Russian Crypto Tax Calculator 2025

Calculate Your Crypto Tax

Determine your tax liability under Russia's 2025 crypto regulations for residents.

Important: This tool calculates tax based on Russian resident status only. Tax rates differ for non-residents and businesses.

Starting January 1, 2025, Russia introduced one of the most detailed crypto tax systems in the world - and it’s not what most people expected. If you hold, trade, or mine cryptocurrency in Russia, you’re now legally required to report every transaction to the Federal Tax Service. There’s no gray area anymore. The law, Federal Law No. 418-FZ, doesn’t just tax crypto - it controls how you interact with it. And the rules are strict, complex, and punishing for mistakes.

How Crypto Is Taxed in Russia Now

Crypto is no longer treated like digital cash. Under the new law, it’s classified as property. That means every time you sell, trade, or convert crypto into rubles or goods, you trigger a taxable event. The tax rate depends on who you are.

For Russian residents, personal income tax (PIT) applies. If your total crypto income in a year is under 2.4 million rubles ($32,653), you pay 13%. Anything above that jumps to 15%. This isn’t just for crypto - it’s combined with your stock and securities gains. So if you made 1.8 million rubles from Bitcoin and 800,000 from stocks, you’re taxed on the full 2.6 million at the higher 15% rate.

Non-residents? They get hit harder. A flat 30% tax applies to all crypto income earned in Russia, no matter how small. No deductions. No exemptions. Just 30%.

For businesses, it’s even tougher. Mining companies and crypto traders must use the general taxation system (OSNO). That means no more simplified regimes like USN or ESHN. The profit tax rate is 25% - 20% higher than the standard corporate rate. That’s a big reason why many small miners have already shut down.

What Counts as Income?

It’s not just selling crypto for rubles. Every trade counts. Swap Bitcoin for Ethereum? Taxable. Use crypto to buy a laptop? Taxable. Even receiving crypto as payment for freelance work? Taxable. The tax base is calculated based on the market value at the exact moment of the transaction.

But here’s the catch: Russia doesn’t let you use any exchange for pricing. You have to use foreign platforms that meet strict criteria - daily trading volume over 100 billion rubles ($1.36 billion) and at least three years of public quote history. That rules out most smaller exchanges, including many popular ones. You’re forced to rely on Binance, Kraken, or Coinbase, even if you never used them.

And there’s no way to deduct mining costs. Electricity, hardware, cooling - none of it reduces your taxable income. That’s a major complaint among miners. One user on RuTracker spent 37 hours in January just calculating his tax liability because he had to manually track 89 transactions across three different exchanges.

What’s Banned or Restricted?

Taxation isn’t the only restriction. Mining is outright banned in Dagestan, Chechnya, and the DPR/LPR territories until 2031. In Siberia and the Far East - regions like Irkutsk, Buryatia, and Zabaykalsky Krai - mining is only allowed during certain months when energy supply isn’t strained. That’s forced many operations to relocate or shut down entirely.

And here’s something most people miss: the three-year ownership exemption doesn’t apply to crypto. If you bought Bitcoin in 2020 and sold it in 2025, you still owe tax. That’s different from other assets like cars or jewelry, which are tax-free after three years. Crypto has no grace period.

