When you buy, sell, or trade crypto, the government might take a cut. But how much? It depends entirely on where you live. In some places, you pay nothing. In others, you could lose more than half your profits to taxes. There’s no global rule. No international crypto tax agency. Just a patchwork of laws that change every year - and 2025 is no different.

Where Crypto Gains Are Taxed the Most

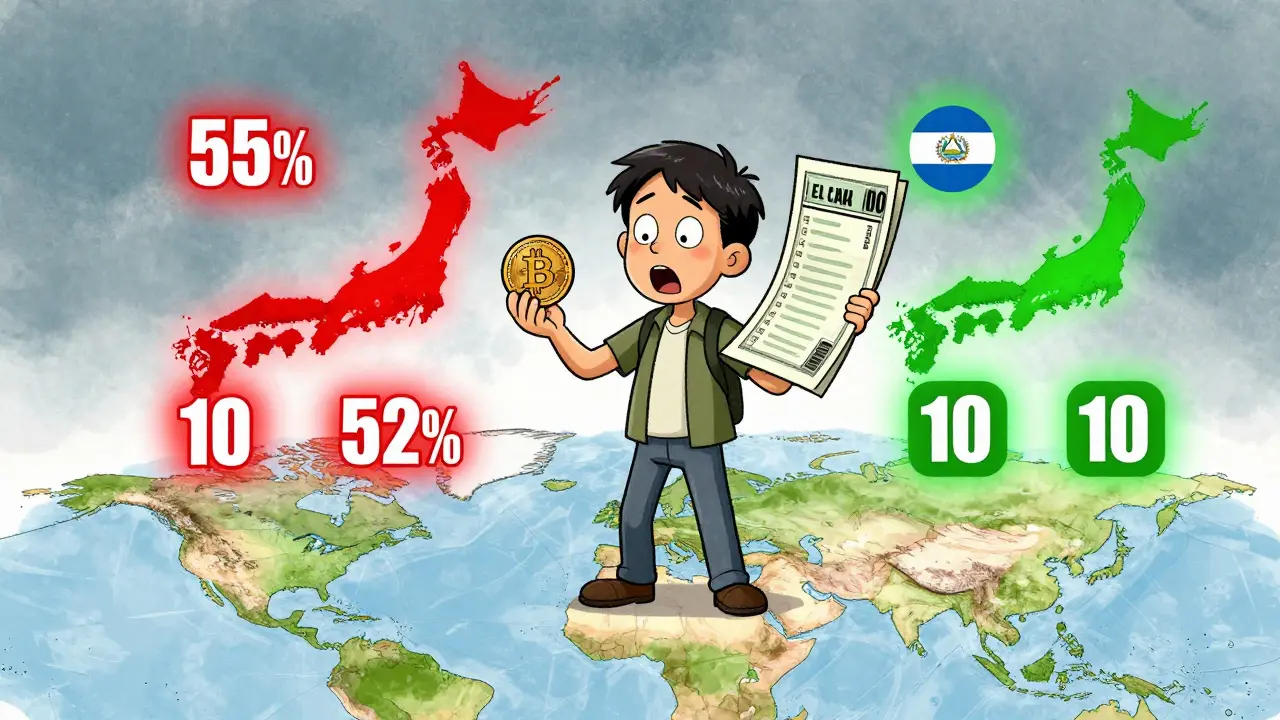

Japan leads the pack for highest crypto taxes. If you make a profit selling Bitcoin or Ethereum, your gains are treated like regular income. Rates range from 15% up to 55%, depending on how much you earn. That’s not a flat rate - it’s progressive. So if you’re clearing $100,000 in crypto gains in a year, you could be paying nearly 55% of that to the government. No exceptions. No loopholes.

Denmark isn’t far behind. Their system is tied to your personal income bracket. If you’re in the top tier, crypto profits get hit with 52% tax. That’s higher than most countries tax their top earners on salaries. And unlike the U.S., there’s no long-term holding discount. Sell after one day or one year - the tax rate stays the same.

France has a flat 30% tax on crypto gains, but that’s misleading. It includes both capital gains and social contributions. On top of that, staking, mining, and airdrops are taxed as income - up to 45%. And if you forget to report a wallet? You could be fined €750 per unreported account. The French tax office doesn’t guess. They use blockchain analytics to track transactions.

