model that’s simpler than it sounds. If you place a limit order that gets filled later (a maker), you pay just 0.10%. If you immediately buy or sell at the current price (a taker), it’s 0.20%. That’s lower than the industry average of 0.25% for takers. For active traders, that difference adds up fast. A trader doing 100 trades a month with $10,000 each could save over $150 compared to exchanges charging higher taker fees.Why does this matter? Because Ethfinex wants you to add liquidity - not just take it. The lower maker fee encourages traders to place limit orders, which deepens the order book. That means tighter spreads and less slippage when you trade. It’s a system designed for people who trade regularly, not just buy and hold.

What You Can’t Do on Ethfinex

Here’s the catch: you can’t fund your account with a credit card. That’s a big deal in 2025. Most retail traders expect to deposit instantly with Visa or Mastercard. Ethfinex only supports bank wire transfers. That means waiting 1-5 business days for funds to arrive. For someone trying to jump on a price spike, that delay can cost money.There’s also no mobile app. No iOS or Android version. If you want to check your portfolio or place a trade on the go, you’re stuck using a browser. That’s outdated for a platform that claims to be user-friendly.

Security and Transparency - The Real Selling Points

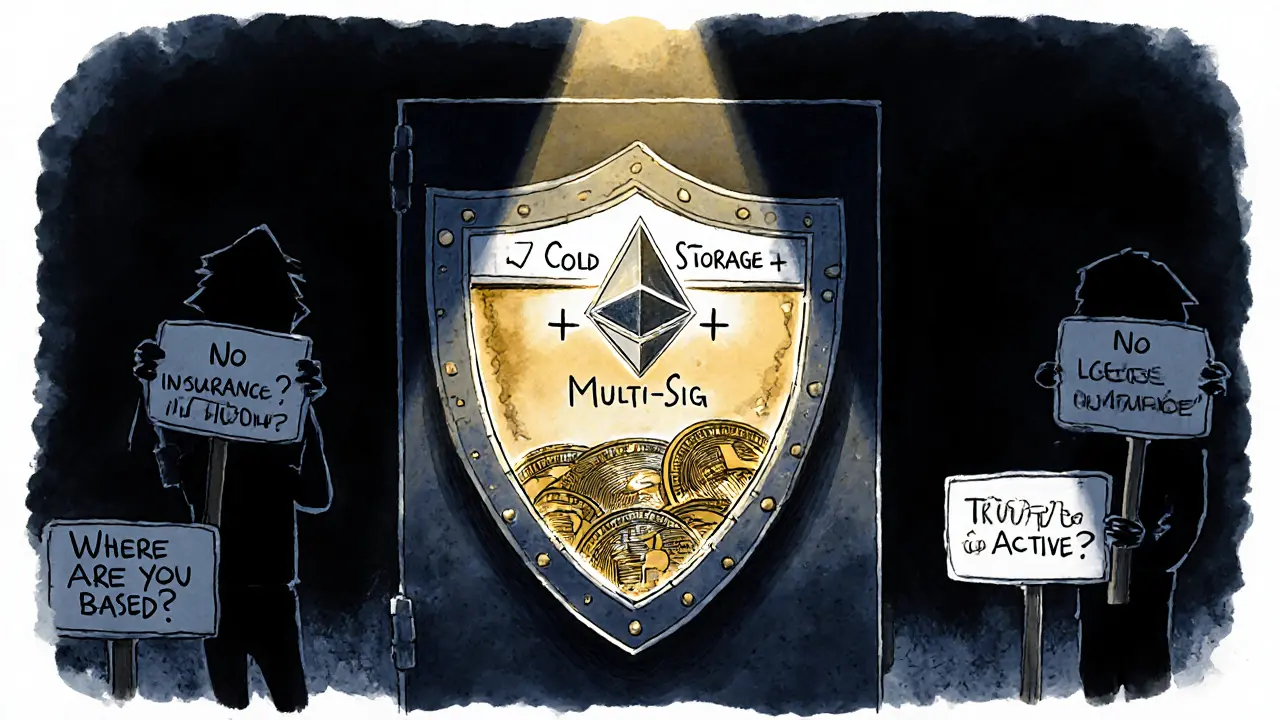

Ethfinex doesn’t shout about its security. But that’s actually a good sign. No flashy marketing. No promises of “100% insured funds.” Instead, they focus on cold storage, multi-sig wallets, and regular audits - the basics that matter. There’s no public record of any major hack or breach since the platform launched.Transparency is where Ethfinex really shines. Every trade fee is clearly listed. Withdrawal fees are published upfront. For Ethereum withdrawals, it’s 0.01 ETH. That’s higher than some exchanges - Binance charges 0.001 ETH - but it’s still reasonable if you’re moving larger amounts. The exchange doesn’t hide fees in fine print or change them without notice.

