As of 2025, you can buy, sell, and hold cryptocurrencies in Turkey - but you can’t use them to pay for your coffee, rent, or even a car. The Central Bank of Turkey (CBRT) has drawn a hard line: crypto is an investment, not a currency. This isn’t a ban on crypto itself. It’s a ban on using it like money. And that distinction changes everything for Turkish citizens and businesses trying to navigate the digital asset landscape.

Why the Payment Ban Still Stands

In April 2021, the CBRT made its first major move: banning the use of cryptocurrencies for direct payments. That rule didn’t just stick - it got stronger. By March 2025, new regulations were published in the Official Gazette, reinforcing the ban with legal teeth. Today, if you try to pay for groceries with Bitcoin, Ethereum, or any other coin, the merchant is legally required to refuse it. Same goes for real estate deals, utility bills, or online subscriptions. Even if both parties agree, the law doesn’t allow it.This isn’t about stopping innovation. It’s about protecting the Turkish Lira. With inflation hitting over 60% in 2024, many Turks turned to crypto not to gamble, but to survive. Bitcoin and USDT became digital savings accounts. The CBRT didn’t want that escape valve to become a leak in the entire monetary system. If people started paying rent in crypto, the Lira’s value could collapse faster. So they blocked payments - but left trading wide open.

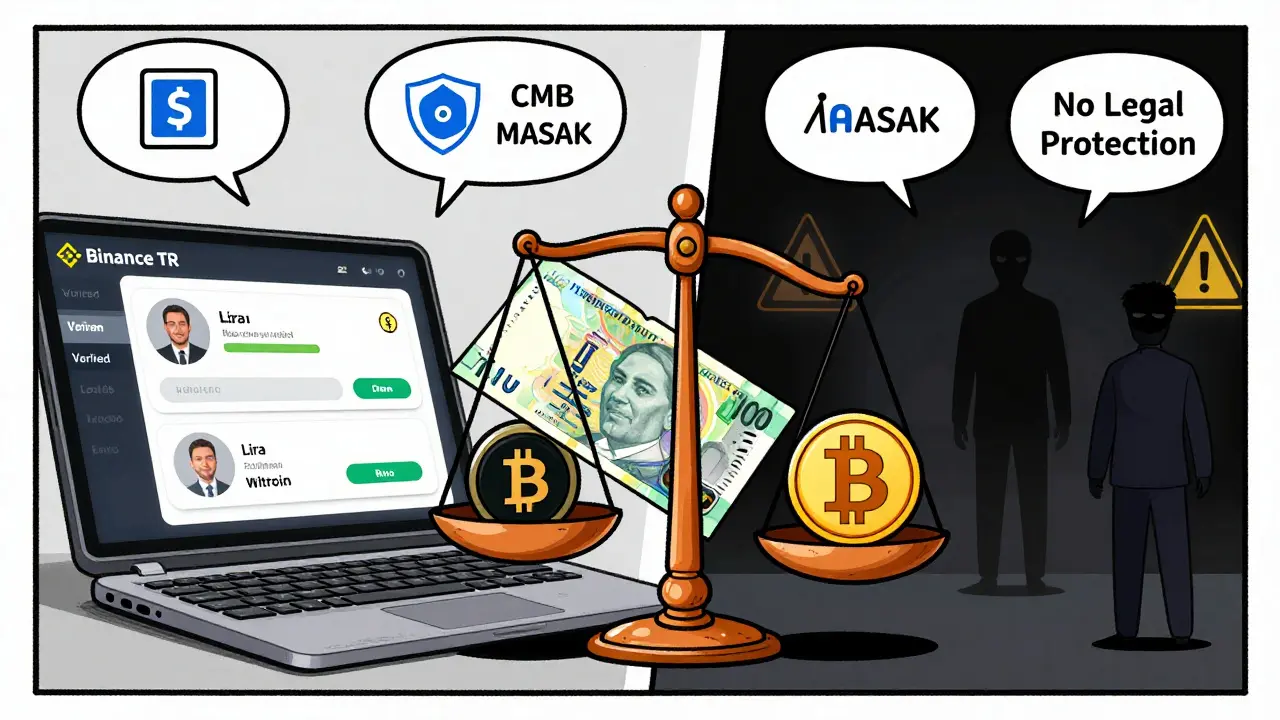

Who’s in Charge Now?

The CBRT doesn’t run crypto rules alone. The Capital Markets Board (CMB) is the main regulator. They license and monitor every crypto exchange, wallet provider, and trading platform operating in Turkey. Then there’s MASAK, the Financial Crimes Investigation Board, which tracks money laundering. And TÜBİTAK, the national science council, sets the technical standards for security and blockchain compliance.Before March 2025, the rules were messy. Now, there are two key communiqués that define everything:

- Communiqué I (III-35/B.1) - Sets the rules for starting a crypto business in Turkey. You must be a joint-stock company. Shares must be in cash, registered under real names. No anonymous owners.