Germany’s system is more complex. If you hold crypto for less than a year, gains are taxed as income - up to 45%. But if you hold for more than 12 months? Zero tax. That’s not a loophole. It’s a deliberate policy. The government wants people to hold, not flip. So most German crypto investors wait. It’s not just smart - it’s mandatory to save money.

Where You Pay Nothing - And Why

Twelve countries have zero tax on cryptocurrency as of 2025. That’s not a typo. You can buy, sell, trade, stake, and mine without paying a single cent in capital gains tax.

El Salvador is the most famous. Bitcoin is legal tender. The government doesn’t tax crypto because it’s part of the economy. If you use Bitcoin to buy coffee, you’re not taxed. If you sell Bitcoin for dollars, you’re not taxed. It’s built into the system.

Switzerland, the UAE, and Hong Kong don’t tax private crypto investments. But here’s the catch: if you’re running a crypto business - like a trading firm or mining operation - you pay corporate tax. Personal holdings? Free. That’s why so many crypto founders live in Zurich or Dubai. They keep their personal wallets separate from their business entities.

Portugal is tricky. You pay 28% if you sell crypto within a year. But if you hold for more than 12 months? Tax-free. And you don’t even need to be a resident. Non-residents who trade crypto from Portugal are also exempt. But if you want to claim residency to get the benefit? You need to live there 183 days a year.

Malaysia and Oman only tax crypto if it’s part of a business. If you’re buying and selling as a hobby? No tax. But if you’re trading 10 times a week, running a bot, or mining at scale? That’s business. And business is taxed.

How the U.S. and U.K. Compare

The U.S. treats crypto like property. Short-term gains (held under a year) are taxed as ordinary income - 10% to 37%, depending on your salary. Long-term gains (held over a year) are taxed at 0%, 15%, or 20%, based on your income. So if you’re in the 10% income bracket, you might pay 0% on long-term crypto gains. That’s a huge incentive to hold.

But here’s the catch: every single transaction triggers a taxable event. Buy ETH with USD? Not taxable. Sell ETH for USD? Taxable. Swap ETH for SOL? Taxable. Buy a NFT with Bitcoin? Taxable. Most people don’t realize they’re creating taxable events every time they trade. That’s why so many Americans use crypto tax software - manually tracking 50+ trades a year is impossible.

The U.K. is similar but simpler. Basic-rate taxpayers pay 10% on crypto gains. Higher-rate taxpayers pay 20%. There’s a £3,000 annual allowance - so if your total gains for the year are under £3,000, you pay nothing. But you still have to report every trade on your Self-Assessment Tax Return. If you don’t? Fines can reach 200% of the tax you owe. The HMRC uses data from exchanges like Coinbase and Binance to cross-check reports.

What You Need to Know About Residency

Where you live matters more than where you bank. If you’re a U.S. citizen, you pay U.S. taxes on crypto no matter where you live. The U.S. taxes its citizens globally. So moving to the UAE won’t help you avoid U.S. tax - unless you renounce citizenship.

But if you’re not a U.S. citizen? Residency rules change everything. Portugal, Switzerland, and the UAE all require you to be a tax resident to claim their zero-tax benefits. That usually means living there for 183 days or more per year. Some countries, like Malaysia, don’t care where you live - as long as you’re not trading as a business, you’re fine.

Non-residents? Often exempt. If you’re a tourist in Dubai and sell crypto from your phone? No tax. If you’re a Canadian living in Singapore and trade crypto there? No tax - because Singapore doesn’t tax capital gains, and you’re not a resident. But if you move back to Canada? Suddenly, your past gains become taxable.

Staking, Mining, and Airdrops - The Hidden Taxes

Most people think taxes only apply when they sell. But that’s wrong. Getting crypto as income? That’s taxable too.

Staking rewards? Taxed as income in the U.S., France, Germany, and the U.K. You pay tax on the dollar value of the reward when you receive it - not when you sell. So if you earn 0.5 ETH worth $1,200 in January, you owe tax on $1,200 - even if ETH drops to $800 by December.

Mining? Same thing. The coins you mine are income at the time they’re added to your wallet. If you mine 1 BTC worth $60,000, you owe tax on $60,000. Then if you sell it later, you pay capital gains on the difference.

Airdrops? Also income. If you get 100 tokens for free because you held a certain coin, you pay tax on their value when you receive them. Many people forget this. They get free tokens, think it’s a gift, and then get audited.

Compliance Is Getting Harder - And Riskier

Tax authorities aren’t guessing anymore. They’re using blockchain analytics tools. The IRS, HMRC, and French tax office all have access to data from major exchanges. If you have a Coinbase account and didn’t report gains? They know.