User Ratings: Real People, Real Feedback

On Trustpilot, Ethfinex has a 4.6 out of 5 based on 32 reviews as of September 2025. That’s not a huge sample, but it’s consistent. The most common praises? Fast order execution, clean interface, and responsive support. The few negative reviews mention slow deposits and lack of altcoin options.Compared to other lesser-known exchanges, Ethfinex wins. On Cryptogeek, it scores 4 out of 5 - higher than FTX US (3/5) and ionomy (3/5). Those are small sample sizes, but they point to a pattern: users who stick with Ethfinex tend to be happy.

What’s Missing? A Lot.

Here’s the truth: Ethfinex doesn’t offer much beyond spot trading. No futures. No margin. No staking. No NFT marketplace. No API for bots. No institutional trading tools. If you’re a casual trader who just wants to buy ETH or BTC, it’s fine. But if you’re looking for advanced features, you’ll need to go elsewhere.There’s also no clear info on where the company is based, who runs it, or whether it holds any licenses. That’s a red flag for some. In 2025, regulatory clarity matters. Exchanges like Coinbase are registered with U.S. regulators. Ethfinex? Silent. That doesn’t mean it’s shady - but it means you’re trusting an anonymous team with your assets.

Who Is Ethfinex Really For?

Ethfinex isn’t for everyone. It’s not for beginners who want to buy crypto with a credit card. It’s not for day traders needing leverage or futures. It’s not for people who want 500+ altcoins to choose from.It is for:

- Active traders who care about low taker and maker fees

- People who value transparency over flashy marketing

- Traders who already have bank accounts and don’t mind wire transfers

- Those who prioritize order book depth and tight spreads

If you fit that profile, Ethfinex still holds value in 2025. The fees are among the lowest in the space. The platform runs smoothly. And the few users who leave reviews say they’d stick with it.

The Bottom Line: Still a Viable Option?

Yes - but only if your needs match what Ethfinex offers. It’s not the biggest exchange. It’s not the most feature-rich. But for traders who want clean, low-cost spot trading without the noise, it’s still one of the better hidden gems.Just don’t expect miracles. No mobile app. No instant deposits. No crypto loans. No staking rewards. If those things matter to you, look at Kraken or Bitstamp. But if you’re focused on minimizing fees and trading efficiently, Ethfinex quietly does its job.

Is Ethfinex still operational in 2025?

Yes, Ethfinex is still active as of October 2025. The platform continues to process trades, deposits, and withdrawals. User reviews from September 2025 confirm ongoing service, with no signs of shutdown or major downtime.

Does Ethfinex support credit card deposits?

No, Ethfinex does not accept credit or debit card deposits. The only deposit method available is bank wire transfer. This makes it less convenient for new users who want instant funding, but it reduces fraud risk and keeps fees low.

What are Ethfinex’s trading fees?

Ethfinex charges 0.10% for maker orders (limit orders that add liquidity) and 0.20% for taker orders (market orders that remove liquidity). This is below the industry average of 0.25% for takers, making it one of the more cost-effective exchanges for active traders.

How much does it cost to withdraw Ethereum from Ethfinex?

Withdrawing Ethereum from Ethfinex costs 0.01 ETH per transaction. This is higher than some competitors like Binance (0.001 ETH), but it’s standard for exchanges that prioritize security over ultra-low withdrawal fees. For large withdrawals, the cost per ETH becomes negligible.

Does Ethfinex have a mobile app?

No, Ethfinex does not offer a mobile app for iOS or Android. All trading must be done through a web browser. This is a significant limitation for users who want to monitor markets or execute trades on the go.

Is Ethfinex safe to use?

Ethfinex has no public record of hacks or security breaches. It uses cold storage and multi-signature wallets to protect user funds. However, it doesn’t publicly disclose insurance coverage or regulatory licensing, which makes it harder to assess full security compared to regulated exchanges like Coinbase or Kraken.

