Blockchain was built on a promise: once data is written, it can never be changed. That’s the whole point - trust without intermediaries, tamper-proof records, and permanent history. But in practice, this immutability isn’t the flawless superpower it’s made out to be. It’s more like a locked vault with no key - useful until you realize you’ve locked the wrong thing inside. And when that happens, there’s no reset button. No undo. No do-over. Just permanent, unchangeable data that can cause real-world damage.

Immutability vs. Reality

Think of blockchain as a digital ledger that copies itself across thousands of computers. Every new transaction gets chained to the last using cryptography. Change one block? You’d have to change every block after it - and convince over half the network to accept your version. That’s hard. Really hard. That’s why Bitcoin and Ethereum are considered secure. But hard doesn’t mean impossible.

In January 2019, the Ethereum Classic network got hit by a 51% attack. A single group controlled more than half the mining power. For 12 hours, they reversed transactions, double-spent 219,500 ETC, and walked away with $1.1 million. This wasn’t a theoretical risk. It was real. And it proved something critical: immutability isn’t absolute. It’s probabilistic. It depends on how much money and computing power it would cost to break it. If someone has enough resources, they can rewrite history. And that’s not rare. It’s happened more than once.

The GDPR Problem

Imagine you sign up for a blockchain-based health service. You upload your medical records. The system stores a hash of your data on-chain - a digital fingerprint - and keeps the real data off-chain. Sounds smart, right? Now imagine you want to delete your data. Under GDPR, you have the legal right to be forgotten. But if that hash is on the blockchain, it’s stuck there forever. Even if the original data is gone, the fingerprint remains. Regulators see that as a violation. In 2023, a European healthcare provider paid €500,000 in fines because they couldn’t erase a patient’s data from an immutable ledger. That’s not a glitch. It’s a design flaw.

The European Commission’s 2023 Digital Finance Package made it clear: blockchain solutions must allow for data correction and deletion. No exceptions. So how do companies respond? Most now store only hashes on-chain - the real data lives elsewhere, in traditional databases they can control. IBM’s healthcare blockchains use this method in 17 countries. R3 Corda, used by over 250 banks, lets notaries approve corrections under legal authority. It’s not perfect, but it’s the only way to stay compliant.

Smart Contract Bugs and Lost Money

Smart contracts are self-executing code on blockchains. They’re supposed to be reliable. But code is never perfect. A single typo can cost millions.

In 2022, a developer on Reddit lost 2.3 ETH ($4,200) because they accidentally sent funds to the wrong address. No one could reverse it. No customer service line. No refund policy. Just silence. That’s not an edge case. GitHub issue #17892 for the Ethereum Geth client has 217 comments from users who made irreversible mistakes. DeFi projects lost over $2 billion in 2022 alone due to bugs that couldn’t be fixed.

Some teams tried to solve this with upgradable smart contracts - a proxy system that lets developers swap out old code for new. But now you’ve got centralization. One team controls the upgrade key. That’s the opposite of decentralization. And it’s everywhere: 68% of DeFi projects use this pattern, according to DeFi Llama. It’s a trade-off: flexibility over ideology. And it’s becoming the norm.

Scalability and Security Trade-Offs

Bitcoin handles 4-7 transactions per second. Visa handles 24,000. That’s not a minor difference - it’s a dealbreaker for real-world use. When networks get congested, transaction fees spike. Miners prioritize high-paying transactions. That creates windows of vulnerability. Attackers exploit delays to double-spend or manipulate order.

Bitcoin’s security relies on Proof-of-Work. It’s energy-intensive. The entire Bitcoin network uses more electricity than Norway - 121.49 TWh per year. That’s not sustainable. And as energy costs rise, smaller miners get pushed out. Centralization creeps in. The more concentrated mining becomes, the easier it is for one group to launch a 51% attack. Immutability depends on distributed power. But as the system scales, it risks becoming less distributed.

Storage is another hidden cost. The Bitcoin blockchain is now 473.6 GB. Running a full node means downloading and verifying every transaction since 2009. That’s fine on a server. Not so much on a laptop or phone. As the chain grows, fewer people run full nodes. Fewer nodes mean less decentralization. Less decentralization means weaker immutability. It’s a slow feedback loop - and we’re already in it.