- Communiqué II (III-35/B.2) - Tells you how to run it. Minimum capital? 150 million Turkish Lira ($4.1 million) for exchanges. 500 million Lira ($13.7 million) for custodians. That’s not a suggestion. It’s a legal requirement.

Foreign companies like Binance or Coinbase can’t just set up shop and start marketing to Turks. They need local authorization. And even then, they’re not allowed to run ads targeting Turkish users unless they’re fully licensed. This has pushed many Turks to use offshore exchanges - but that’s where the risks grow.

What Happens If You Break the Rules?

The penalties aren’t light. In 2024, MASAK fined Binance TR the maximum allowed: 8 million Turkish Lira ($750,000) for failing to verify users properly and not monitoring suspicious transactions. That wasn’t a slap on the wrist. It was a warning to every crypto platform: comply or get crushed.Now, MASAK is getting even more power. By late 2025, they’ll be able to freeze both bank accounts and crypto wallets tied to illegal activity. They’re also going after rented accounts - those fake profiles people use to hide identities. And they’re cracking down on unlicensed platforms that pretend to be “crypto brokers” or “wallet services.”

For regular users, breaking the law usually means using unregulated exchanges or trying to bypass KYC. That’s risky. If your account gets flagged, you could lose access to your funds - and there’s no legal recourse. Turkish courts won’t protect you if you’re operating outside the system.

How Turks Are Using Crypto Anyway

Despite the payment ban, Turkey is one of the top crypto markets in the world. Why? Because people aren’t using crypto to buy things. They’re using it to protect their wealth.When the Lira loses 50% of its value in a year, Bitcoin becomes a lifeline. A 2025 survey by the Turkish Digital Asset Association found that 42% of crypto holders in Turkey use it primarily to hedge against inflation. Another 28% use it to send money abroad - bypassing strict foreign exchange controls. Only 6% use it for daily purchases.

Many Turks buy crypto on licensed exchanges like Paribu or Binance TR, then transfer it to cold wallets. Some convert it to stablecoins like USDT and hold them as digital cash equivalents. Others use peer-to-peer platforms to trade crypto for cash - a gray area, but common. The system isn’t perfect, but it works for people who need an alternative.

The Digital Lira Is Coming

While crypto is restricted, the CBRT isn’t ignoring digital money. They’re building their own version: the Digital Lira. This isn’t a cryptocurrency. It’s a central bank digital currency (CBDC) - fully backed by the state, controlled by the bank, and designed to replace cash over time.The Digital Lira will be used for payments, savings, and even government benefits. Unlike Bitcoin, it won’t be volatile. Unlike crypto, it won’t be decentralized. It’s the government’s answer to the crypto surge: control the digital money, don’t let private coins take over.

Experts expect the Digital Lira to roll out in phases starting in 2026. First, pilot programs for public sector employees. Then, integration with mobile payment apps. Eventually, it could replace physical cash entirely. That’s why the CBRT is so strict about crypto payments - they’re laying the groundwork for their own digital currency to take center stage.

What’s Next for Crypto in Turkey?

The future isn’t about lifting the payment ban. It’s about expanding what’s allowed within the rules.One big shift is coming: real-world asset tokenization. That means turning things like gold bars, apartments, or farmland into digital tokens on a blockchain. You won’t be able to pay for a house with Bitcoin - but you might be able to buy a fraction of a property using a tokenized asset. The CMB is already drafting rules for this. Institutional investors are watching closely.

Another area growing fast: crypto mining. Turkey’s cheap electricity and young tech workforce make it attractive for miners. While not directly regulated by the CBRT, mining operations are now being monitored for energy use and tax compliance. Some local governments are even offering incentives to bring in mining farms - as long as they don’t use the grid for illegal crypto payments.

And then there’s the question of enforcement. With millions of Turks using foreign exchanges, regulators can’t monitor everything. But they’re getting smarter. AI-powered transaction tracking, cross-border data sharing with EU regulators, and mandatory reporting from Turkish banks are all being rolled out. The goal isn’t to stop crypto. It’s to contain it - keep it as an investment, not a payment tool.

What Should You Do If You’re in Turkey?

If you’re a Turkish citizen or resident:- Buy and hold crypto - legal and common.

- Use licensed exchanges - Binance TR, Paribu, Koinim. Avoid unregulated platforms.

- Never use crypto to pay for goods or services - it’s illegal and risky.

- Keep records - even if you’re not taxed now, the system is tracking everything.

- Watch for Digital Lira updates - it could change how you store and spend digital money.

If you’re a foreigner trying to serve Turkish customers:

- Don’t market directly - you need CMB approval.

- Don’t bypass KYC - MASAK will find you.

- Don’t assume payment bans will lift - they’re here to stay.

The message is clear: Turkey isn’t anti-crypto. It’s anti-payment. Crypto is allowed as an asset. Not as a currency. And that’s not changing anytime soon.

Can I still buy Bitcoin in Turkey in 2025?