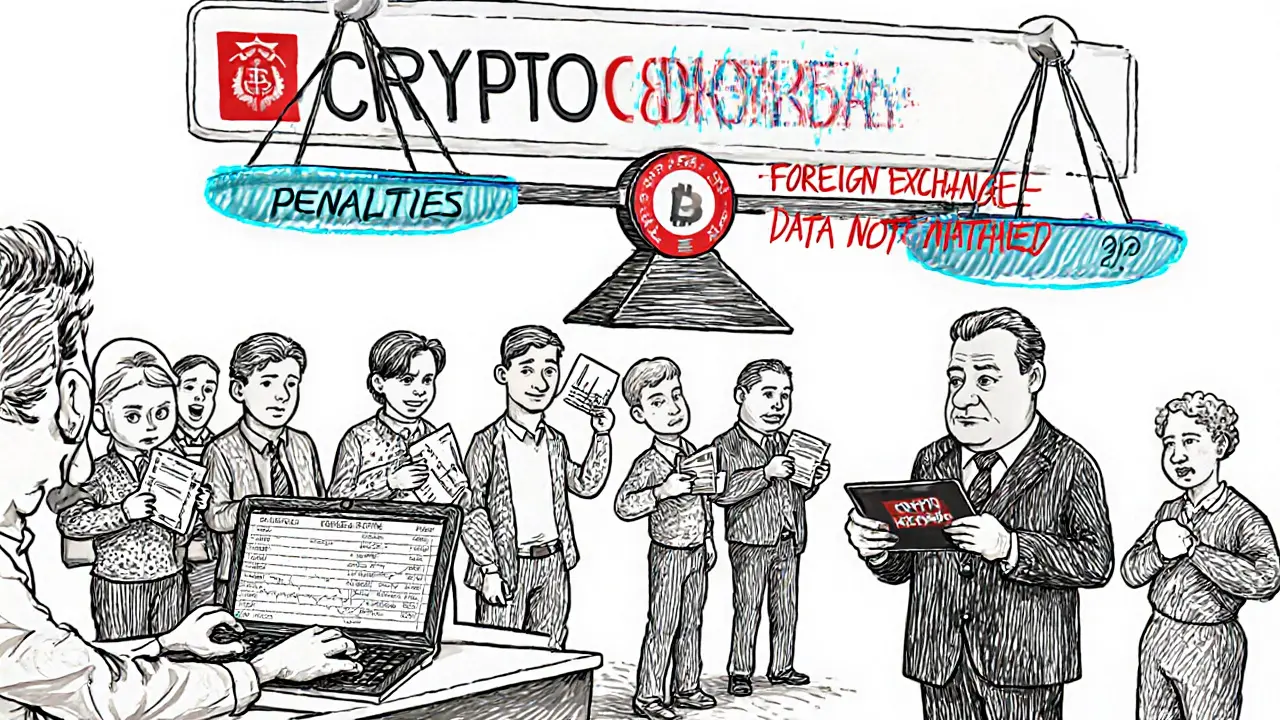

Reporting Rules and Penalties

You must file quarterly reports with the Federal Tax Service. Every transaction - buys, sells, trades - must be logged with wallet addresses, transaction IDs, timestamps, and exchange rates. The FTS has built new digital portals just for this. No paper forms. No exceptions.

Fines are steep. Miss a report? Up to 40,000 rubles ($544). Underreport income? Penalties of 15% to 40% of the unpaid tax, plus interest. The system is automated. If your wallet address shows up on a foreign exchange’s report, and your tax filing doesn’t match, you’ll get a notice.

Accountants say it’s a nightmare. A survey of 127 Russian accounting firms found 89% needed two to three weeks of special training just to handle crypto tax filings. Sixty-two percent said verifying foreign exchange data was the biggest hurdle - because many platforms don’t provide the exact timestamps or rates Russia requires.

Who’s Affected the Most?

The 600,000 ruble ($8,163) annual reporting threshold is causing chaos. It sounds high - until you realize it applies to the total value of all your crypto transactions, not just profits. If you made ten small trades of 70,000 rubles each, you hit the threshold. You’re now required to report everything - even if you broke even.

Garantex, one of Russia’s biggest exchanges, says 78% of their users had annual transaction volumes below this limit in 2024. That means most small traders are being dragged into a system designed for big players. Many are switching to peer-to-peer (P2P) platforms to avoid detection. The Association of Cryptocurrency and Blockchain Enterprises estimates 38% of users have moved offline to avoid reporting.

On the flip side, institutions are stepping in. Forty-seven banks and financial firms registered as crypto service providers by February 2025. They’re using the new legal framework to offer custody, trading, and compliance services - something that was impossible before.

What’s Next?

The government expects to collect 12 billion rubles ($163 million) in crypto taxes in 2025. That’s a drop in the bucket compared to total tax revenue - but it’s a start. By 2027, they’re projecting 28 billion rubles ($381 million). Experts from the Higher School of Economics think those numbers are too optimistic. They believe market contraction and underground activity will cut that in half.

The Central Bank is already testing the digital ruble for welfare payments, starting October 2025. That could be the real game-changer - a state-backed digital currency that’s easier to track than Bitcoin or Ethereum.

And the law isn’t final. The State Duma plans to review amendments in July 2025, focusing on the reporting threshold. There’s pressure to raise it or make it based on profits, not total volume. But don’t expect major changes before the end of the year.

What Should You Do?

If you’re in Russia and own crypto, here’s your checklist:

- Track every transaction - buys, sells, trades, payments - with dates, wallet addresses, and amounts.

- Use only approved foreign exchanges to determine market value. Don’t guess.

- Calculate your total annual income from crypto, even if you didn’t cash out.

- File quarterly reports, even if you had no profit.

- Keep records for at least five years. The FTS can audit you retroactively.

Don’t wait until April to start. The first wave of audits is already happening. People who ignored the rules in 2025 are already getting notices. And penalties don’t wait.

There’s no way around this anymore. Russia isn’t banning crypto - it’s taxing it into submission. The question isn’t whether you should comply. It’s whether you can afford not to.

Is crypto legal in Russia in 2025?

Yes, crypto is legal in Russia, but it’s heavily regulated. You can buy, sell, and hold cryptocurrency, but you must report all transactions to the Federal Tax Service. Mining is banned in some regions and restricted in others. The government treats crypto as property, not currency, and taxes it accordingly.

Do I pay tax if I didn’t sell my crypto?

Yes. Even if you didn’t sell your crypto for rubles, any trade - like swapping Bitcoin for Ethereum - counts as a taxable event. The value of the crypto at the time of the trade is used to calculate your income. Holding alone doesn’t trigger tax, but trading does.

Can I deduct mining costs from my taxes?

No. Under Russia’s 2025 crypto tax law, mining expenses - electricity, hardware, cooling - cannot be deducted from your taxable income. The full market value of mined crypto is treated as income, with no offsets. This is one of the most criticized parts of the law.

What happens if I don’t report my crypto transactions?