Enterprise vs. Public Blockchains

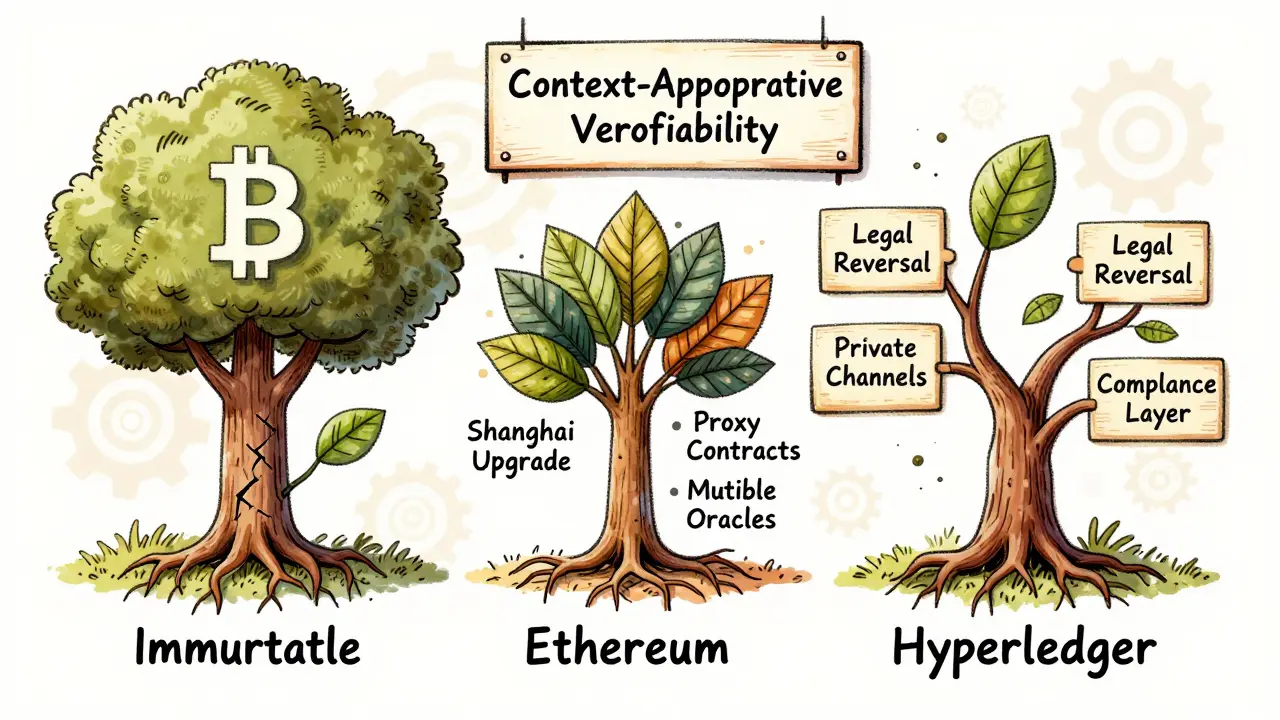

Not all blockchains treat immutability the same way.

Public chains like Bitcoin and Ethereum (pre-Shanghai) treat it as sacred. No exceptions. Even when users beg for fixes, the community resists. Hard forks - like Ethereum’s 2016 DAO split - are rare, controversial, and divisive. They split communities. They create two blockchains. They’re emergency brakes, not routine tools.

Enterprise blockchains? They’re different. Hyperledger Fabric, used by 30% of Fortune 500 companies, lets you define who can see and change data. You can have private channels, encrypted data, and admin override. R3 Corda uses notaries to validate and, if needed, reverse transactions under legal frameworks. These systems aren’t trying to be “trustless.” They’re trying to be legal, auditable, and flexible.

That’s why 89% of cryptocurrency projects stick to strict immutability - but only 32% of enterprise ones do. The difference? Purpose. Crypto wants permanence. Business wants compliance.

What’s Changing Now?