Yes. Buying, selling, and holding Bitcoin and other cryptocurrencies is fully legal in Turkey. You can use licensed exchanges like Binance TR, Paribu, or Koinim to trade crypto with Turkish Lira. The only restriction is using crypto to pay for goods or services - not owning it.

Why can’t I pay with crypto in Turkey?

The Central Bank of Turkey banned crypto payments in 2021 to protect the Turkish Lira’s role as the sole legal tender. With high inflation, many people turned to crypto to save money. Allowing crypto payments could have weakened the Lira further by reducing demand for the official currency. The ban keeps crypto as an investment, not a currency.

Is Binance allowed to operate in Turkey?

Binance TR, the local subsidiary, is licensed by the Capital Markets Board and operates legally in Turkey. However, the global Binance platform is not authorized to market to Turkish users directly. Binance TR must follow strict rules, including KYC, capital requirements, and transaction monitoring - and has been fined in the past for violations.

What happens if I use an unlicensed crypto exchange?

Using an unlicensed exchange is risky. Your funds aren’t protected by Turkish law. If the platform gets shut down or hacked, you have no recourse. MASAK may also flag your transactions, leading to bank account freezes or investigations. Even if you’re not breaking the law personally, you’re exposing yourself to fraud and loss.

Will Turkey ever allow crypto payments?

Almost certainly not in the near future. The Central Bank views crypto payments as a threat to monetary control. Instead, they’re pushing their own digital currency - the Digital Lira - which will be the only state-backed digital payment method. Crypto will remain an investment asset, not a payment tool.

Are crypto earnings taxed in Turkey?

As of 2025, there is no specific capital gains tax on crypto profits in Turkey. However, if you’re trading crypto as a business or generating regular income, the tax authority may classify it as commercial income. The rules are still evolving, but keeping detailed records is essential in case regulations change.

Turkey got guts. Lira might be trash, but crypto ain't gonna replace it. 🇹🇷💪

The regulatory architecture presented here is remarkably coherent: a deliberate bifurcation between speculative asset-class status and sovereign monetary sovereignty. One cannot simultaneously preserve currency integrity and permit decentralized monetary substitution without systemic risk.

People use crypto to survive not speculate. The bank’s fear isn’t innovation it’s losing control. Simple as that

If you're in Turkey and holding crypto you're not gambling you're just trying not to lose everything. Stay smart and use licensed platforms 💪

cant believe they still let ppl buy btc but not use it to buy coffee lmao

hope the digital lira dont turn into another mess but i trust the people will find a way 🙏

I get why they did it. Inflation is wild. People need a way out. But banning payments? That’s like letting someone keep a lifeboat but not letting them use it to escape the sinking ship.

So the state says crypto is an asset but not money? That’s like calling a tiger a house pet and then locking it in a cage. The tiger still eats. The crypto still moves. The bank just doesn’t like that it’s not on its leash.

Let me get this straight - you can buy Bitcoin but not use it to pay for rent? That’s not regulation, that’s psychological warfare. They want you to think crypto is safe as long as you don’t actually use it. Bullshit. It’s control disguised as caution. And the Digital Lira? That’s not progress - it’s surveillance with a shiny UI. 🚨

This is precisely why Western nations must never follow this model. Allowing private digital currencies, even as assets, erodes the foundation of monetary authority. The CBRT is correct: only the state may issue money. Any deviation is a slide into chaos.

I... I just... wow. The level of structural foresight here is almost poetic. The CBRT didn’t just ban payments - they created a containment field. Crypto as a savings valve, not a transactional tool. And the Digital Lira? That’s not a response - it’s a reclamation. The state is saying: we will digitize, but on our terms. 🤯

Honestly? This is the most balanced crypto policy I’ve seen anywhere. They didn’t panic. They didn’t ban. They didn’t pretend crypto doesn’t exist. They made space for it - just not in the wrong places. Smart. Real smart.

So you can buy Bitcoin but not use it to buy a kebab? Bro, that’s like letting me own a Ferrari but telling me I can only park it in my garage and admire it. What a joke. 😂

Stick to licensed exchanges. Don’t gamble on unregulated platforms. This isn’t advice - it’s survival. Your money isn’t safe if you ignore the rules.

The Digital Lira is the logical endpoint of centralized monetary control. It is not a technological advancement - it is a political statement. The state will own your digital identity as surely as it owns your passport. And you will call it progress.

You know what’s really happening here? It’s not about inflation. It’s not about the Lira. It’s about fear. Fear that people are realizing money isn’t magic. That it’s just a story. And when you let people hold Bitcoin - when they see that their savings aren’t tied to some central bank’s printed paper - that story starts to unravel. And the state? It can’t handle that. So it builds a better story. A shiny, controlled, trackable, surveilled story called the Digital Lira. And we’re supposed to be grateful? We’re supposed to cheer while they take our freedom to transact without permission? I’m not cheering. I’m mourning. 💔