You face fines of up to 40,000 rubles for missing quarterly reports. If you underreport income, penalties range from 15% to 40% of the unpaid tax, plus interest. The Federal Tax Service now receives data from foreign exchanges and can match your filings with real transaction records. Ignoring the law is risky.

Do I pay tax on crypto received as payment?

Yes. If you receive crypto as payment for goods, services, or freelance work, it’s treated as income. The value at the time of receipt is added to your annual taxable income and taxed at your personal income tax rate - 13% or 15% depending on your total earnings.

Can I use Russian exchanges to calculate my tax?

No. Russian exchanges don’t meet the legal requirements for tax calculations. You must use foreign platforms with daily trading volumes over 100 billion rubles and at least three years of public data - like Binance or Kraken. Russian exchanges are not recognized for tax purposes, even if they’re licensed.

Is there a tax-free holding period for crypto in Russia?

No. Unlike other assets like cars or jewelry, crypto has no ownership exemption. Even if you held Bitcoin for 10 years, you still pay tax when you sell or trade it. The three-year rule that applies to other movable property does not apply to cryptocurrency.

What’s the reporting threshold for crypto in Russia?

The annual reporting threshold is 600,000 rubles ($8,163) in total transaction value - not profit. If your combined buys, sells, and trades exceed this amount in a year, you must file a report. This applies to all users, regardless of whether they made a profit. Many small traders are caught off guard by this rule.

Crypto isn't money. It's math. And now Russia is taxing math.

Man, I feel bad for the miners. They're just running computers, and now they're being treated like Wall Street traders. The electricity bill alone could buy a small car. No deductions? That's just cruel.

Imagine having to use Binance just because your local exchange doesn't have 3 years of public data... 😅 Russia's rules feel like they were written by someone who's never actually traded crypto. It's not about regulation-it's about control. And honestly? It's kinda beautiful how they're forcing everyone into the same box. Even the rebels have to play by the rules now.

The requirement to use only foreign exchanges with specific trading volumes is legally problematic. It creates an artificial market distortion and may violate principles of fair access to pricing data. This is not tax policy-it is regulatory overreach disguised as compliance.

Wait-so if I swap 0.01 BTC for 0.5 ETH, I owe tax on the value of the ETH at that exact second? And I have to track it down from Binance, even if I’ve never used it? 😭 This isn’t taxation. This is digital surveillance with a tax form attached.

OMG I JUST REALIZED I DID 12 TRADES LAST YEAR AND I'M OVER THE 600K THRESHOLD 😱 I THOUGHT ONLY PROFITS COUNTED!! I'M SO SCARED NOW!!

They're not banning crypto. They're just making it so annoying to use that people give up. Classic. Like taxing water because you don't like people drinking from the river.

This is a masterclass in state control disguised as fiscal policy. By forcing every transaction through foreign platforms, Russia isn't just collecting taxes-it's mapping the entire crypto footprint of its citizens. The digital ruble isn't the future-it's the endpoint. And this law? It's the bridge.

Notice how they banned mining in Dagestan and Chechnya? That’s not about energy-it’s about control. The FSB has access to every exchange report. Every wallet address. Every timestamp. This isn’t taxation. This is the beginning of a digital police state. The Central Bank’s digital ruble? It’s the final step. You won’t be allowed to hold anything outside their system soon.

The 600K threshold on transaction volume-not profit-is a brilliant (and brutal) design. It turns every small trader into a compliance liability. The system is engineered to discourage participation, not enable it. This isn’t fiscal policy-it’s behavioral engineering. And it’s working.

It’s funny-Russia is the only country that taxes crypto trades like they’re stock options, but still lets you buy a Lamborghini with Bitcoin without blinking. So you can spend it freely, but if you swap it? Taxed. The logic is… poetic, in a dystopian way.

If you're holding crypto in Russia, you have two choices: comply meticulously, or disappear from the system. There is no middle ground. The government isn't trying to help you-it's trying to make you irrelevant. But for those who play by the rules? They're building a transparent, traceable financial future. One that might just outlast the chaos.

Okay so I just spent 48 hours trying to track my 117 crypto transactions because I hit the 600k threshold and now I'm emotionally drained, my cat won't talk to me, and I accidentally reported a trade from 2022 because I misread the timestamp on Kraken. I'm not even mad. I'm just… impressed. Russia didn't just create a tax law-they created a psychological horror game where the prize is a 15% tax rate and a lifetime of anxiety. I give it 10/10 for realism. 🙃

At least they didn't ban it. That's something. I'd rather pay tax than live in a world where crypto's illegal. Even if the rules are insane, at least I know where I stand. Now if only they'd let us use local exchanges for pricing...

Let me be perfectly clear: this is not taxation. This is financial coercion. The Russian state has weaponized accounting to dismantle the very essence of decentralized finance. By forcing citizens to rely on Western exchanges for valuation-exchanges that are themselves subject to U.S. and EU regulatory pressure-they are effectively outsourcing their surveillance apparatus. The digital ruble is not an innovation. It is the final act of centralization. And those who believe they can evade this system through P2P are deluding themselves. Every wallet, every transaction, every timestamp is being logged. The only question is not whether you will be caught-but when.