The industry is waking up. Ethereum’s Shanghai upgrade in April 2023 improved staking security, making attacks harder. The European Blockchain Services Infrastructure (EBSI) launched version 2.0 with built-in compliance layers that let you redact data without breaking the chain. Chainlink’s 2023 whitepaper proposes “mutable oracles” - decentralized systems that can update data based on governance votes.

Even Bitcoin isn’t ignoring the problem. BIP 300, currently in draft, proposes “drivechains” - sidechains that can have their own rules, including mutability, while staying anchored to Bitcoin. It’s a compromise: Bitcoin stays immutable. Other chains can adapt.

Academic research is exploding. 147 peer-reviewed papers on blockchain mutability were published in 2023 - more than double the number from 2021. The World Economic Forum summed it up best: “The future of blockchain lies not in absolute immutability but in context-appropriate verifiability.”

Real-World Lessons

Here’s what we’ve learned:

- Immutability is not a feature - it’s a design choice. You can’t have it without trade-offs.

- If you’re building for regulation (healthcare, finance, EU markets), assume you’ll need mutability. Plan for it.

- Hashing data on-chain and storing the real data off-chain isn’t a workaround - it’s the standard now.

- Smart contracts aren’t “code is law.” They’re code that can break. Always build in upgrade paths.

- Don’t trust the myth of absolute immutability. It’s a dangerous assumption. The Ethereum Classic attack wasn’t a fluke - it was a warning.

Blockchains are powerful. But they’re not magic. They’re tools. And like any tool, they work best when you understand their limits - not when you pretend they’re flawless.

Can blockchain data ever be deleted?

Technically, no - not on public blockchains like Bitcoin or Ethereum. Once a transaction is confirmed, it’s permanently part of the ledger. But in practice, companies get around this by storing only cryptographic hashes on-chain and keeping the real data off-chain in traditional databases. This lets them delete the original data while preserving the blockchain’s integrity. Some enterprise blockchains like Hyperledger Fabric and R3 Corda also allow admins to revoke or correct data under specific conditions.

What happened in the Ethereum Classic 51% attack?

On January 5, 2019, an attacker gained control of over 51% of Ethereum Classic’s mining power. For 12 hours, they reversed transactions and double-spent 219,500 ETC - worth $1.1 million at the time. This proved that immutability isn’t guaranteed. It depends on the network’s security. If enough computing power is concentrated in one hand, the blockchain can be rewritten. The attack exposed a fundamental flaw: immutability is probabilistic, not absolute.

Why is immutability a problem for GDPR?

GDPR gives users the right to have their personal data erased. But blockchain data can’t be deleted. If personal information - even a hash of it - is stored on-chain, it violates this right. In 2023, a European healthcare provider was fined €500,000 for storing patient data on an immutable blockchain. The solution? Keep raw data off-chain and store only non-identifiable hashes on-chain. That way, you can delete the real data while keeping the ledger intact.

Do all blockchains have the same level of immutability?

No. Public blockchains like Bitcoin and Ethereum prioritize strict immutability and rarely allow changes. Enterprise blockchains like Hyperledger Fabric, R3 Corda, and Energy Web Chain are designed for business use and include mechanisms for data correction, access control, and even reversible transactions under legal authority. The level of immutability depends entirely on the system’s design goals - security vs. flexibility.

Are there ways to fix smart contract bugs without breaking immutability?

Yes - but they involve trade-offs. The most common method is the “upgradable proxy pattern,” where a smart contract points to another contract that can be swapped out. This lets developers patch bugs without rewriting the blockchain. However, this introduces centralization: one team controls the upgrade key. It’s a compromise between security and practicality. Most DeFi projects now use this, even though it goes against the original idea of “code is law.”

What’s the future of blockchain immutability?

The future isn’t about absolute immutability. It’s about context-appropriate verifiability. Public blockchains will likely keep strict immutability for crypto, but enterprise systems will increasingly build in controlled mutability - especially for regulated industries. New tools like EBSI’s compliance layers, Chainlink’s mutable oracles, and Bitcoin’s proposed drivechains show the industry is moving toward flexible, rule-based systems. Immutability isn’t disappearing - it’s being refined.