Germany requires you to report every crypto transaction to the Federal Central Tax Office. France demands annual crypto asset declarations. The U.K. requires you to list every trade on your Self-Assessment form. Even countries with zero tax, like Portugal, require you to prove you held assets for over a year - and you need receipts, wallet addresses, and transaction IDs.

Penalties are harsh. Fines can be double the tax owed. In some cases, you can be criminally charged for tax evasion. The days of flying under the radar are over. If you’re trading crypto seriously, you need records - not just screenshots, but full transaction histories with dates, amounts, and values in local currency.

What Should You Do?

If you’re thinking about moving for tax reasons? Don’t just pick a country because it’s tax-free. Look at the full picture: residency rules, banking access, cost of living, political stability. The UAE has zero tax - but if you’re not a resident, you can’t open a local bank account. Switzerland is stable - but living there costs $4,000 a month.

If you’re staying put? Track everything. Use a crypto tax tool. Don’t rely on exchange summaries. They’re incomplete. Export your full transaction history from every wallet and exchange. Reconcile it. Know your cost basis. Know your holding periods.

And if you’re unsure? Talk to a tax professional who understands crypto. Not your regular accountant. Not a friend who read a blog. Find someone who’s handled crypto clients before. The rules change too fast for guesswork.

Crypto taxation isn’t about avoiding taxes. It’s about understanding them. The countries with the highest rates aren’t punishing you - they’re treating crypto like any other asset. The zero-tax countries aren’t giving you a gift - they’re building an economy around it. Your job isn’t to cheat the system. It’s to work within it - smartly, legally, and with full awareness.

Been holding since 2021 and never paid a cent in taxes. Just moved to Portugal last year and life got a lot simpler. No more crypto tax software nightmares. Just hold for a year and forget about it.

Japan’s tax rate is insane but honestly I’m not surprised they’re the worst. They tax everything like it’s 1998 and you’re filing your W-2 by hand. I’d rather get audited than live there.

It is incorrect to state that Germany imposes zero taxation on holdings exceeding twelve months. The German Federal Central Tax Office has clarified that the exemption applies only to disposals occurring after the one-year holding period, and any income derived from staking or mining remains fully taxable under Section 22 EStG. Furthermore, the use of decentralized exchanges does not exempt one from reporting obligations under §146 AO.

just got my first airdrop last week and forgot to report it 😅 hope i dont get audited…

the U.S. is a tax nightmare because they treat every swap as a taxable event. it’s like being taxed every time you breathe. no one actually tracks this. the IRS knows it’s impossible. they’re just hoping you’ll panic and pay.

Why are we even talking about tax havens? America built the internet. America funds innovation. If you want to escape taxes, move to a country that doesn’t have the infrastructure to support your lifestyle. That’s not freedom. That’s parasitism.

Don’t let the fear of taxes stop you from investing. Just keep good records. I use Koinly and export every transaction. It takes an hour a quarter. Way better than getting hit with a 200% fine. You don’t need to be a genius, just consistent.

The real question isn’t where you pay the least-it’s whether the state has the moral authority to claim a share of your digital labor. Crypto was born to escape centralized control. Taxing it like traditional capital is the system co-opting its own disruption. The zero-tax jurisdictions aren’t loopholes-they’re the future’s first draft.

People forget that even in zero-tax countries, you still need to prove you’re not running a business. If you’re trading 5 times a day with a bot, they’ll classify you as a trader regardless of where you live. The line between hobby and business is thinner than people think.

in nigeria we dont tax crypto but we also dont have banks that accept it so its a win lose situation. i mine on my phone and just hold. no taxes but no cashout either. the system is broken but at least my gains are mine

France is a nightmare. I got fined €750 for not reporting a wallet I forgot existed. I didn’t even use it. Just held 0.02 BTC from 2017. They tracked it. They came for me. Don’t be like me.

Switzerland is a joke. Zero tax for you? Sure. But if you want to open a bank account, you need €1M and a Swiss lawyer. It’s not freedom. It’s a luxury tax on the rich who think they’re clever.

Anyone who thinks crypto tax avoidance is ‘smart’ is delusional. You’re not outsmarting the system-you’re just delaying the inevitable. The IRS has AI that traces wallet links across 12 blockchains. You think you’re hidden? You’re not.

^^^ this is why i use hardware wallets and never link my exchange to my real name. still scared though 😬