What cryptocurrencies does Ethfinex support?

Ethfinex primarily supports Bitcoin (BTC), Ethereum (ETH), and a small selection of major altcoins like Litecoin (LTC), Chainlink (LINK), and Polkadot (DOT). It does not offer hundreds of tokens like Binance or KuCoin. The focus is on liquidity and stability, not volume of options.

How does Ethfinex compare to Binance or Coinbase?

Ethfinex is much smaller than Binance or Coinbase. It lacks features like staking, futures, mobile apps, and credit card deposits. But its trading fees are lower than both. If you’re a serious trader focused on spot markets and low costs, Ethfinex can be a better fit. For beginners or those wanting convenience, Binance or Coinbase are stronger choices.

Next Steps: Should You Try Ethfinex?

If you’re already holding ETH or BTC and want to trade them without paying high fees, start with a small deposit. Test the withdrawal process. See how fast your wire transfer clears. Try placing a few limit orders. See if the order book stays deep and the trades execute cleanly.If it works for you, keep using it. If you miss instant deposits or a mobile app, move on. There’s no shame in choosing an exchange that fits your style - even if it’s not the biggest one out there.

Man, I’ve been using Ethfinex for over two years now and honestly? It’s the only exchange I trust with my main portfolio. I don’t care about the mobile app or credit cards-I trade from my desktop anyway. The fee structure is clean, the order book never gets shallow, and I’ve never had a withdrawal issue. I used to hop between Binance and Kraken, but the fees ate me alive. Now I just stack ETH and trade spot here. Simple. Efficient. No drama.

They’re not just low-fee-they’re being monitored by the shadow crypto elite. You think they don’t track every trade? Every withdrawal? That 0.01 ETH fee? That’s not a cost-it’s a beacon. They’re funneling data to the Fed’s blockchain surveillance unit. No licenses? No transparency? That’s the point. They don’t want you to know they’re a front for the deep state’s crypto laundering operation.

Love this breakdown. I’m a weekend trader who just wants to buy ETH without paying 0.5% in fees every time. Ethfinex is my secret weapon. Yeah, no app? Fine. Wire transfer takes 3 days? I plan ahead. I don’t need to chase pumps-I’m in it for the long game. And the fact they don’t shove 500 garbage tokens in your face? Bless their hearts. This is what crypto was supposed to be: focused, honest, and built for traders, not hype-chasers.

Interesting analysis but you’re missing the systemic flaw. Ethfinex’s model relies on liquidity provision, which in turn depends on market participants having capital surplus. In a bear market, makers retreat. The taker fee becomes irrelevant when the order book collapses. The platform’s architecture assumes perpetual bull markets-which is a cognitive bias disguised as a business model. Also, cold storage ≠ security. It’s just storage. Without KYC/AML integration, you’re trading in a regulatory gray zone. That’s not transparency-it’s obfuscation.

Ethfinex is not for the weak minded. People want instant gratification they get nothing. The real traders they know value. Fees low order book deep no distractions. This is not a casino. This is a market. If you need app and card you belong on Robinhood not here. No drama no hype just trade. I use it since 2022 no problems no hacks no lies. The silence is strength.

Why are we even talking about this? US-based exchanges are regulated. This thing is a ghost operation. No license no HQ no accountability. If you’re putting money here you’re not a trader you’re a sucker. Binance might be sketchy but at least they have a CEO. This? Some guy in a basement with a server farm. I don’t care how low the fees are. I’m not risking my crypto on a website that doesn’t even tell you where it’s based.

Really appreciate the balanced take here. I was on the fence because of the wire transfer thing, but after reading this I decided to test it with $500. Took 2.5 days-slower than I hoped but not terrible. Placed a few limit orders, got filled exactly as expected. No slippage. The interface is clean, no pop-ups, no ads. I’m not going to be a day trader, but for what I need? This is perfect. No need to overcomplicate it.

The fee structure is statistically superior but the lack of regulatory oversight renders it functionally obsolete. In 2025, trust is not a technical feature-it is a legal construct. An exchange without a jurisdiction is a phantom. You cannot have security without accountability. The cold storage is irrelevant if the entity behind it can vanish overnight. This is not innovation-it is evasion.

Low fees + no app = perfect for me. I don’t need to check my portfolio every 5 minutes. I buy, I hold, I trade when I’m ready. Wire transfer? I plan my trades like I plan my taxes. No stress. Ethfinex doesn’t try to be everything. It does one thing well. And that’s enough.

While the operational efficiency of Ethfinex is commendable, one must consider the broader implications of engaging with unregulated financial infrastructure. The absence of formal licensing introduces systemic counterparty risk, even if no breaches have occurred historically. Moreover, the lack of mobile accessibility may reflect a deliberate design choice to exclude retail speculative behavior, thereby attracting a more disciplined user base. However, this exclusivity also limits scalability and mainstream adoption. A nuanced evaluation must weigh operational excellence against regulatory compliance as a non-negotiable pillar of financial trust.

Just wanted to say I started using Ethfinex last month after reading this. I was skeptical but wow-it’s so refreshing not being bombarded with ads and ‘buy now’ popups. I did a $2k wire, took 3 days, no issues. Placed a limit order for ETH and it filled perfectly. No drama. No confusion. I’m sold. If you’re tired of exchanges acting like casinos, give this a shot. It’s like finding a quiet coffee shop in a world of loud clubs.

low fees yes no app meh no card big deal. i trade on my laptop anyway. just got my first eth withdrawal through and it worked. 0.01 eth fee felt like a tax but whatever. i like that its simple. no noise. no fluff. just trade. 🤝

While the fee structure is indeed competitive, the absence of regulatory compliance presents a material risk that cannot be mitigated by operational efficiency alone. Financial institutions are bound by legal frameworks not merely for the sake of bureaucracy, but to ensure systemic integrity and consumer recourse. Ethfinex’s model, while appealing on the surface, operates outside the guardrails that protect users during market volatility, insolvency events, or legal disputes. One cannot substitute transparency for legal accountability. The silence is not virtue-it is vulnerability.

ETHFINEX IS A SCAM. THEY’RE USING YOUR TRADES TO MANIPULATE THE MARKET. THE LOW FEES? A TRAP. THEY’RE SELLING YOUR ORDER DATA TO HFT FIRMS. NO MOBILE APP? BECAUSE THEY DON’T WANT YOU TO SEE THE REAL TIME PRICE SLIPPAGE. THEY’RE STUFFING THE ORDER BOOK WITH FAKE ORDERS. I SAW IT WITH MY OWN EYES. I’M A DEVELOPER. I RAN A PACKET CAPTURE. THEY’RE DOING IT. YOU THINK YOU’RE SAVING MONEY? YOU’RE BEING PUMPED AND DUMPED IN REAL TIME. WAKE UP.

The notion that Ethfinex is a 'hidden gem' is a fallacy perpetuated by those who misunderstand market structure. Exchanges are not tools-they are institutions. Institutions require governance. Governance requires jurisdiction. Jurisdiction requires licensing. An unlicensed entity, regardless of fee structure, is not a marketplace-it is a liability waiting to be liquidated. To call it viable is to confuse efficiency with legitimacy.

I really liked how you broke this down. I was worried about the wire transfer delay, but I’ve been using it for 6 months now and it’s never been a problem. I just schedule my deposits on Friday and by Monday I’m trading. The interface is so clean-no clutter, no confusion. I feel like I’m actually trading instead of fighting through ads and pop-ups. I’ve told two friends about it and they’re both using it now. It’s nice to find something that just works.

They’re not just silent about their location-they’re hiding from the IRS. That 0.01 ETH withdrawal fee? That’s not a fee, it’s a watermark. Every transaction is tagged with your IP, your device ID, your wallet history. They’re feeding it all to the NSA’s crypto tracking AI. No app? No credit cards? That’s because they don’t want you to trace your own activity. This isn’t an exchange-it’s a honeypot for the surveillance state. And you’re the bait.

I’m not a big trader but I’ve been using Ethfinex for my small ETH swaps for a year now. I don’t need fancy features. I just want to move crypto without getting ripped off. The fees are fair, the site doesn’t crash, and support replied to my ticket in under 12 hours. Yeah, no app. Yeah, wire transfer. But I’m not in a rush. I’d rather have a reliable, honest platform than one that’s flashy but full of hidden costs. This one’s got my trust.